7 January 2024 · Block Height 878199 · Bitcoin Price $102K

Happy Tuesday!

Rumors swirled last week with suspicion that a bitcoin liquid staking protocol might be rehypothecating users’ bitcoin to capture more yield. While these rumors are unconfirmed, it’s spawned a whole narrative on wrapped assets and transparency.

So for today’s newsletter, a breakdown of wrapped assets — and the risks they could pose.

How safe is your wrapped Bitcoin?

User hans kicked up the initial scuttlebutt when they raised suspicions about Bitcoin staking protocol SolvBTC cycling the same user assets for multiple staking protocols. While this is unconfirmed at the time, it is an evolving story that kicked off several days of discussion and increased scrutiny around the whole wrapping and staking industry.

With over 300k BTC ($29.8 billion) of wrapped Bitcoin on various layers, the market shows increasing appetite for the crypto ecosystem’s most pristine asset.

Source: BitcoinLayers.org

Let’s lay some basic groundwork for how these systems work, leaning heavily on the work of our friends over at BitcoinLayers.

Who’s holding the money with wrapped bitcoin?

BitcoinLayers founder Janusz has a great overview post explaining how Bitcoin pegged assets work. At a basic level, depositors give their on-chain real BTC to a counterparty who then issues another asset on another blockchain/layer/protocol and guarantees the ability to redeem that asset back for real Bitcoin at a later date.

The majority of these counterparties are good ole-fashioned custodians such as Coinbase, BitGo, and Binance, but some counterparties use various federations (Stacks, Lombard) or signatory schemes such ThresholdDAO. While there is some variety in how exactly the custodians store the bitcoin and who signs for it, there are differing levels of transparency into who owns what bitcoin.

For example, if a counterparty publishes a public address holding 1,000 BTC on their website and says “here’s the wallet with all our real bitcoin that backs our issued token,” how do you know that they actually own that bitcoin? In many cases, the ownership is proven cryptographically or with external auditors. Sometimes, it’s just demonstrated by depositing from the protocol into those wallets and then withdrawing from the same wallet upon redemption.

However, as Janusz points out, many of these protocols and custodians are quite furtive about whose bitcoin they exactly control. “With a number of these protocols, the disclosure is simply listed in a blog post or their documentation site. Also, reserves, most of the time, are simply a list of bitcoin addresses on a webpage. We don’t really know if they're in fact an address managed by the relevant custodians.”

For large institutional operators such as Coinbase or Kraken, there is probably less concern about their treasury as they are largely trusted, well regulated institutions. But there are many suspected fly-by-night operators, and if crypto has taught us anything, it’s that we should assume there’s at least someone operating a shady business.

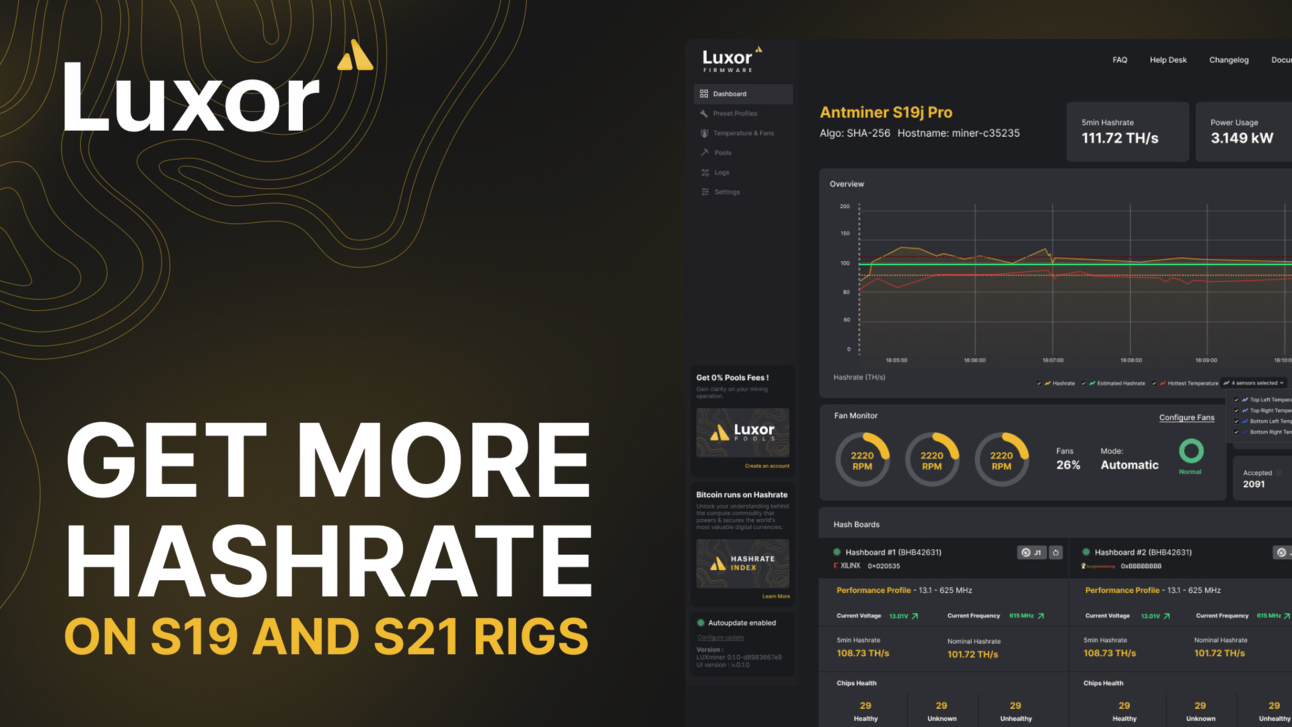

Brought to you by Luxor

LuxOS: Smarter firmware for miners. Boost hashrate, cut energy costs, protect your hardware, and maximize profits with tools built for peak performance. Elevate your mining operation today!

A few ways wrapped bitcoin could go wrong

One way a custodian could abuse users is by issuing more assets than they can redeem. E.g. 1000 BTC deposited and 1,100 wrapped BTC issued. There are innumerable analogues in crypto and in the real world where similar schemes have fallen apart.

Another potential abuse is an issuer of a staked asset themselves staking that same asset across multiple protocols. This is one of the suspicions hans identified, accusing SolvBTC of using presigned transactions to inflate TVL of their bitcoin deposits. This would be risky for both depositors of the protocol and the apps/protocols who count SolvBTC’s deposits as their own TVL when in fact it may just be the same bitcoin deposited several times over to multiple different parties.

Then there are the numerous risks associated with delegated or liquid staking itself: the operator of the liquid staking token could get slashed by the protocol, get hacked, or get rugged in some way.

Not an issue of “decentralization,” but rather trust assumptions and transparency

One of the main takeaways is that users should probably prioritize transparency and trust assumptions over “decentralization.” A decentralized signatory structure isn’t necessarily better if the underlying deposits are not handled properly. As Janusz puts it, “Does this make all custodian providers insecure? Of course not. A derivative with a centralized custodian might always stay backed. A future, trustless bridge implementation could get hacked.”

We’ve seen some asset issuers such as Lombard undergo good faith audits and demonstrate overcollateralization and an overall tight ship with staked assets. We also see tBTC’s Threshold scheme demonstrate both a comparatively decentralized signatory scheme and proactive transparency for user deposits.

Overall, it’s probably better that this conversation kicks off now while the cumulative wrapped bitcoin is under 15% of the overall Bitcoin supply. And remember – not your keys, not your coins. You remembered to withdraw your coins from exchanges on Proof of Keys day last week, right?