Brought to you by Lygos Finance

Happy Friday — we hope everyone had a Merry Christmas!

In our last newsletter, we listed the stories that defined 2025, and one of the highlights included the rolling narrative of bitcoin miners expanding into AI.

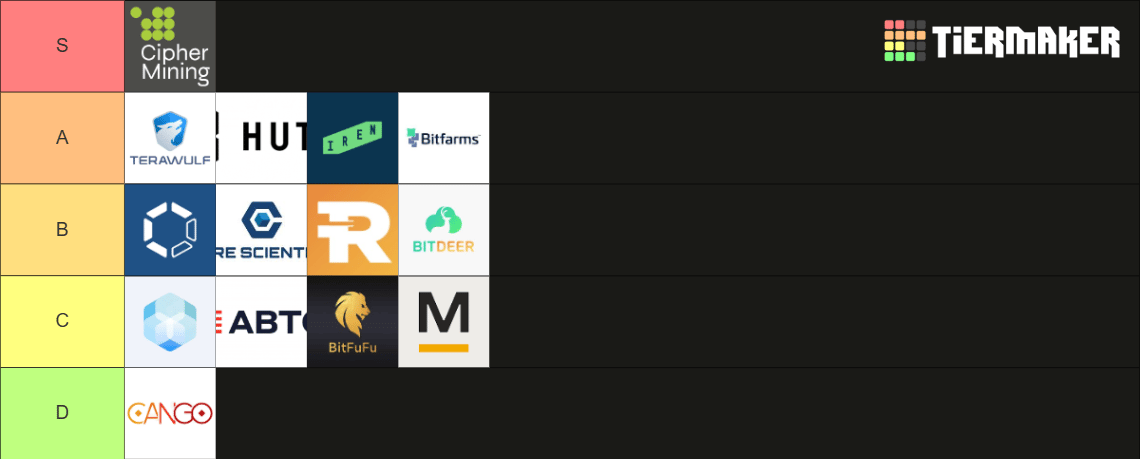

For today’s newsletter, we zoom in on this trend by providing our Bitcoin Mining Stock Vibe Rankings for EOY 2025.

The market rewarded bitcoin miners with AI strategies lavishly this year, particularly those who proved they can actually get deals done and construct sites for an entirely new, mega-intensive form of computing.

We got a lot of flak the first time we did this back in April (and like praise to balance out the imprecations), but we’re doing it again because, well, it’s fun.

You can tune into it on YouTube (or wherever you get your podcasts) to learn more about our rationale. Or, keep scrolling and read our vibe rankings!

Lygos: Bitcoin Credit, No Custodian Required

Unlock dollar liquidity without giving up your BTC. Lygos is a fully Bitcoin-native, non-custodial lending platform built on Discreet Log Contracts (DLCs).

• Hold your keys: BTC stays on layer 1 in your control. No wrapping, no bridging, no rehypothecation

• Rates as low as 10% APR

Bitcoin mining stocks vibe rankings: 2025 year-end edition

To start, the first metric on our rubric was simple: is a miner expanding into AI/HPC, and if they are, how far have they progressed? Do they have deals signed? Are those wading into the waters (but without a swimming buddy yet) in a place to do so with the sites they currently operate?

From here, it was pretty easy to decide which miners would be at the top of the rankings, and which ones below.

Where it got tricky, though, was deciding just how high some of the AI-expansion leaders should go. And inversely, how much we should discount miners who have small AI footprints, are (ostensibly) hunting AI tenants to sign a deal, or who have huge MW footprints without much to show for expansion.

The latter point is important, because a miner’s hashrate and MW size might look good on paper, but with peers inking fingerlicking deals in a market with juicier margins, companies with too much mining exposure are falling out of investor favor.

There’s plenty of room for disagreement on these rankings (and we certainly butted heads on the podcast!), but directionally, we stand by our tier list.

Are you nodding along or pursing your lips in disgust? Let us know what you think the rankings should be by creating your own rankings. Share it on X and tag @blockspace!

All of that said, here are the rankings. Please direct all tomato tossing or bouquet brandishing to [email protected].

Will’s Tier List

Colin’s Tier List

Charlie’s Tier List

Disclosure for newsletter and podcast: Colin holds CIFR; Charlie holds CIFR and IREN; and Will holds CIFR, IREN, BITF, CLSK and GLXY. Blockspace did not include CleanSpark and Galaxy Digital on this list due to conflicts of interest related to sponsorships and other contracts.

Like these stories? Reply BITCOIN to let us know!

The Data Behind Bitcoin Mining

Trusted by miners and institutions, Hashrate Index provides the metrics and research used to understand hashprice, hardware markets, and network dynamics.

In the News

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

TeraWulf secures zoning approval for NY data center

TeraWulf (NASDAQ: WULF) secured a critical regulatory approval on Monday night when officials in Lansing, New York, voted to classify its Lake Cayuga site for permitted industrial use. The decision resolves a zoning dispute that previously stalled the company’s plans to convert a former coal plant into a data center. - link

Bitcoin hashrate drop may signal bottom as treasury firms buy the dip: VanEck

Bitcoin miner-turned-AI factory Hut 8 announced Tuesday a new partnership with artificial intelligence company Anthropic and compute provider Fluidstack to develop large-scale AI data center infrastructure in the United States, beginning with a 245 megawatt project in Louisiana. - link

Brink hires independent auditor to review Bitcoin Core

Bitcoin development incubator Brink bank rolled an audit of the Bitcoin Core codebase by Quarkslab, and Bitcoin Core passed the audit with Quarkslab finding no serious bugs or vulnerabilities. The first ever independent audit of the code that underpins the majority of the network sets a new standard, “mark[ing] a milestone in the development history of Bitcoin,” as Bitcoin Magazine’s Technical Editor Shinobi writes in his coverage. - link

Chart of the Week

Galaxy Digital’s research is second-to-none in the crypto space, and this chart tells you why. The insight itself is great — and sobering — but man, look at how gorgeous that chart is. The dollar inlay for the change in the dollar’s purchasing power since 2020 is chef’s kiss.

Blockspace Podcasts

Welcome back to The Mining Pod! Today, Will, Colin, and Charlie are back with another (in)famous Vibe Rankings for Bitcoin Mining Stocks. For bitcoin mining stocks, 2025 was a year defined by aggressive expansion in the AI sector, but some miners have been more fruitful with their endeavors than others. For today’s roundup, the team dives into our 2025 year-end rankings for the top bitcoin mining stocks, which includes some spirited debate about who belongs in what tier – and whether or not any bitcoin mining stock earned an S rank in 2025.

Today is Boxing Day, an English holiday born from the custom where upper-class brits would gift their Christmas feast leftovers and other gifts to servants. The tradition survived in Canada, itself still a member of the British Commonwealth. But the United States never kept the tradition following independence, probably because the U.S.’s founding was a rejection of the very class-based tradition that informed the holiday.

-CMH & CBS