Brought to you by Fractal Bitcoin

Happy Tuesday! Today, we’ve got an an op-ed from UTXO Management Venture Partner Guillaume Girard on why we shouldn’t burn quantum-vulnerable coins. Plus, tweet of the week and a nice chart on crypto media sentiment.

It’s about a 5 minutes read.

Tuesday Morning Opens

BTC $85.5K 0%

GOLD $3,459 1%

MSTR $330 3.9%

COIN $182 4%

MARA $13.23 7.6%

CLSK $6.72 9.8%

RIOT $6.74 7.3%

CORZ $6.74 5%

On the perennial problems of human intervention

I’ll start by admitting I’m nowhere near as knowledgeable as Jameson Lopp when it comes to assessing the quantum threat to Bitcoin. That said, I wrote this to rebut his argument for burning quantum-vulnerable coins and explain why I believe it sets such a dangerous precedent for Bitcoin.

If you’re unfamiliar with the “Quantum Problem” and its implications for Bitcoin, I recommend reading Lopp’s article first: Against Quantum Recovery of Bitcoin. It provides essential context for what follows.

The crux lies in this question from Lopp:

“I’ve started seeing more people weighing in on what is likely the most contentious aspect of how a quantum resistance upgrade should be handled in terms of migrating user funds. Should quantum-vulnerable funds be left open to be swept by anyone with a sufficiently powerful quantum computer, or should they be permanently locked?”

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources. How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

I’d argue that, generally, any large-scale human intervention in Bitcoin should be categorically rejected. Bitcoin was designed to avoid human “intervention” precisely because it inevitably leads to mistakes or corruption. One might claim intervention “for the right reasons” is justifiable, but that opens the door to endless subjective debates.

History is our teacher here: communists genuinely believed they were “doing the right thing” for society, yet their interventions consistently led to disaster because humans are less efficient than free markets at solving large-scale problems.

Lopp acknowledges this tension in his piece but pushes further with an intriguing point:

“I assume this is because not freezing user funds is one of Bitcoin’s inviolable properties. However, if quantum computing becomes a threat to Bitcoin’s elliptic curve cryptography, an inviolable property of Bitcoin will be violated one way or another.”

This is a fair point from first principles, but preemptively violating Bitcoin’s properties to prevent potential future violations feels wrong—like something out of Minority Report. Moreover, not all violations are equal. A quantum computing theft of bitcoin isn’t the same as a deliberate community decision to freeze funds when doing nothing remains an option. Setting aside the consequences of inaction for now, choosing to undermine Bitcoin’s ethos preemptively isn’t equivalent to the crime of quantum-enabled theft.

Miner, Meet your Margin

LuxOS will unlock up to 9.93% higher hashrate and 14% better efficiency on your S21 XP. Optimize your fleet and stay competitive — start now.

What constitutes “confiscation”?

Lopp argues that “confiscation” isn’t the right term for his proposal:

“I don’t think ‘confiscation’ is the most precise term to use, as the funds are not being seized and reassigned. Rather, what we’re really discussing would be better described as ‘burning’—placing the funds out of reach of everyone.”

I strongly disagree. Lest we stumble into a Ceci n’est pas une pipe-esque discourse, let’s call a pipe a pipe – this is 100% confiscation. Dressing it up as “burning” feels like semantic sleight-of-hand reminiscent of euphemisms like the “re-educating valued workers” used to downplay political purges in Siberia. I’m not labeling Lopp a communist here; my point is that rephrasing doesn’t change reality. This is preventive confiscation of perfectly valid coins, vulnerable or not.

Given Lopp’s well-known Bitcoin stance, I don’t assume he’d support arbitrary coin seizures. But this proposal risks opening a dangerous door. Today, it’s quantum-vulnerable coins; tomorrow, it could be something else. Imagine: “Greetings from the Department of Bitcoin Wizardry. Your self-custodied bitcoins are vulnerable, so we recommend burning them to prevent potential losses.”

Tweet of the Week

”Stay humble, stack sats” really hits differently during times of market turbulence. But for the degens among us, may we suggest the power of prayer?

Chart of the Week

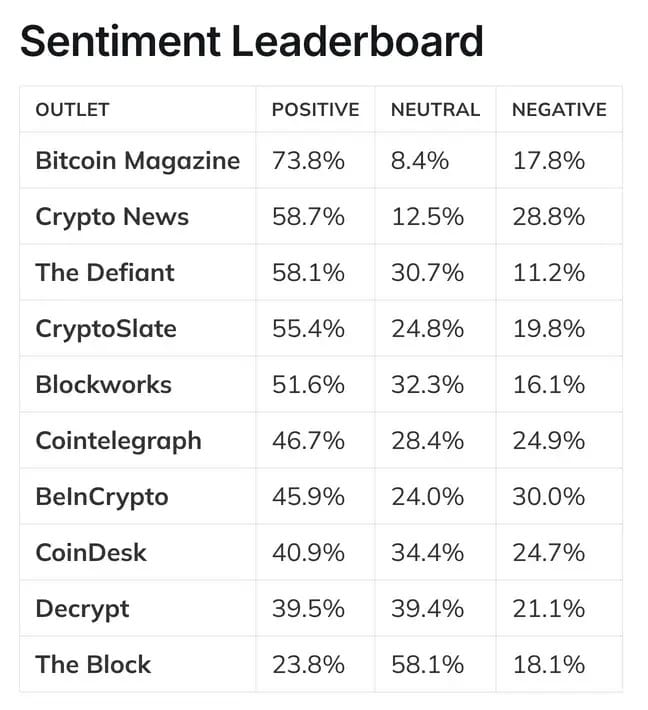

Newsletter Bitcoin Perception ran a great piece detailing sentiment in crypto media on Bitcoin. The Block scored the highest on neutrality, while Bitcoin Magazine was the most bullish bitcoin (shocker!) - link

-GG & CMH