Brought to you by Lygos Finance

Happy Tuesday!

CleanSpark released its fiscal year 2025 financials last week, so for today’s newsletter, we break down the bitcoin miner’s numbers and zoom in on their plans to expand into AI loads.

As CEO Matthew Schultz said on a recent Mining Pod, “it’s not a pivot — it’s an expansion,” and the company fully intends to operate AI workloads alongside BTC mining in the future.

Read on for this recap, headlines, new pods, and more.

Lygos: Bitcoin Credit, No Custodian Required

Unlock dollar liquidity without giving up your BTC. Lygos is a fully Bitcoin-native, non-custodial lending platform built on Discreet Log Contracts (DLCs).

• Hold your keys: BTC stays on layer 1 in your control. No wrapping, no bridging, no rehypothecation

• Rates as low as 10% APR

All roads lead to load: Inside CleanSpark’s FY 2025 earnings call

CleanSpark (NASDAQ: CLSK) acquired its first bitcoin mine in 2020 with the buy out of bitcoin miner ATL Data Center. It would be the first of many strategic acquisitions as the clean energy company dove head on into bitcoin mining.

That acquisition bestowed CleanSpark with 0.2 EH/s of hashrate – 0.1% of Bitcoin’s hashrate at the time. Fast forward to 2025, and CleanSpark now operates 50 EH/s, which represents 4.5% of Bitcoin’s total hashrate.

CleanSpark quickly became one of the largest bitcoin miners in the world following its expansion into bitcoin mining, and now, it’s expanding yet again into AI services, all while keeping its bitcoin mining engine underneath.

As we’ve seen across the bitcoin mining sector, bitcoin mining has become a launchpad for other compute loads, and CleanSpark plans to use hashrate as a flexible source of load that can operate alongside lucrative AI loads.

As CleanSpark CEO Matthew Schultz said on a recent Mining Pod, “this is an expansion, not a pivot.”

Even with this expansion top of mind, CleanSpark’s fiscal year 2025 earnings show that the company’s core business will serve as a North Star as CleanSpark charts new waters.

CleanSpark’s fiscal year 2025 results

During the 2025 fiscal year ended September 30, CleanSpark mined 7,873 BTC for $766 million in revenue and $364.5 million net profit, marking a complete reversal from a net loss the prior year (-$145 million). CleanSparks adjusted EBITDA rose from $245.8 million in FY2024 versus $823.4 million in FY2025.

CleanSpark also reported its marginal cost to mine bitcoin as under $43,000 marginal cost to mine a Bitcoin, highlighting that CleanSpark’s margins are still healthy despite the recent decline to hashprice.

CleanSpark is operating over 266,000 ASIC miners that produce 50EH/s with a 16.07 J/TH energy efficiency, and it forecasts that it will have 57EH/s online at the end of 2025.

Management did hammer a point in CleanSpark’s FY2025 earnings call regarding fundraising for its expansions: CleanSpark did not issue a single new share via an equity offering in 2025 while hitting their scaling goals. With margins around 55% (flat from last year), the company can use cash flow to fund portions of its expansions.

CleanSpark holds 13,033 BTC, worth about $1.12 billion, though a portion (~5,444BTC) is posted as collateral.

CleanSpark’s AI and bitcoin mining expansions

As it eyes expansion into AI loads, CleanSpark will employ the same distressed asset M&A strategy that made its name in bitcoin mining.

“We will continue acquiring distressed assets,” CEO Matt Schultz said on its earnings call.

Typifying this approach, CleanSpark’s recently acquired an Austin County, Texas site with 285 MW of ERCOT-approved power. Schultz highlighted this site, alongside an expansion at its Sandersville, Georgia sites as the company’s first targets for AI load.

Schultz noted on The Mining Pod that CleanSpark “beat out a trillion dollar hyperscaler because we told the utility that we’d start buying power in 6 months instead of the 2-3 years it would take to build out an AI campus.”

CleanSpark’s dual-load design for AI and bitcoin mining

Even with its expansion into AI, CleanSpark isn’t abandoning bitcoin mining. Instead, the company plans to use it to augment and complement its budding AI business.

During its earnings call, CleanSpark management relayed a conversation with a Georgia utility executive who effectively said, “We need about 120 hours a year where someone can give power back.” Bitcoin has historically filled that role; now, the solution seems to be a blend of AI and mining at the same campuses so a portion of the load remains interruptible.

CleanSpark’s plan is to use AI campuses for stable, premium-priced long-term tenants but keep a slice of Bitcoin mining at or near those sites to preserve flexible load for the utility and earn better power rates.

How CleanSpark monetizes its bitcoin stash

For the hardcore Bitcoiners the most interesting part of the call might be the detail on Digital Asset Management (DAM), an internal desk that runs options strategies on CleanSpark’s bitcoin treasury.

They’ve launched three programs:

Spot plus: covered calls tuned to optimize near-term cash needs from production

Yield: longer-dated, lower-delta covered calls to generate ongoing yield on the treasury

Cash-secured puts: written using the premium corpus generated from the first two strategies

In Q4 alone, CleanSpark pulled in $9.3M in option premiums, lifting effective realized prices to ~$116k per BTC vs ~$111.7k spot, and it generated ~12% annualized yield on covered calls and ~8% on cash-secured puts. And even turned a “free” Bitmain option that would have expired worthless into ~$7M of cash.

All roads lead to load

CleanSpark quickly made its name in bitcoin mining, an expansion that many said CleanSpark made “too late” at the time, Schultz said on The Mining Pod.

Now, CleanSpark finds itself on the cusp of yet another expansion, and for any critics who say they are too late for this revolution, Schultz said on The Mining Pod that CleanSpark has been here before. And it plans to take what it learned from its old venture to carry it forward into the new.

“Our business will continue to prioritize efficiency. That's part of our DNA from the microgrid days,” Schultz said on The Mining Pod. “I think you're going to see an interesting hybrid approach to Bitcoin mining, and Bitcoin mining is always going to be at the core of who CleanSpark is.”

This article is sponsored by CleanSpark.

Like these stories? Reply BITCOIN to let us know!

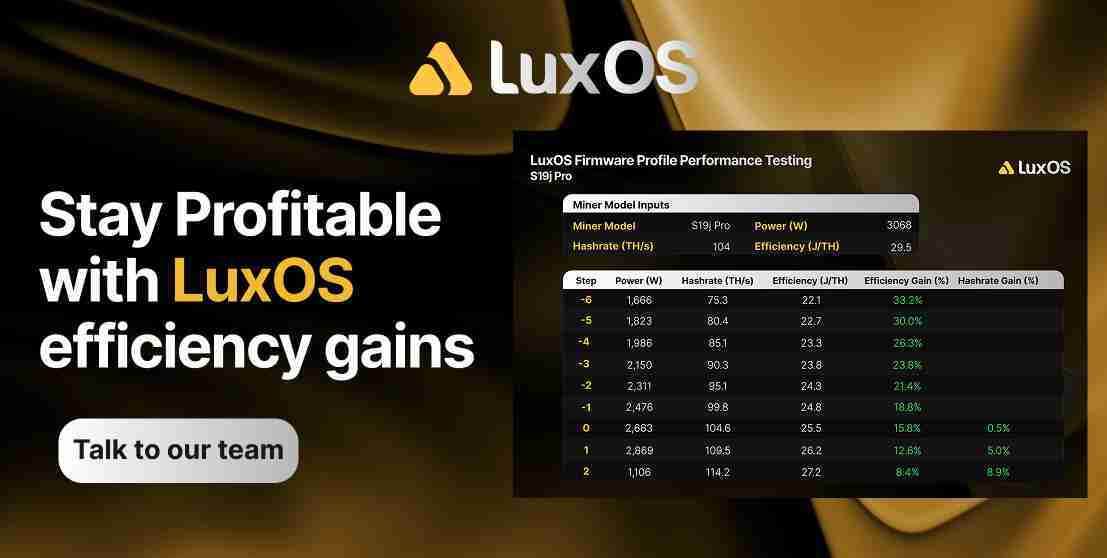

Stay Profitable at All-Time Low Hashprice

Hashprice is near record lows, and stock S19 series units are operating on the edge. With efficiency gains of up to 33%, LuxOS cuts hashcost dramatically.

Chart of the Week

Here’s one for the silver bugs: the XAG/XAU ratio has jumped over 7% since the end of November, signaling a strengthening silver prices versus gold.

Blockspace Headlines

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

Anthropic team begins using AI to audit smart contracts, unearths zero-day exploits

In a simulation run by the team at Anthropic, researchers scanned 405 smart contracts with various LLMs. The team detected $4.6 million worth of vulnerabilities across Ethereum, Binance Smart Chain, and Base. - link

Strategy announces $1.44B cash reserve for dividends payments

Bitcoin treasury strategy progenitor Strategy (NASDAQ: MSTR) is establishing a $1.44B warchest to cover dividends on its five preferred stocks and interest payments on debt. The company announced the move in a December 1 press release with updated guidance for FY2025. Strategy currently holds 650,000 BTC. - link

Greenidge’s Dresden power plant suffers electrical fire

Greenidge Generation’s (NASDAQ: GREE) power plant in Dresden, New York was hit by an electrical fire that has suspended bitcoin mining operations at the site. The fire occurred on November 23, per SEC filings, and the company expects to have its bitcoin mine back online in the coming weeks without specifying a hard deadline. - link

On this day in 1942, the first nuclear chain reaction occurs, a watershed moment for the Manhattan Project that would go on to develop the first atomic bomb two and a half years later.

-CBS & CMH