Like our content? Let us know by replying with your favorite recent read!

Tired of our content? Click here to unsubscribe.

Presented by

Fractal Bitcoin

Market Opens

BTC $105K 4%

GOLD $3,328 2%

MSTR $367 0%

COIN $307 0%

MARA $14.18 1%

CLSK $8.85 1.6%

RIOT $9.27 3%

CORZ $11.35 4.3%

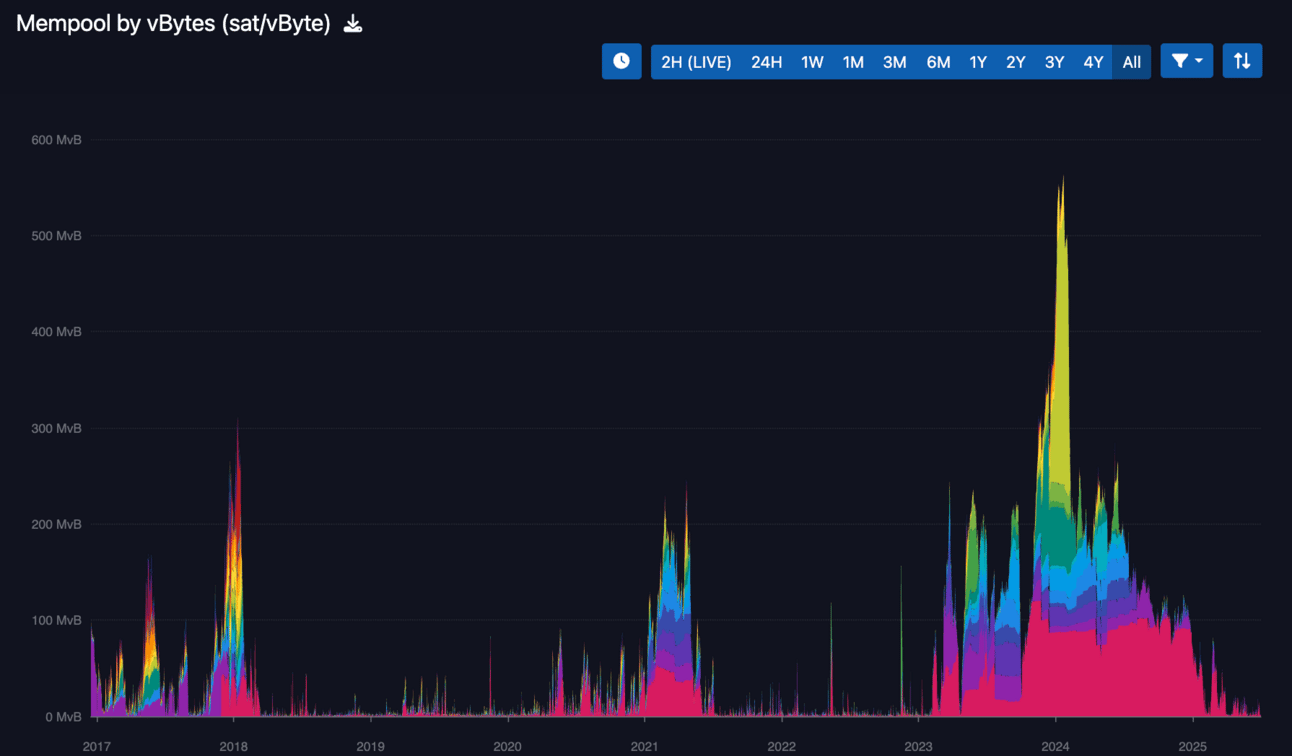

Where did all the fees go?

Bitcoin’s mempool is quiet – way too quiet.

In April, the largest bitcoin mining pool, Foundry, mined a block that included just 7 transactions. It was the emptiest non-empty block in more than two years. (An empty block occurs when a mining pool deliberately mines a block with no transactions).

The later half of 2024 and the first half of 2025 have been a stark departure from the go-go days of 2023 and the first half of 2024. Back then, Bitcoin’s mempool was frothy with activity thanks to metaprotocols like inscriptions, runes, and BRC-20 tokens, so much so that bitcoin miners hauled in record USD-denominated transaction fee flows on April 20, 2024.

It’s unusual for transaction fee activity to be this low in a bull market. According to CoinMetrics data, in 2021, bitcoin miners earned $2.8 million per day in fees on average. So far in 2025, that average is just $0.55 million. So what exactly is going on?

To explain Bitcoin’s fee drought, we have to look at three different trends: technical advancements, Bitcoin’s financialization, and metaprotocols.

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

Segwit adoption and Bitcoin’s financialization are primary culprits

To start with an obvious and easy explanation, the majority of the Bitcoin network is now using a transaction standard that is cheaper and more data efficient.

SegWit was released in 2016, but it didn’t become a ubiquitous transaction standard until relatively recently. SegWit transactions are smaller and more data efficient than those that came before it, and as of 2023, 90%+ of all active wallets have adopted SegWit.

It would stand to reason that, as SegWit has become increasingly adopted and transactions have become more efficient, we’d see this reflected in transaction fee revenue. But this only tells part of the story.

For the rest, we have to look at institutional adoption.

In a June 19 newsletter, Glassnode notes that Bitcoin’s integration into legacy finance, spurred forth by the January 2024 bitcoin ETF approvals, has recently manifested in two trends.

For the first, the value of average bitcoin transactions are increasing. The post notes that in June, 89% of transactions were settling value at or greater than $100,000, versus 66% in November 2022.

Serious About Mining? Get the Data to Match.

Premium users of Hashrate Index get full access to live metrics, market trends, and ASIC pricing tools — everything you need to mine and invest with precision.

News From Blockspace

Strategy taps common stock ATM, raises $519.5 million

Strategy (MSTR), formerly MicroStrategy, deployed its common stock at-the-market offering program for the first time in four weeks, selling 1,354,500 shares to net $519.5 million in proceeds between June 23 and June 29, 2025. — link

Hut 8 energizes 205 MW ‘Vega’ data center

Hut 8 (HUT) has flipped the switch on its ‘Vega’ data center in the Texas Panhandle, the first step toward bringing online an estimated 15 EH/s of Bitmain U3S21EXPH ASICs under a colocation agreement with Bitmain. — link

Cango closes mining deal, brings total capacity to 50 EH/s

Cango has completed the share-settled portion of its November 6, 2024 agreement to acquire on-rack bitcoin miners, issuing 146,670,925 Class A ordinary shares (worth roughly $657 million) to purchase the remaining 18 EH/s of rigs. The purchase lifts the company’s total deployed hashrate to 50 EH/s. — link

Blockspace Podcasts

On the latest Writer’s Room, Charlie and Colin break down Michael Saylor's Bitcoin Prague keynote where he tells people to leverage it all for bitcoin - including borrowing from family members (what could go wrong?). Plus, the FHFA’s directive ordering Fannie Mae and Freddie Mac to recognize crypto as legitimate assets for mortgages and more!

On the latest Mining Pod, Brian Wright, co-head of mining & data centers at Galaxy Digital joins us to talk about their massive pivot from bitcoin mining to HPC at the Helios facility.

Where do you think bitcoin transaction fees will be this time next year?

-CMH