Loving Blockspace? Reply with your favorite read from this week!

Had enough? Unsubscribe here.

Presented by

Fractal Bitcoin

Bitcoin broke over all-time highs yesterday. And we’re seemingly not done with the winning, hanging just under $120,000 per Bitcoin!

Today, Charlie tackles BlackRock’s Bitcoin ETF now accounting for 3.3% of the total bitcoin supply (and if you think that’s a lot, you should see how much its custodian holds…).

Plus, Bitcoin miners pivoting to treasury strategies and why Core Scientific share price tanked after the buy out offer from tech darling CoreWeave.

Market Opens

BTC $117K 6%

GOLD $3,369 1%

MSTR $431 2%

COIN $386 0%

MARA $19.30 2%

CLSK $13.05 1%

RIOT $12.74 1%

CORZ $13.05 1%

Fractal: Scale Bitcoin + Boost Miner Revenue.

Is Bitcoin’s most active scaling solution already here?

Fractal’s rapid hashrate growth and transaction growth suggest it might be.

A new report by Blockspace Media breaks down Fractal Bitcoin, the chain that’s quietly achieved:

🔸 ~80%+ of Bitcoin’s hashrate via merged mining

🔸 11 M+ daily transactions (comparable to Solana & Base)

Powered by Cadence Mining, a novel hybrid block production model, and seamless onboarding via UniSat, Fractal is emerging as Bitcoin’s most used innovation layer.

Blackrock manages over 3% of Bitcoin supply

BlackRock’s iShares Bitcoin Trust (IBIT) surpassed 700,000 BTC this week and now holds approximately 3.3% of Bitcoin’s total supply. IBIT is the largest Bitcoin ETF and accounts for over 55% of all U.S. spot Bitcoin ETF holdings. - link

OUR TAKE: Michael Saylor’s firmly behind the behemoth that is IBIT. Strategy’s 597,000 BTC just doesn’t carry the same gravitas it used to now that Larry Fink is in first place. Yes, these are structurally different types of Bitcoin holding entities, but we all know that it’s mostly a game of who’s-got-more-bitcoin regardless of what the exact claimant process looks like.

Or… are these actually that structurally different? Both IBIT and Strategy trust their BTC to Coinbase Custody. If this is news to you, then you might be even more surprised to learn that 9 out of 12 of the American ETFs custody with the same entity, Coinbase.

This isn’t necessarily a bad thing – Coinbase Custody is arguably the most secure, tenured, and regulated service available to institutions. However, this centralization is cause for two primary concerns: technical and regulatory risk.

If a single entity is custodying over 10% of BTC supply, even if they are going above and beyond best practices it creates a single entity to target. Whether that means a hacker trying to exploit a company’s security or a government subpoenaing a single entity, fewer actors in Bitcoin means a larger overall risk surface.

While I’m not worried about Coinbase Custody specifically, the growing trend of Bitcoin held by trusted custodians is a long term concern and it is more difficult to reverse than establish.

-CBS

P.S. Check out the fireside chat we did with Coinbase Custody at OPNEXT, the Bitcoin scaling conference.

Bitcoin miners are pivoting to altcoin treasuries?

This week, two public bitcoin miners revealed that they are establishing crypto treasuries, but with Ethereum (ETH) and Solana (SOL) – not bitcoin. This week, Bit Digital made good on announcements at the end of June that it would morph its bitcoin mining operations into an ETH staking and treasury business. The company converted all of its BTC into ETH and now holds over 100,000 ETH ($281.5 million). BIT Mining, on the other hand, announced yesterday that it wants to raise between $200-300 million to kickstart a SOL treasury company. – link, link

OUR TAKE: If it bleeds, it leads, apparently.

By it, I mean either SOL or ETH, and by bleed, I mean the fact that ETH recently hit a 5-year low when priced in BTC and is down 30% YTD (SOL is also down 30% YTD when priced in BTC).

So why, exactly, are these companies going against the grain and opting to build warchests with the second and third most valuable cryptocurrencies? That’s anyone’s guess, but to this writer, it seems like a naked bid for relevance.

That at least seems to be the case from BIT Mining’s side, whose stock soared 190% on the news. The company has languished in relative obscurity while its peers have matured into billion dollar companies; its mining operations are teensy weensy compared to the majors in this sector, and even after the news juiced its stock, BIT Mining’s market cap is only ~$90 million. So why not, I suppose, chase the crypto treasury hype with a coin (SOL) that doesn’t have as many corporate adopters as bitcoin? Anything to get that stock price fattened up.

I will be a little more generous with Bit Digital, which used to mine ETH before the merge and which has been staking it since. Concurrent with this ETH pivot, Bit Digital is also trying to spin off its AI/HPC business, WhiteFiber, into another public entity. In doing so, they are divesting themselves entirely of their bitcoin mining business, which wasn’t much to write home about anyway (the company’s active hashrate was 1.5 EH/s at the end of Q1).

With Bit Digital leaning into AI/HPC and out of bitcoin mining completely, it makes some sense that they would roll that entire business and its treasury into ETH, which it can then stake to earn yield. At 3-4% APR, they can earn $8.4-11.3 million per year staking their ETH. Admittedly, this is less than the annualized revenue for their Q1 bitcoin mining earnings ($31.2 million), but they also don’t have to deal with depreciation, electricity costs, or any of the other hassles that comes with mining. And the staking revenue is almost all gravy – the margins are much higher since the operating costs are next-to-nothing.

Either company is essentially making a gambit that the market will reward altcoin treasury companies, in part because they did so for bitcoin and in part because there are few companies buying up ETH and SOL treasuries (so maybe there is a first-mover advantage here).

Still, as I write this, bitcoin is roaring above its all-time high, so I can’t help but wonder: why not just keep it simple, stupid, and just buy bitcoin?

-CMH

CORZ is down 27% since the CoreWeave news…why?

Core Scientific (CORZ) shares have slipped 27% to nearly $13 since the news of CoreWeave’s (CRWV) all-stock takeover. The July 7 press release stated that the deal “represents a $20.40 per share value based on the closing price of CoreWeave Class A common stock as of July 3, 2025.”

We won't know the final acquisition price until the deal closes in Q4 2025. But in the meantime, the CORZ spot price and the CRWV options market may help us divine a close guess.

In our latest article, we break down what the options market for CoreWeave and the CORZ selloff can tell us about market expectations for the acquisition.

Follow the Hashrate, Spot the Opportunity

The Global Hashrate Heatmap has just been updated with Q2 data. See where Bitcoin mining is growing, shrinking, or holding steady across regions like the U.S., China, and Latin America — and what that might mean for your next move.

Blockspace Headlines

House Announces "Crypto Week" for July 14th

The U.S. House of Representatives designated July 14-18 as "Crypto Week" as it considers three major bills: the CLARITY Act, GENIUS Act, and Anti-CBDC Surveillance State Act. The legislative push aims to establish comprehensive crypto regulation to cement the US as a global leader in digital assets - link

GameSquare Announces $100M Ethereum Treasury Strategy

NASDAQ-listed GameSquare approved a $100 million Ethereum treasury allocation, raising $8 million through a public offering. The stock surged over 150% following the announcement as “bitcoin treasury companies” now broadens to “crypto treasury companies” - link

Ego Death Capital Closes $100M Bitcoin-Focused Fund

Ego Death Capital closed its second fund, raising $100 million to invest in “Bitcoin technology companies.” It’s the largest Bitcoin-not-crypto fundraise to-date. - link

Chart of the Week

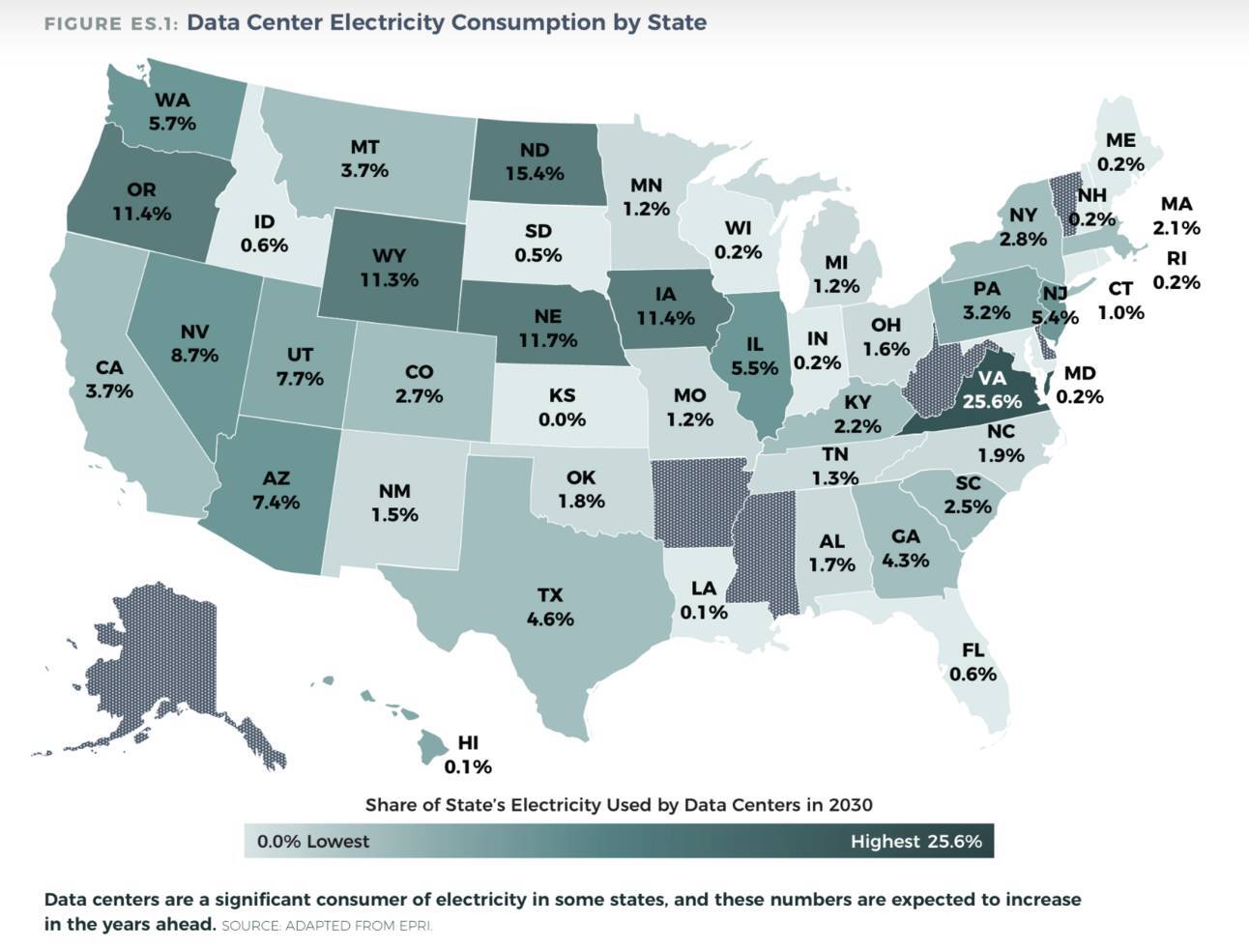

Data centers could consume 25% of all the electricity used in Virginia by 2030? That’s a lot of bandwidth and electrons to prop up the deep state…

Blockspace Podcasts

Ben Harper from Luxor Technology joins us to discuss CoreWeave's $9 billion acquisition of Core Scientific, IREN’s $130 million Nvidia GPU purchase, hashprice hitting $60 for the first time since February, summer hashrate curtailment, and why transaction fees are so low. Plus, why Bit Digital and BIT Mining are becoming altcoin treasury companies.

Weekly Non Sequitur

Happy National French Fry Day! (to all who celebrate). As legend has it, we get the term “French Fry” from American GIs in WWI, who associated the treat with French-speaking Belgium where they first encountered it. Apparently, the nomenclature and origin of the french fry is bitterly disputed, with both the French and the Belgians laying claim.

-CMH & CBS