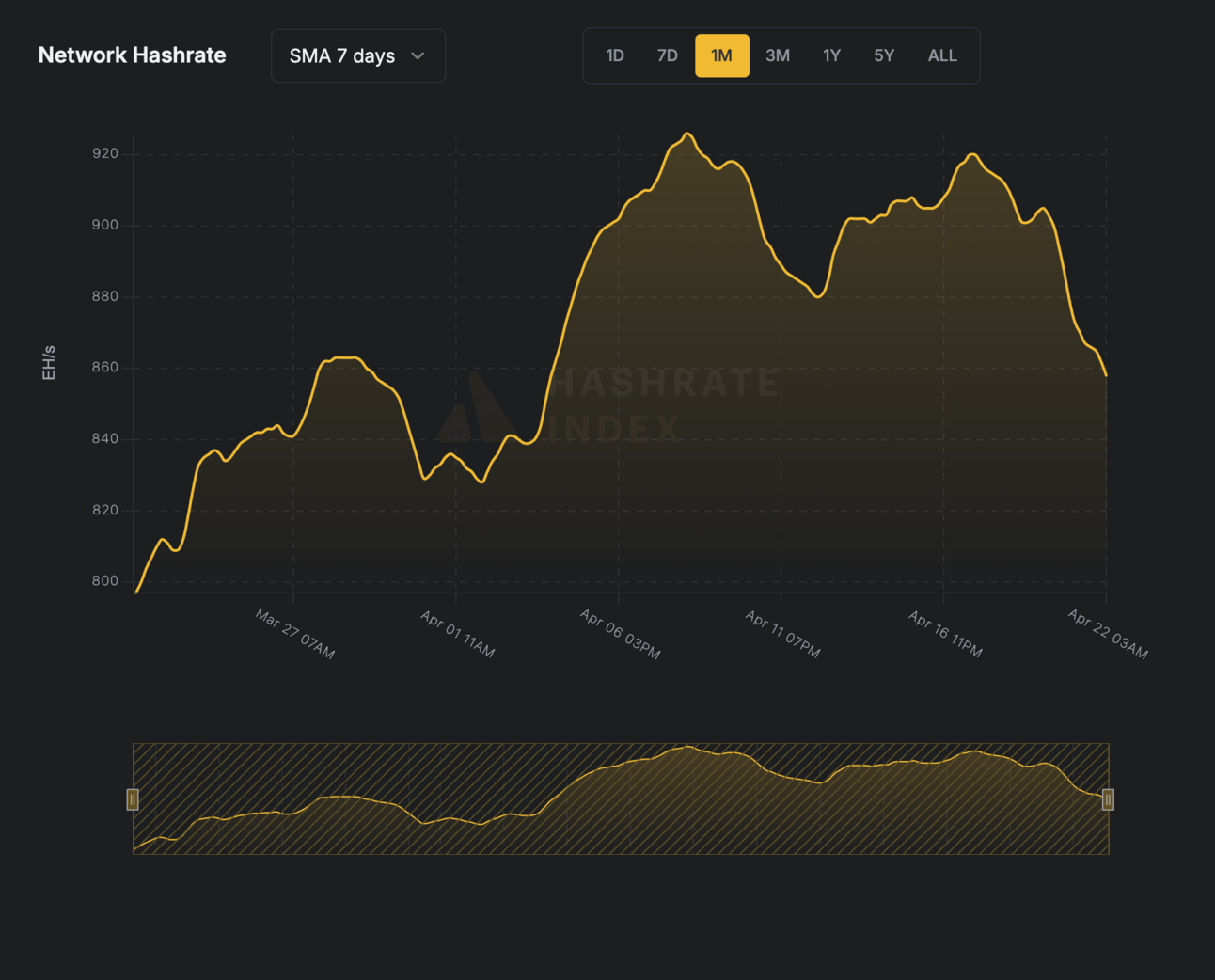

23 April 2025 · Hashrate 7-Day SMA: 846 EH/s · Hashprice: $48.53/PH/Day

Welcome to Mining Wednesday, where Blockspace covers the intersection of bitcoin mining, energy, and AI.

Today, an update on tariff exemptions for ASIC miners — or rather, the lack thereof. Plus, headlines, tweets and chart of the week!

It’s about a 5 minute read.

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Market Opens

BTC $93.8K 5%

GOLD $3,325 2.7%

MSTR $343 8%

COIN $190 9%

MARA $14.06 14%

CLSK $8.77 17%

RIOT $7.12 13%

CORZ $6.92 8%

ASIC miners will not benefit from computer tariff exemption

ASIC mining hardware will not enjoy the same tariff exemptions as computers, smart devices, and semiconductors, and bitcoin mining companies are looking for ways to adapt to Trump’s new import levies despite the 90-day pause on reciprocal tariffs and the 10% flat tax that replaced them.

On April 12, the Trump administration announced that it would exempt computers, smart phones, semiconductors, and similar computing hardware from its tariff regime. The move piqued speculation that ASIC mining computers may benefit from this exemption – but that’s not the case.

“Based on the latest tariff exemptions under 8471, Bitcoin mining ASICs do not qualify,” Ethan Vera, the COO of bitcoin mining software and services company Luxor, told Blockspace. Taras Kulyk, the CEO of bitcoin mining software and services company Synteq Digital, corroborated this, telling Blockspace “that’s correct, based on our counsel.”

The exemption only applies to computing devices classified under Harmonized Tariff Schedule of the United States (HTSUS) code 8471, while ASIC miners belong to HTSUS code 8543 (specifically, 8543.70.9960). Code 8543 applies to “electrical machines and apparatus, having individual functions.” The U.S. Customs and Borders Protection agency classified ASIC miners under this code in a June 2018 ruling.

The computer exemption would have been a godsend for U.S. miners who are bracing for tariff-induced price hikes to the hardware at the heart of their business – and all at a time when mining profitability is in the dumps.

As Blockspace reported earlier this month, miners were scrambling to expedite ASIC imports out of Southeast Asia, paying as much as quadruple the usual fare for air freight in a race for the exit against the clock. This maddash occurred in the lead up to the original reciprocal tariffs slated for April 9, which would have imposed levies of 24%, 32%, and 36% respectively on Malaysia, Indonesia, and Thailand, the primary manufacturing hubs for ASIC miners.

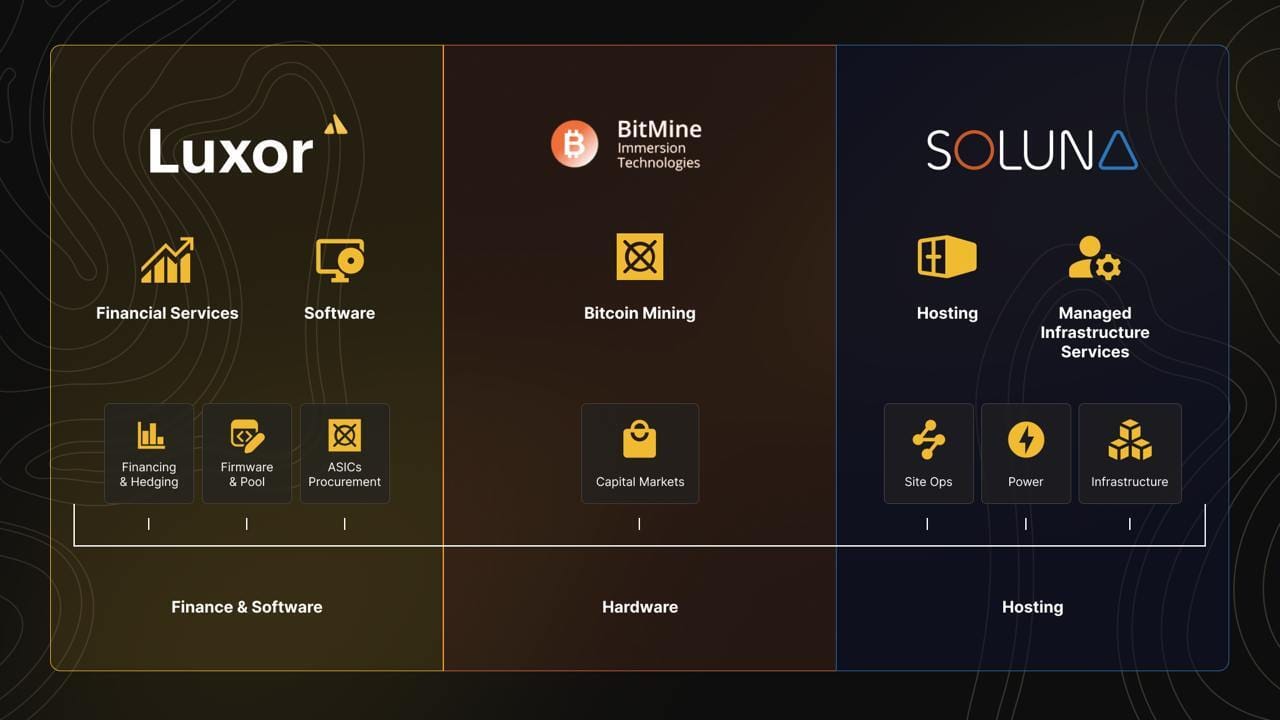

Full Stack Mining Solutions, From Financing to Firmware

BitMine partnered with Luxor and Soluna to build a turnkey mining solution, combining power, procurement, financing & firmware optimization. See how this collaboration helped BitMine triple deployed capacity & lock in predictable revenue

Bitcoin Mining Headlines

U.S. Patent Office revises Crusoe-Upstream ruling, rejects all petitions made by Crusoe

A Director Review of a patent case between petitioner Crusoe Energy and Upstream Data has vacated two petitions by Crusoe that the U.S. Patent Trial and Appeal Board upheld in a ruling this January, a revision that marks a complete victory for Upstream Data in what was previously a mixed ruling. The new decision denies Crusoe’s petition that two claims of Upstream’s patent on an oil-and-gas bitcoin mining container design constitute an “abstract idea,” meaning that now the USPTO has rejected all of Crusoe’s petitions against the patent. — link

Bitmain partner Antalpha files for IPO

Bitmain’s strategic financing partner, Antalpha Holding Company, has filed for an initial public offering (IPO) on the Nasdaq under the ticker ANTA, according to a U.S. Securities and Exchange Commission prospectus. The firm seeks to raise $50 million, and it earned $47.5 million in revenue last year. - link

Auradine raises $153 million, eyes AI business line

ASIC miner manufacturer fledgling Auradine has raised a $153 million series C led by StepStone Group and including funding from Samsung Catalyst Fund, Qualcomm Ventures, and MARA. The company plans to use the funds to expand its Teraflux ASIC miner line, as well as kickstart its AuraLinks AI business segment for AI infrastructure- link

Galaxy Digital expands CoreWeave megawatt capacity at Helios

Per a press release this morning, Galaxy Digital is set to expand its critical IT load for AI infrastructure provider CoreWeave under an option in the previous contract. Galaxy will now host up to 393 MW of IT load - link

‘Vibe’ Ranking Bitcoin Mining Companies

Chart of the week

What’s going on with Bitcoin’s hashrate? Hashrate is down 10% from its April 8 all-time high on the 7-day average. Now, wild oscillations in hashrate aren’t abnormal, but a 10% dip is enough to raise eyebrow…

FREE REPORT: Forecasting Bitcoin hashrate through 2027

-CMH