Happy Tuesday!

As AI slop penetrates social media, crypto content is plumbing new depths of attention-farming excrement.

So for today’s newsletter, a love-hate letter to YouTube from some chuckleheads who run YouTube channels for a living.

Plus, headlines from Blockspace and a podcast with Rory Murray, VP of Digital Assets for Bitcoin miner CleanSpark.

The absolute state of Crypto YouTube

If you are reading this, you probably don’t know how bad it truly is.

I’m talking about YouTube – specifically, Crypto YouTube.

Dear reader, just by virtue of being subscribed to our niche, highly curated newsletter, you have already self-selected to tune out the pablum of crypto content that permeates the biggest top of funnel for our industry.

Let’s explore the state of Crypto YouTube. Put on a suit of armor, because there be dragons cringe.

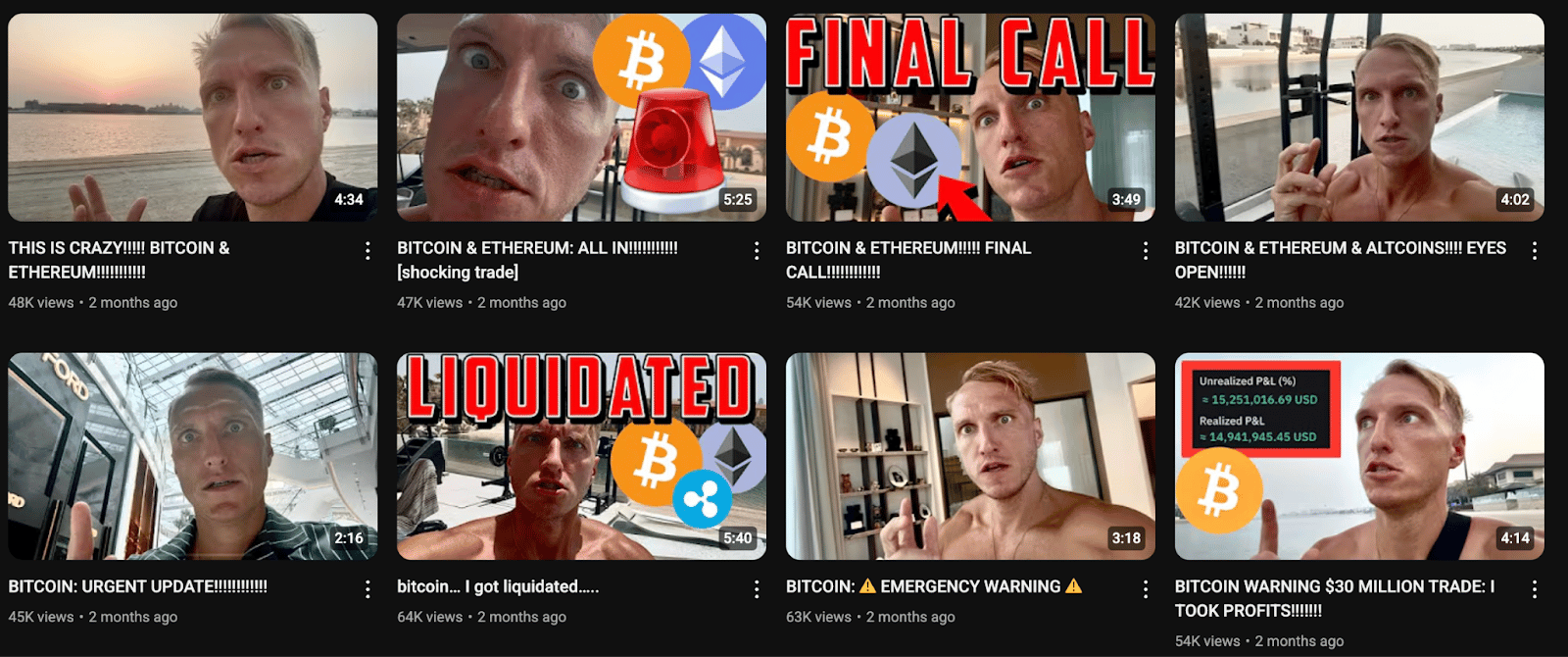

The Inverse Law of Quality

Let’s introduce a concept I call the “Inverse Law of Quality.” The lower the quality of a Crypto YouTube video, the higher the views it received (and vice versa).

Look no further than the infamous “shill price list” leaked from Crypto Twitter anon-sleuth ZachXBT a couple years ago. A good undisclosed shill on a medium-size YouTube channel was a cool $5k back in the day.

Source: ZachXBT

Archetypes of the grift

The Crypto YouTube grift comes in many shapes and sizes, but I’ve zeroed in on some classic archetypes of Crypto YouTubers that I outline below.

Soloprenuer: This is the king of Crypto YouTube content, the business model with the highest ROI. Often just a dude with a camera, big expressions, and a dream (and usually an eastern european accent).

All he needs is a ticker and an audience and he can do the rest. I’m talking about titans of the industry such as The Moon Carl or the disgraced BitBoy X (formerly BitBoy Crypto before his extremely public legal dispute, likewise extremely public divorce, and still incredibly publicized drug crashout).

But the absolute GOAT of this format is MMCrypto. Nobody does it better than this guy. His strained face demands that you click to learn about his latest trade.

Then you’re funneled into a few minutes of incoherent rambling punctuated by crypto buzzwords and probably a chart or two. But it’s peak crypto clickbait content.

Slop-house production: Wanna juice your brand with a high-throughput content team? Get a slop-house sweatshop operation going and really crank out some videos.

One of my favorite examples of this is a shorts-only content house promoting a solana memecoin called $YETI.

“Yeti Crypto” videos all follow the Hero’s Journey: poor bum risks it all on the YETI coin, makes 1000x, and then flaunts it (his life is now perfect).

It’s a fantastic format and according to socialblade the brand has done over 400 million views since June.

And yet, $YETI is down 93% since launch. So the game goes.

Headlines by Blockspace

Want to get these headlines in real time? Join our Telegram group!

Bitcoin Miners bounce back early on Monday after Trump tariff jitters on Friday

Bitcoin mining stocks, particularly those with an AI pivot in place experienced resiliency in the first hour of trading on Monday, October 13. Friday’s afternoon session saw massive market volatility as stocks and crypto sold off after President Trump stated that he would impose large tariffs on China. - link

TeraWulf proposes $3.2 billion senior secured notes offering

TeraWulf (WULF) announced in a press release that its wholly owned subsidiary, WULF Compute LLC, intends to offer $3.2 billion in aggregate principal amount of senior secured notes due 2030. - link

Two Seas Capital urges vote against Core Scientific’s sale to CoreWeave

According to a press release today, Two Seas Capital released an investor presentation October 10 detailing why it opposes Core Scientific’s (CORZ) proposed sale to CoreWeave (CRWV), calling the transaction process flawed, the structure deficient and the exchange ratio inadequate. - link

Digital asset funds pull in $3.17 billion even as AUM dips 7% on tariff scare last week: CoinShares

Digital asset investment products attracted $3.17 billion of net inflows last week despite a sharp price correction linked to escalating U.S.–China tariff tensions, according to asset manager CoinShares. Year-to-date inflows have now climbed to a record $48.7 billion, surpassing last year’s full-year total. - link

Strategy raises $27.3 million and buys 220 Bitcoin for its first purchase in two weeks

Strategy Inc (MSTR) has raised $27.3 million through its at-the-market equity programs and used the proceeds to acquire 220 BTC at an aggregate cost of $27.2 million, increasing its total holdings to 640,250 BTC, according to an October 13 filing. This is the first time Strategy purchased BTC in two weeks. - link

Binary Mining Is Over: Download The Intelligent Miner

Our research shows Intelligent Mining delivers 8-14% more profitability than traditional operations. Learn how to make this transition for your operation.

Blockspace Podcasts

Welcome back to The Mining Pod! Today, Rory Murray, VP of digital asset management at CleanSpark, joins us to talk about the explosive markets we're seeing in late 2024, why he believes Bitcoin's four-year cycle is dead, and the secular trends that will define the next chapter of crypto. We dive deep into the debasement trade, record bitcoin ETF inflows, the intersection of macro and Bitcoin mining stocks, and what keeps a veteran trader up at night. Also, Rory shares his framework for navigating animal spirits and how they relate to Bitcoin's long-term trajectory.

Where we drop fun topics with nothing to do with Bitcoin.

The Old English/Anglo-Saxon name for October is "Winterfylleth,” a compound word for “winter” and “full moon.” The Anglo-Saxons divided the year into two, equally-split seasons (summer and winter) according to the equinoxes, and the first full moon in October marked the beginning of winter.

-CBS, CMH