12 March 2025 · Hashrate 7-Day SMA: 824 EH/s · Hashprice: $47/PH/Day

Welcome to Mining Wednesday, where Blockspace covers the intersection of bitcoin mining, energy, and AI.

Today’s guest post comes from Hashlabs Mining consultant Muad Dib, a researcher at the Cambridge Centre for Alternative Finance with extensive experience writing on public Bitcoin mining metrics. In this article, we’ll take a look back at the volatile 2022 energy markets with reflections for Bitcoin miners headed into a consequential 2025. It’s about a 3 minute read.

Plus, podcasts and industry rumors below 👀

NiceHash is the go-to platform for Kaspa and Dogecoin miners looking to maximize their mining profits by up to 40%! Get paid in Bitcoin with payrate surges that beat pool payrates! No need to swap, no conversion fees - just more profit in your BTC wallet. Plus, boost your efficiency even further with NiceHash Firmware for Antminer Kaspa machines, unlocking better performance and higher earnings per watt.

The lingering fog of electricity markets

Global energy markets were a mess in 2022. Following Russia’s invasion of Ukraine, key energy metrics shattered historic norms. Brent crude oil spiked to 15 year highs, as did Henry Hub prices and other natural gas markets globally.

For Bitcoin miners, this volatility proved momentarily disastrous. Companies like Argo Blockchain saw natural gas prices surge, severely impacting mining economics. Bankruptcies became a fixture of the post-2021 bull market, claiming Core Scientific, Compute North and others.

This period of turbulence underscores the importance of securing stable power rates for long-term operational viability. In a world of complexities, miners must be sure of one task: securing cheap, consistent power.

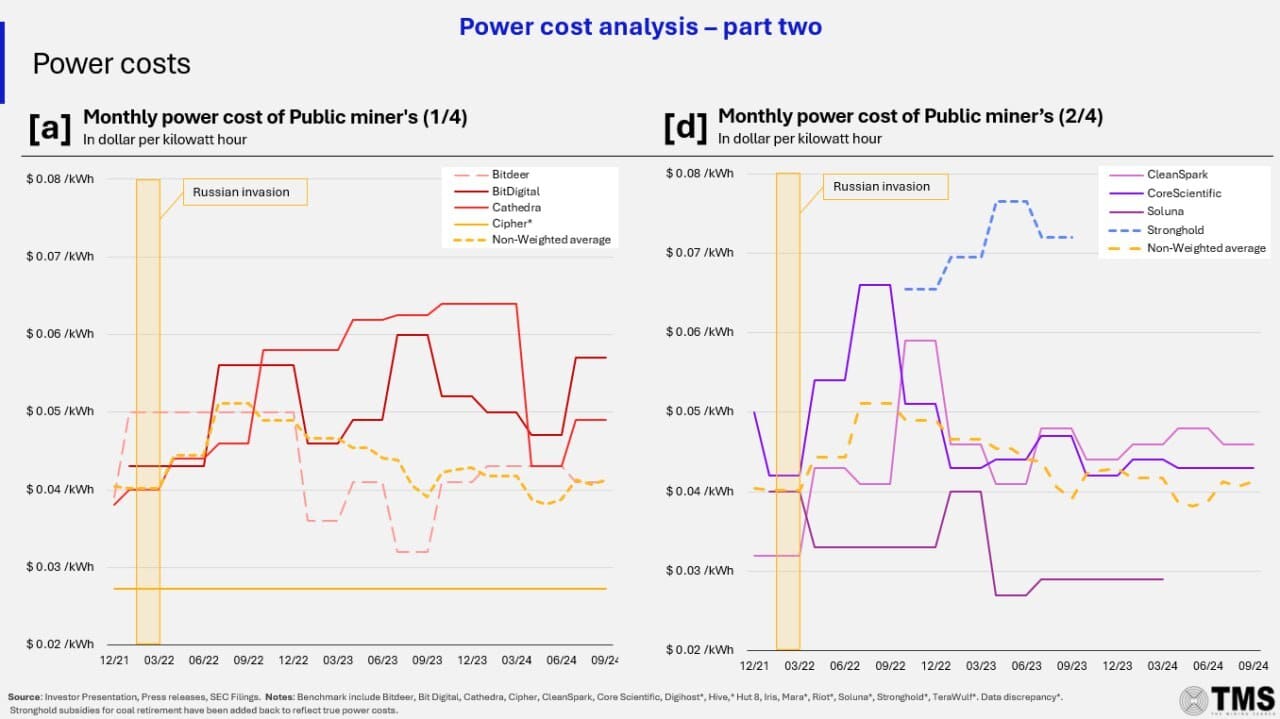

From March to September 2022, electricity prices spiked significantly for most North America-based miners:

Bit Digital saw its power cost per kWh increase by 30%.

Cathedra, which relied on hosting providers, experienced a 45% increase in rates.

Core Scientific struggled with negative margins as its fixed hosting costs rose from $0.042/kWh to $0.066/kWh.

CleanSpark faced power costs peaking at $0.059/kWh in Q4 2022, despite paying only $0.032/kWh in Q1 2022 at its Georgia grid location (including operations in Massena, New York).

By late 2022, the surge in power prices subsided, with rates normalizing in 2023 and 2024. This significant correction is particularly evident in the power rate curve of Hut 8.

(Riot experienced negative power rates due to its participation in a curtailment program. By voluntarily reducing power consumption to help balance the grid, Riot earned power credits that effectively offset its electricity costs.)

As demand shifts—particularly with the rise of AI and high-performance computing (HPC)—Bitcoin miners must remember what underpins their business: energy consumption. As hashprice continues to decline to all-time lows, we’ll soon see which miners focused on press releases over robust energy strategies.

Note: Power costs disclosed by public miners reflect the average power rates over a three-month period across their operations. When available, monthly data—such as that from Riot and TeraWulf—has been used for greater granularity. However, data from companies like Mara, Riot, Digihost, and Hive was inconsistently reported, leading to gaps in data presentation.

Troubleshoot Miners in Seconds with LuxOS

Identify errors, diagnose underperformance, and automate reports — all through the new Events API. Less time digging through logs, more time optimizing.

Rumor mill

Rumor has it M&A is coming for a few more well known private miners, similarly to the Consensus Technology Group (CTG) acquisition by NYDIG in Q4 2024, which Blockspace reported on first.

Is more M&A in the air? Are we going to see another public miner? Time will tell.