31 January 2024 · Block Height 881623 · Bitcoin Price $104K

Happy Friday, and welcome back to the Blockspace newsletter!

For today’s letter, a note on the “infinite money glitch” debt-to-bitcoin strategy; plus Tether is coming to Lightning, KuCoin’s $300 million plea deal, and more.

Domo arigato, Mr. Saylor

MicroStrategy has a Japanese doppelganger, and its name is Metaplanet.

The former hospitality company started issuing convertible notes to accumulate bitcoin last April. It currently holds 1,761 BTC, and its stock is up 2,480% since it started stacking. On January 28, the firm announced a round of warrants to accumulate another $750 million BTC toward its goal of owning 10,000 coins by the end of the year.

Metaplanet became the first disciple of MicroStrategy’s “infinite money glitch,” and it was a bellwether that the strategy would catch on (publicly traded bitcoin miners MARA and Riot, for example, adopted it at the end of 2024).

Traditionally, the only public companies with substantial bitcoin treasuries have been bitcoin miners, but MicroStrategy pioneered the concept of a bitcoin holding company, a label that Metaplanet uses to describe itself.

Source: Bitcoin Treasuries

If you’re unaware of the MicroStrategy strategy, it works more-or-less like this:

A company issues a convertible note to raise capital and buys bitcoin with the funds. Convertible notes are hybrid debt/equity financial instruments where a creditor loans money that the debtor can pay back in cash or equity. Once the note matures, the lender will take cash or equity depending on which offers the best return. The company issuing the note is typically betting that its stock will be worth more when the note matures.

The bet has certainly paid off for MicroStrategy, which is up more than 2,650% since August 2020 when it adopted its bitcoin strategy. This financial engineering is touted by proponents as a sort of perpetual motion machine for MicroStrategy’s value, with some even arguing that the company will be the most valuable in the world one day. In its purest form, MicroStrategy’s stock now allows investors to trade bitcoin’s volatility in a novel way.

Obviously, this strategy rests on the assumption that bitcoin, to quote Saylor, “is going up forever.” The companies adopting it also need to prudently structure the stock conversion price of the note, lest a steep drawdown in bitcoin makes the stock worth less than the loan, which would force the company to pay it back in cash at a time when its main source of liquidity (bitcoin) is in the dumps.

For now at least, the strategy is attractive enough to investors that Metaplanet, MARA, and Riot are following in MicrSstrategy’s footsteps. But much like the public bitcoin stock market, which is oversaturated with companies which no longer command the investor attention the sector used to enjoy, the question looms: will “bitcoin holding companies” also become a crowded trade?

Time will tell. To close with a Japanese proverb: “Too much is as bad as too little.”

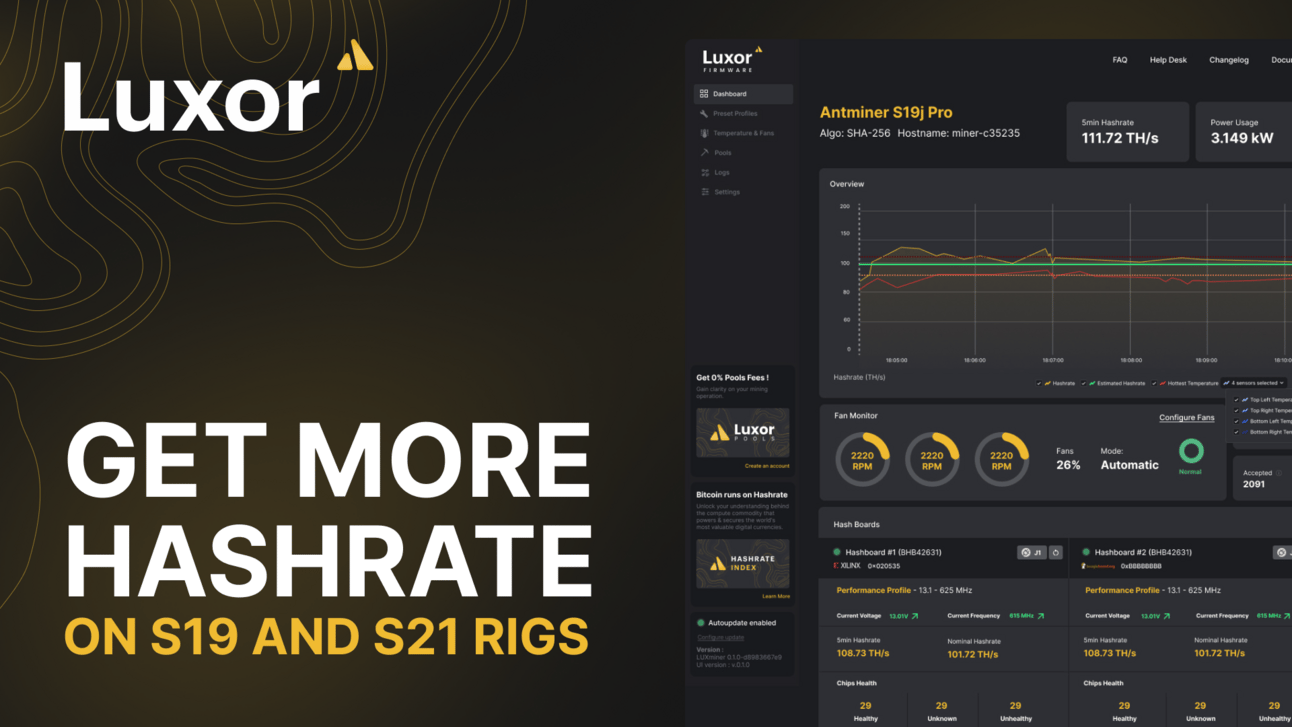

Brought to you by Luxor

Get game-changing mining results with Luxor Firmware. Boost hashrate, cut energy costs, protect your hardware, and maximize mining profits with LuxOS.

Bitcoin news

Miners brought over 1 EH/s of hashrate together for 256 Foundation’s Telehash event, pledging to donate any earnings from the solo pooled hashrate. The event hosts were surprised to see the donated hash hit a $326k block during the livestream. And they say a watched rig never finds a block!

Stablecoin giant Tether announced the integration of USDT to Bitcoin’s Lightning Network, leveraging the Taproot Assets standard. Tether has 350 million users according to the announcement’s press release.

The Vanguard Group has added to its position in Core Scientific. As of December 31, 2024, the investment firm reported beneficial ownership of 19,378,652 shares of Core Scientific's common stock, representing approximately 6.93% of the outstanding shares. Vanguard also has exposure to Riot Blockchain and MARA.

The exchange agreed to pay penalties totaling nearly $300 million, comprising a $112.9 million criminal fine and $184.5 million in forfeiture. As part of the settlement, KuCoin will exit the U.S. market for at least two years, and the two cofounders will step down from management and enter deferred prosecution agreements.