5 Febraury 2025 · Hashrate 7-Day SMA: 837 EH/s · Hashprice: $58/PH/Day

Welcome back to the Blockspace Newsletter!

For today’s letter, we feature an interview with MicroBT Founder and CEO Dr. Zuoxing Yang, and we also have some January production updates from leading public miners. Today’s read is about 5 minutes.

A sit down with MicroBT’s Dr. Yang

Below is a transcript of a Blockspace interview with MicroBT’s Dr. Yang. The CEO reveals MicroBT’s timeline for the next Whatsminer series, how the company plans to compete with Bitmain’s future-facing models like the S21U3EXPH, the impact of HPC/AI on its core business line, and other topics. The following interview has been edited for clarity, as a MicroBT employee served as translator for the Q&A.

If you come at the king, you best not miss.

When Dr. Zuoxing Yang – the mastermind behind the famous Antminer S9 – left Bitmain in 2016 to found MicroBT, his aspirations were bold and his task herculean. At the time, Bitmain was the undeniable champion in the ASIC miner manufacturing arena, and MicroBT’s Whatsminer ASIC line set out to challenge that dominance.

Nine years later, little has changed. Although MicroBT has cut into Bitmain’s marketshare, estimates put it at a not-so-close second behind Bitmain’s 78% of the ASIC market. MicroBT only has 14%, according to Coin Metric’s MINE-MATCH methodology. Moreover, MicroBT’s marketshare has been slowly receding since at least January 2022, when it was 22%. (This data is likely directionally accurate but not totally so, since Coin Metrics has not added new models since the S21).

Source: Hashrate Index

Many miners will tell you that MicroBT’s Whatsminer ASICs are second-to-none when it comes to quality, and that most models outlive Bitmain’s own. But Bitmain’s outsized marketshare feeds on itself; each year of dominance means it can out-earn its competitors, which in turn means it can order a larger tapeout of ASIC chips from TSMC, which leads to more orders, which strengthens its position further, and so on.

Regulatory troubles could disrupt Bitmain’s dominance, but there’s no indication that the U.S. government’s blacklisting of Sophgo – a chip company that shares Bitmain’s CEO and co-founder, Micree Zhan – will spill over into Bitmain. For now at least, MicroBT will need ole fashioned innovation, grit, and perseverance to challenge Bitmain’s market position.

What can you tell me about MicroBT’s latest hardware, the M60++ series?

So besides the series’ flagship, the M60++, we have three types of new models. The first one is a hydro-cooled model that is a high temperature resistant model that can support temperatures up to 80 degrees celsius. The second model is our high power density air-cooled model which is built for overclocking, and the last one is the new M60s++.

Okay, so obviously, a big step forward for the M60 series. When might we expect another series for MicroBT?

We are always trying our best to create deep optimizations so our next generation will be launched in March or April of 2026.

Institutional miners and some of the public bitcoin miners are starting to adopt alternative forms of cooling like hydro and immersion. So I have a two-front question: how is MicroBT going to approach developing those systems going forward, and which system does MicroBT think will be more successful?

Four years ago in 2019, I introduced the immersion liquid cooling during the Chengdu bitcoin mining summit. So we believe that immersion and hydro have specific advantages; for example, low noise and long life expectancy for operations. But we believe air cooling machines would also work for legacy facilities, and that hydro and immersion might be best for building newer facilities [since they require different infrastructure]. And if we just compare immersion and hydro currently from a technical perspective, we do not see one as better than the other. We believe we will see both run in parallel.

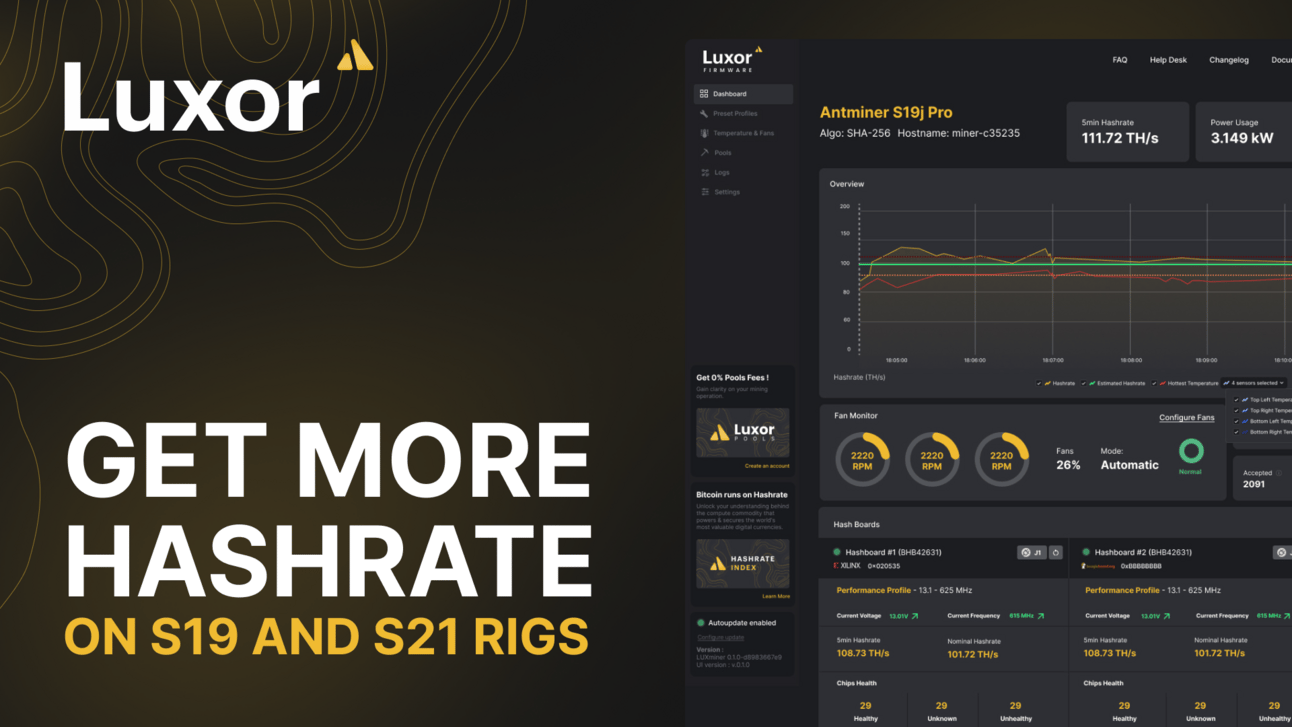

Brought to you by Luxor

Get game-changing mining results with Luxor Firmware. Boost hashrate, cut energy costs, protect your hardware, and maximize mining profits with LuxOS.

Looking at new advancements and form factors, Bitmain recently released the S21U3EXPH. It's a traditional, U-form server rack. Does MicroBT have any plans to produce something similar?

So currently all of our miners just use the 2U size, but we also plan to release a 3U model, maybe in the middle of 2025. This 3U model could reach one petahash with a total power consumption of 10kw. We will produce both 2U and 3U form factors in the near future. We believe both will coexist for a long time, as our customers need both.

Shifting focus, how has the HPC and AI landscape impacted the foundries and bitcoin mining hardware manufacturers’ ASIC chip allocations?

AI chips and bitcoin mining chips have each adopted the latest technical node [3nm] at semiconductor factories. So for the allocations, yes they have a little bit of conflict right now. But for AI chip use cases, we can just treat them as a pilot project, which would help us accumulate knowledge and help chip design teams. In the future, most of the world’s computing power will be used for AI inference. Inference hardware uses the same or similar chips as bitcoin mining. So we can learn from AI and maybe adopt similar cooling systems, like immersion and hydro.

Turning back to bitcoin mining, what regions are producing the most demand for MicroBT machines right now outside of the US?

Everyone knows that currently the U.S. is dominating the bitcoin mining market right now. Besides the U.S., we also see a lot of demand from South America.

Is the Chinese government relaxing some of its restrictions on bitcoin mining? And if not, do you think that there's a chance they do so in the future?

So we respect the regulations and policies from our government, and we believe that the Chinese government has deep consideration for these industries. So compared to the U.S., they have a very positive attitude to miners. So we believe this attitude could influence things in the future, but we do not have any messages or news for the current policies. So maybe it's possible in the future.

January 2025 public miner updates

Every month, we’ll be dedicating this section to public Bitcoin miner updates. Since miners don’t publish their updates at the same time, we’ll include as many as we can and add to the list the following weeks until we cover all the major players. Please note that we try to be as thorough as possible for each miner, but certain metrics are omitted if the miner does not report them.

Cleanspark

Hashrate: 40.1 EH/s EoM (+3%) | 34.76 EH/s avg. (-2%)

Efficiency: 16.15 J/TH EoM (-8%) | 17.37 J/TH avg. (-4%)

BTC mined: 626 (-6%)

BTC holdings: 10,556 (N/A)

Operations: 873 MW (+2%)

Further notes: 0.7 EH Twin City, GA site is 86% complete with full energization expected this month; 5 EH Cheyenne, Wyoming site for S21 XP immersion on track for completion in Q1

Riot

Hashrate: 33.5 EH/s EoM (+6%) | 29.3 EH/s avg. (+7%)

Reported power cost: $35/MWh (-8%)

Curtailment credits: $3.6 million (+250%)

Efficiency: 21.1 J/TH EoM (-9%)

BTC mined: 527 (+2%)

BTC holdings: 18,221 (+3%)

Further notes: First, 400 MW phase of Corsicana, TX completed and fully energized with 15.7 EH/s; second, 600 MW phase of Corsicana paused for assessment of AI/HPC conversion feasibility

MARA

Hashrate: 53.2 EH/s EoM (0%)

BTC mined: 750 BTC (-13%)

BTC holdings: 44,893* (*As of January 3, 2025)

Further notes: 230 containers at Wolf Hollow, TX converted to immersion for S21 Pro models; “nearing full conversion” to S21 Pros at Kearney, NB site

Bitfarms

Hashrate: 15.2 EH/s (+19%) | 11.2 EH/s avg. (+1%)

Efficiency: 20 J/TH EoM (-1%)

BTC mined: 201 (-5%)

BTC holdings: 1,152 (+23%)

Operations: 386 MW (+13%)

Further notes: Signed LOI to sell 200 MW, under-development site in Yguazu, Paraguay to Hive; derating 2025 hashrate guidance by 14% to 18 EH/s “due to the underperformance of … T21 miners”; miner deliveries to continue through Q2 for multiple sites including Stronghold sites in PA

Cipher

Hashrate: 13.5 EH/s EoM (+0%)

Efficiency: 18.9 J/TH EoM (+0%)

BTC mined: 219 (-6%)

BTC holdings: 1,091 (-19%)

Further notes: Phase 1 of Black Pear, TX site “nearing completion”; Cipher recently took in $50 million investment from SoftBank toward AI/HPC business aspirations

Rumor mill

Is Cipher positioning itself to cash in on Project Stargate? Sure looks like it.

Last week, SoftBank—one of the principal funders of the $500 billion Project Stargate AI initiative—invested $50 million into Cipher Mining in a private placement deal. Cipher said that the investment “will support [its] HPC data center development business.”