Help, we’re being filtered! Simply replying to this email with ‘Bitcoin’ or ‘HODL‘ helps tell your email provider you love Blockspace!

Had enough? Unsubscribe here.

11 June 2025 · Hashrate 7-Day SMA: 907 EH/s · Hashprice: $54/PH/Day

Presented by Fractal Bitcoin

Welcome to Mining Wednesday, where Blockspace covers the intersection of bitcoin mining, energy, and AI.

Today, we have a guest post from CoinShare’s Matt Kimmell on Q1’s changes to institutional bitcoin ETF holdings.

TL;DR: a predictable cohort is cycling out of the bitcoin trade, but financial advisors are leading the charge (so retail is here after all, huh?).

It’s about a 5 minute read. But before we dig in…

Market Opens

BTC $109K 0%

GOLD $3,353 0%

MSTR $387 1%

COIN $255 0%

MARA $16.37 1%

CLSK $9.98 1.4%

RIOT $10.38 .5%

CORZ $12.59 1.4%

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

Institutional bitcoin ETF holdings fall in Q1 for the first time

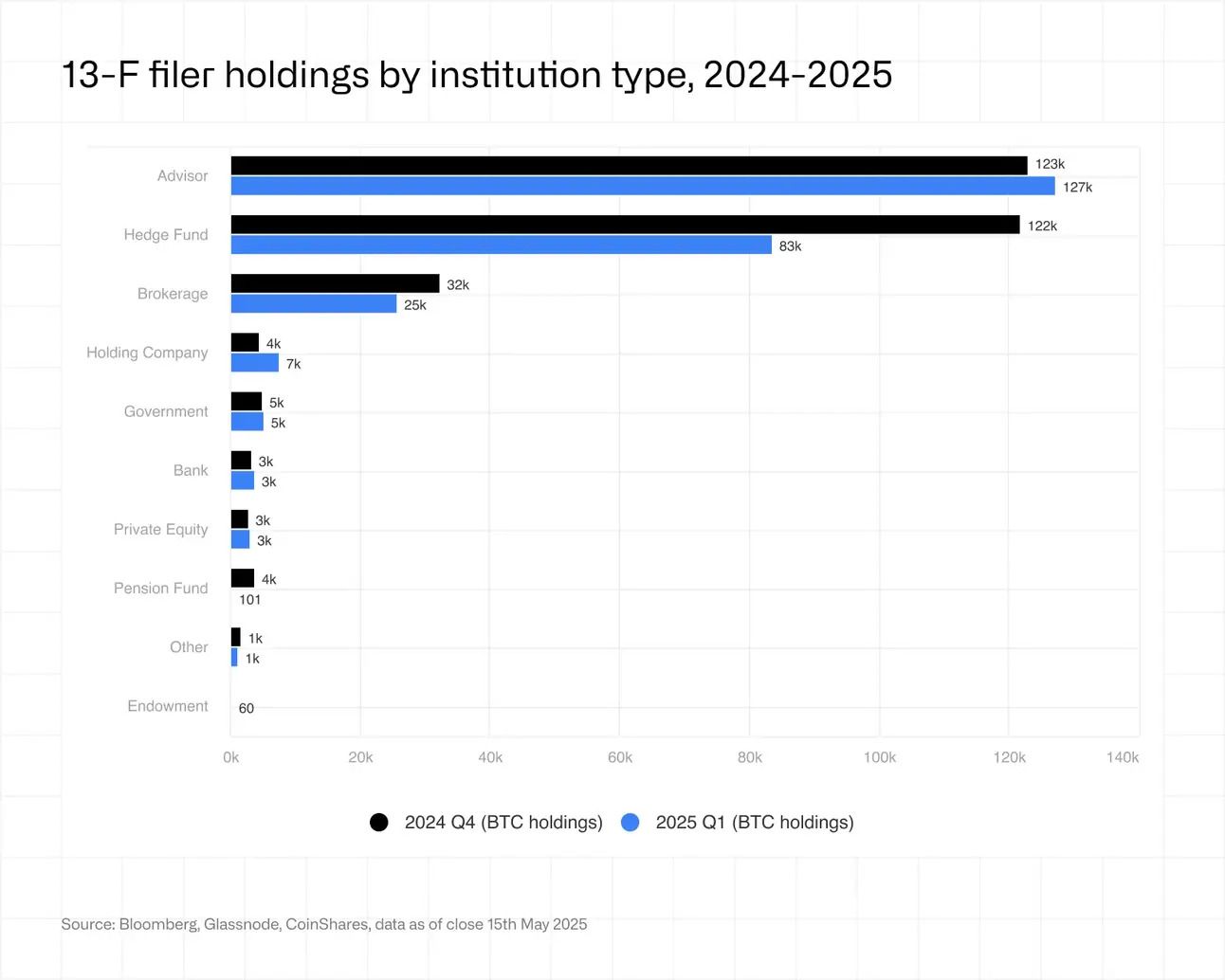

The Q1 2025 batch of 13-F filings shows something we haven’t seen since the U.S. spot bitcoin ETFs launched in January 2024: a decline in reported institutional holdings.

These quarterly disclosures, which are mandatory for firms managing over $100 million, reveal that professional investors held $21.2 billion in U.S. bitcoin ETFs at the end of Q1 2025.

That’s a 23% decline from $27.4 billion in Q4 2024.

This pullback stands out because it's sharper than the 12% overall decline in the broader U.S. bitcoin ETF market. Bitcoin ETF issuers ended the quarter with $92.3 billion in total assets under management, versus $104.1 billion in Q4 2024.

The numbers might seem like a warning sign, but a closer look tells a more nuanced story.

Bitcoin’s price fell 11% during the quarter. This accounts for a meaningful portion of the decrease in asset values; nearly half of the decrease in holdings was the result of bitcoin depreciating rather than investors simply exiting their positions en masse.

But hedge funds divesting themselves of bitcoin ETF exposure was the largest driver of the change, at least when we evaluate which institutional cohorts had the largest net change in their holdings.

Funds trimmed their exposure by nearly one-third.

Hedge funds are notoriously tactical with their positions and manage swaths of capital on a shorter time horizon, so they very likely decreased their positions as the basis trade unwound when bitcoin futures lost their premium.

Meanwhile, investment advisors, who manage longer-term client portfolios, notably increased their holdings in bitcoin terms. Do they know something hedge funds don’t?

Advisors now represent 50% of all 13-F filer assets, up from 42% the prior quarter. They also make up 81% of the total number of professional filers, something not necessarily surprising – but still promising.

Chart source: CoinShares

Get the full story by clicking here!

Mining Metrics That Matter

Hashprice, difficulty, ASIC prices—get all the key data in one place. Hashrate Index empowers miners and investors to track the market, optimize operations, and make data-driven decisions.

Bitcoin Mining Headlines

Want headlines in real time? Subscribe to our new Telegram channel here.

Iren announces $500 million convertible note

The proceeds will be used to pay for the notes conversion, along with working capital for 2025 - link

Riot sells 8.85 million Bitfarms shares

Riot Platforms has sold 8.85 million shares in its competitor Bitfarms, netting $8.58 million from the sale, which is a 56% loss from Riot’s original purchase price. Riot purchased 90.1 million shares in Bitfarms between March and September 2024 in a purported takeover attempt. Riot’s total stake in Bitfarms peaked at 19.9% in September, and following this sale and Bitfarms’ issuance of new stock, Riot’s stake is now 14.6%. — link

Amazon to invest $20 billion in data center infrastructure in PA

Amazon is setting its sights on Pennsylvania to expand its data center footprint. The company plans to invest at least $20 billion in the state to accommodate demand for AI and other data center demand. Amazon also recently announced plans to invest $10 billion in data centers in North Carolina and $5 billion in Taiwan. — link

American Bitcoin owns 215 BTC, filings reveal

Hut 8’s subsidiary, American Bitcoin, has stacked 215 BTC worth $23.6 million since the company came out of stealth mode in April, according to an SEC filing for the company’s proposed merger with Gryphon Digital. American Bitcoin Co-founder and CSO, Eric Trump, emphasized the company’s bitcoin treasury strategy as a key selling point during the company’s Q&A at Consensus 2025. — link

Tweet of the Week

Well, guy who invests in commercial real estate (a very, very sound investment class), you could have fooled us!

“Surviving” Renewable Bitcoin Mining With Soluna's Dipuo Patel

Curious where Bitcoin is going? We got you.

Read our free report on the future of Bitcoin mining hashrate.

Friend of Blockspace “The Mining Search” breaks down a +2 year prediction cycle on Bitcoin mining hashrate, including sensitivity charts based on price, predictions based on hashrate accumulation from public miners, and much more.

Best part? It’s completely free. Blockspace paid for the report so you don’t have too!

Click here to download the report!

-CMH