28 March 2025 · Block Height 889814 · Bitcoin Price $85K

It’s bitcoin treasury szn. The mother of all memestocks is adopting a bitcoin strategy, and the bitcoin strategy continues to go global.

Before we jump in, get your tickets to OPNEXT, the Bitcoin scaling conference hosted by Blockspace at the Strategy (formerly Microstrategy) headquarters, April 11-12. Coinbase, Bitwise, Brink and tons of other Bitcoin engineers will be joining us for 2 focused days on Bitcoin scaling, tech and development talk.

Tickets go up April 1! Use code "BITDEVS” for 10% off a ticket by visiting here.

Boost your ASIC mining with NiceHash Firmware, powered by MARA!

Get the highest efficiency and lowest fees - just 1.4% when mining on NiceHash. Unlock elite mining technology for your Bitcoin (S19, S21 series) and Kaspa (KS5, KS3) Antminers. Supports air, hydro, and immersion cooling. Upgrade now and maximize your profits! 🚀

Gamestop wants $1.3 billion to buy bitcoin

Retail gaming giant GameStop ($GME) wants to adopt a bitcoin strategy, and it’s trying to raise a cool billion to do so. The company announced a $1.3 billion convertible note offering this week, stating that it “expects to use the net proceeds from the offering for general corporate purposes, including the acquisition of Bitcoin in a manner consistent with GameStop’s Investment Policy.” — link

OUR TAKE: “Power to the players”? Another bitcoin treasury company has entered the game.

Unlike Strategy (formerly MicroStrategy), which came out of nowhere to pioneer the bitcoin treasury strategy, Bitcoin’s talking heads and pedestrian spectators have anticipated this move since Gamestop CEO Ryan Cohen’s photo op with Michael Saylor last summer.

There’s also something almost predestined, something wyrd, about it all–like the financial Fates weaving GameStop’s comeback story from one improbable outcome to the next. After all, y’all may remember that GameStop was the standard-bearer for mainstreet’s 2021 memestock skirmish with Wall Street. This was the year that Keith Gill, under the pseudonym Roaring Kitty, fomented perhaps the most impressive short squeeze of all time; sensing the stock was oversold, he galvanized an army of retail investors to ape their hard-earned cash into GME, sending the stock up 2,600% to an all-time high above $480 over the course of January 2021 and wiping out billions of dollars in short positions in the process.

In some sense, this quixotic Robin Hood (maybe pun intended) story of our increasingly bizarro financial landscape set the stage for GameStop's bitcoin foray. Not only because things that were once unthinkable for public markets are becoming more-and-more feasible (and potentially lucrative), but because GameStop itself capitalized on the craze. The company raised $1.67 billion from equity raises in 2021, following with $3.45 billion in 2024. With the windfall, GameStop essentially neutralized its debt and built an impressive cash position of $4.8 billion.

If GameStop is serious about building a bitcoin treasury, it’s hard to imagine they don’t spend some of that cash accordingly. Where else would they invest it? In their waning retail gaming business? Unlikely.

Which brings me to my final point: is it really all that exciting to see a company – perhaps in its twilight, certainly past its prime – pivot to bitcoin? GameStop pulled in $3.8 billion in 2024, versus $5.3 billion in 2023 (and $8.5 billion when it was at its zenith in 2017). It’s hard to look at this bitcoin strategy as anything more than a faltering company grasping for relevance – and for another jolt of memetic energy that will electrify its stock price like in 2021. GameStop is searching for financial pixie dust.

England’s Metaplanet? The Smarter Web Company eyes UK IPO with bitcoin strategy

Web development company The Smarter Web Company will debut on public markets in the U.K. as early as April 2 with bitcoin on its balance sheet and an explicit mandate to buy more, according to public filings. Under the proposed ticker SWC, The Smarter Web Company will issue an initial public offering (IPO) on the Aquis Exchange through a shell company it recently acquired, Uranium Energy Exploration Plc. It expects to raise approximately £2,000,000 (~$2,578,000) from the offering. — link

OUR TAKE: I know what you’re thinking: you’re covering another bitcoin treasury company in today’s newsletter?

Yes, dear reader, I am, but for a different reason. Like I said in the last take, I will spare everyone the diatribe on whether or not there’s enough air in the room for multiple Strategies.

As Metaplanet’s success has shown, however, there is appetite, for now at least, for Strategy acolytes in international markets. Since going public in November 2024, Metaplanet is up 100% and holds 3,350 BTC. Dylan LeClair, a partner at UTXO Management – the investment arm of BTC Inc., the parent company of Bitcoin Magazine and The Bitcoin Conference – leads Metaplanet’s bitcoin strategy. Relatedly, UTXO purchased a listed Hong Kong company, the now named Moon Inc., to replicate this strategy in Hong Kong markets.

You might see where this is going. UTXO also invested in The Smarter Web Company, and UTXO Co-Founder and Chief Investment Officer Tyler Evans is an independent director at The Smarter Web Company, as well. With its influence, UTXO Management appears to be exporting the Strategy bitcoin strategy to international markets. And not without strategic benefit: as Smarter Web Company CEO Andrew Webley told Blockspace, jurisdiction-specific bitcoin strategy companies can tap into funds that have local investment mandates. A U.K. hedge fund, for example, may only invest in U.K. companies. So, they can’t invest in a company like Strategy unless a Strategy-like company lives next door.

So there’s the rub. We’re starting to see the Strategy playbook invade equity markets outside the U.S., with no small influence from the team at UTXO Management. These companies will have access to capital pools that can’t or won’t flow into their U.S. counterparts, but the question still looms: how long until the novelty wears off?

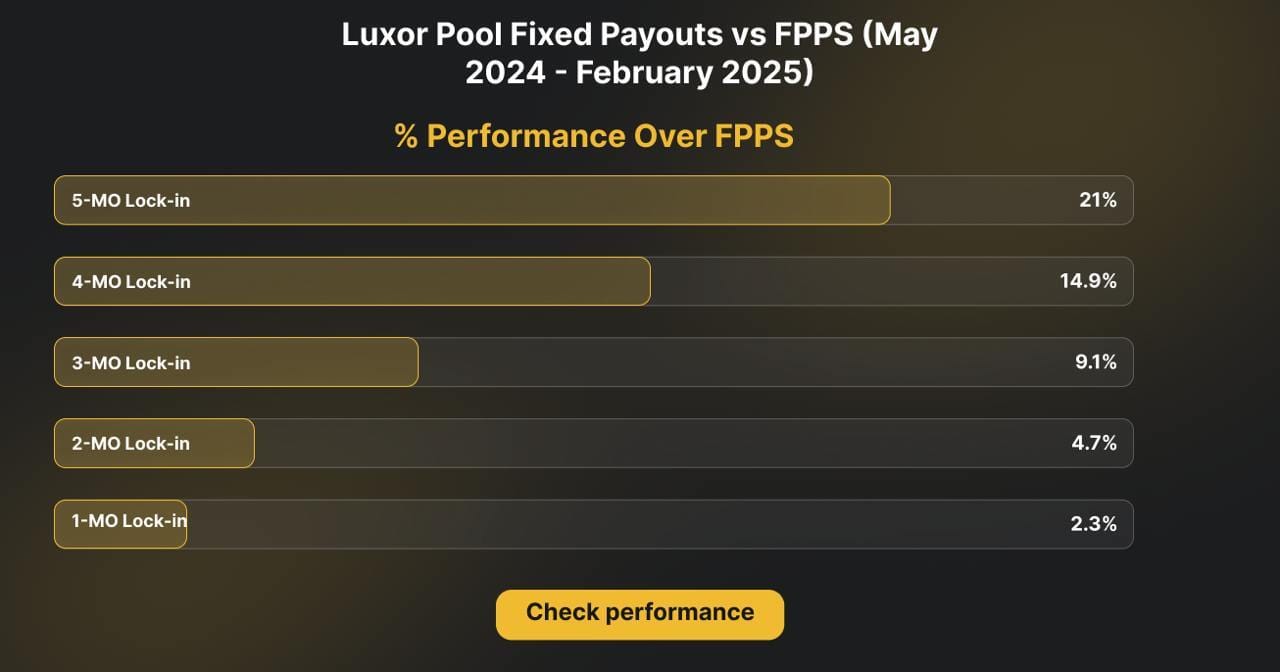

Beat Mining Pool Payouts With Luxor’s Hashrate Forwards

Post-halving, miners on Luxor Pool earned 20%+ more BTC than FPPS peers by locking in fixed payouts. Hedge difficulty & fee risks with our forward market

Galaxy Digital signs longterm hosting agreement with CoreWeave

CoreWeave has entered into a 15 year agreement with Galaxy Digital to host high performance compute and AI infrastructure at its Helios campus in West Texas, per recent SEC filings. CoreWeave–which raised $1.5 billion in its public offering March 28–will be the sole AI/HPC partner for Galaxy Digital. The arrangement is expected to bring in $4.5 billion - link

Oklahoma Strategic Bitcoin Reserve bill passes House 77-15

The Sooner State is in a close 2nd place in the race of 26 states to establish a Strategic Bitcoin Reserve. Arizona’s SBR bill is the furthest along with its next (and final) vote in the Senate coming soon, while Texas is tied with Oklahoma as both bills are on their way to their second committee for possible revisions. The Oklahoma SBR would allow the state treasury to allocate up to 10% of its investable funds into Bitcoin. — link

Taproot Wizards completes collection auction

By far the most anticipated ordinals collection, Taproot Wizards, finally sold and minted over 2,000 wizards in two phases: a whitelisted mint phase and a Dutch auction for the remainder. To-date, Taproot Wizards have raised over $37.5 million in seed rounds & grossed over $30 million from mints of their Quantum Cats and Taproot Wizards collection. — link

Hyperliquid trader forces platform to reveal centralization controls

A well-capitalized and savvy trader took a position on the memecoin JELLY that put the Hyperliquid exchange in a no-win scenario: take on a toxic self-liquidation or pull emergency powers to shut it down. Hyperliquid chose the latter, the “decentralized” exchange equivalent to “taking my ball and going home.” — link

Rebar Labs launches mempool protection API Rebar Shield

Rebar Lab’s new service allows users to submit transactions directly to the company, which passes them along to partnered mining pools. The service allows users to avoid transaction frontrunning by power users such as ordinals snipers.— link