It’s so over.

If you woke up early this morning, you probably have seen the market headlines. If you just woke up, consider going back to sleep.

Bitcoin broke below $80,000 late ET hours as Asian markets dumped the orange coin, dropping to a low of $74,600 over the last 24 hours.

Many noted Bitcoin’s staying power against the fray, staying above $80,000 even as tech stocks continued to shed value.

Unfortunately, everything is going down today. Even gold, which has been on a tear since August 2024, dipped this weekend. So, let’s do some headlines you missed this weekend since there’s nothing much to consider in the stock market.

Trump continues pressing on tariffs, China counters

China reciprocated Trump’s 34% tariffs with its own. Beijing is also considering using stimulus packages to protect itself from the fallout of the new trade war - link

Digital assets see outflows for first time in 2 weeks

$240 million left the ecosystem, mostly from Bitcoin ETFs - link

Binance’s CZ appointed as Pakistan’s strategic advisor on crypto

This happened a few minutes before we sent the email, so we’ll check back in later - link

ETH/BTC erases post-2020 gains despite DeFi, NFTs, stablecoins

At 0.02, ETH has shed 45% of its value against Bitcoin this year - link

Post-halving, miners on Luxor Pool earned 20%+ more BTC than FPPS peers

Lock in fixed payouts–hedge difficulty & fee risks with our forward market - link

The controversial developer says the dual changes would ‘dramatically’ help his project, a way to verify compute on Bitcoin - link

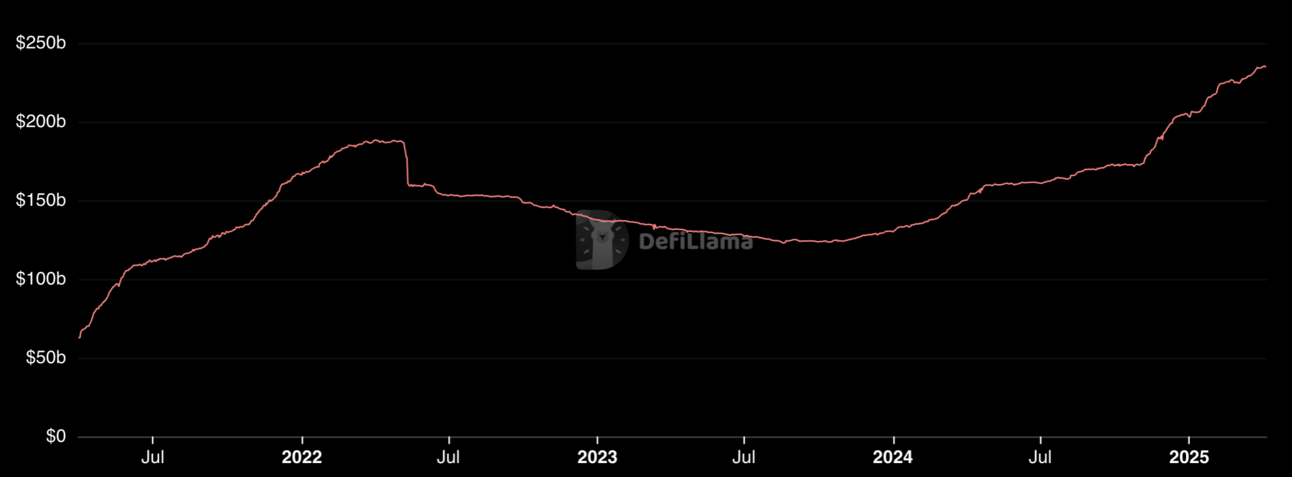

Stablecoin supply nears $250 billion

The outstanding supply of all stablecoins has added nearly $50 billion since the US election date - link

Source: DeFiLlama

Inside Bitcoin’s Darknet Markets (Podcast)

Colin and Charlie dive into the seedy underbelly of cryptocurrency: darknet markets - link

L1s, VCs, and the Bitcoin investments with Rajiv (Podcast)

Rajiv of Framework Ventures joins The Gwart Show to chat Hyperliquid’s success, the future of memecoins, and why Bitcoin-based financial products represent a massive opportunity - link

Tweet of the day

Closing thoughts: Start the day with a bagel & coffee. It’s bangin’

-Will