Happy Tuesday!

Bitcoin miners have fully pivoted into the AI/HPC sector. And wow, does Wall Street love it.

This week, we cover IREN’s big time news, plus headlines from around the sector.

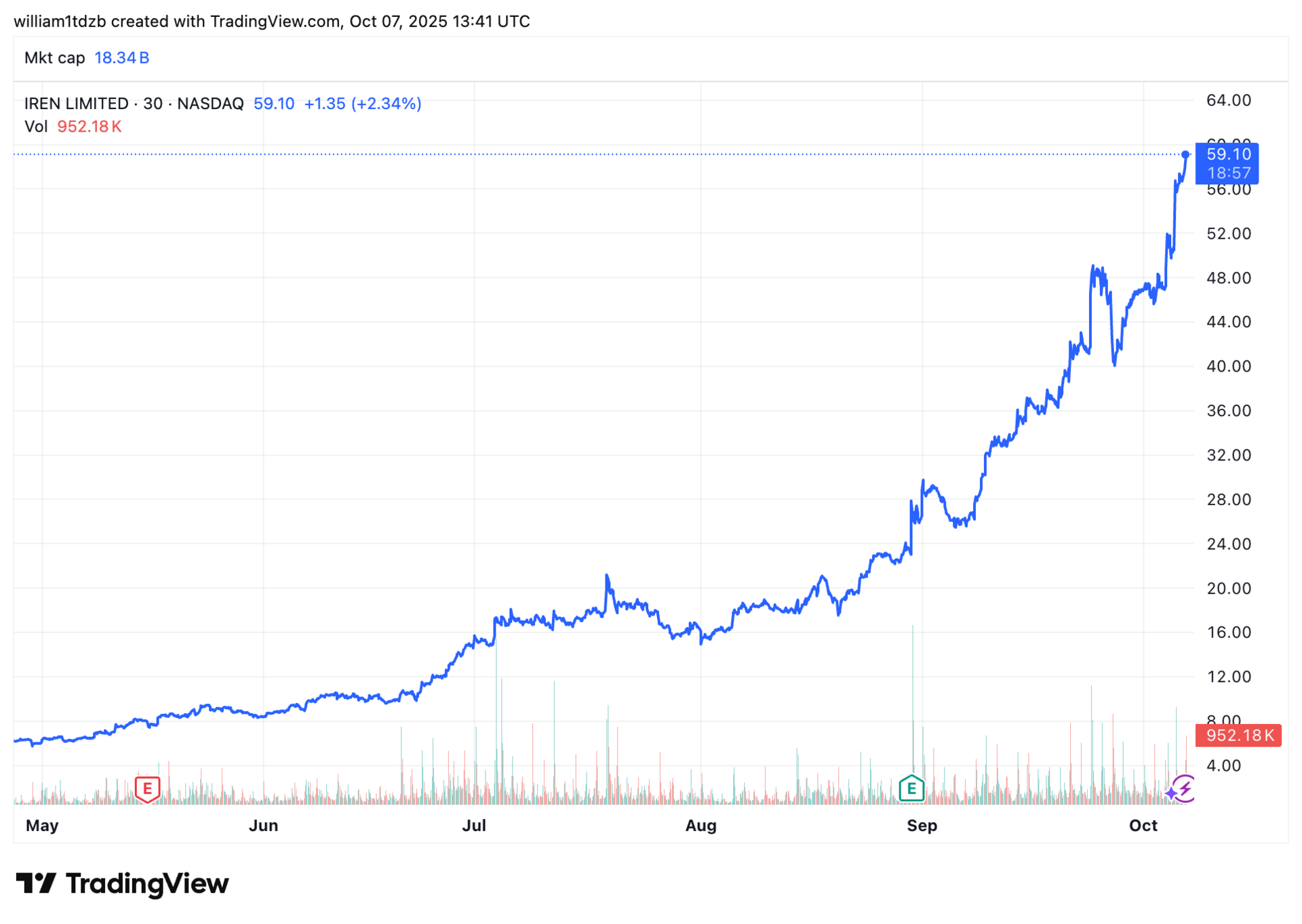

IREN announces AI cloud deal, pushing ARR potential over $500 million

Per a company press release, IREN announced this morning it has signed new multi-year cloud services contracts with leading AI firms for deployments of NVIDIA’s latest Blackwell GPUs, pushing its annualized run-rate revenue (ARR) potential above $500 million.

Markets responded warmly, pushing the miner another 2.3% in the early morning sessions to just under $60 per share.

The announcement is a watershed moment for the (increasingly) former Bitcoin miner. Although still operating 50 EH/s of Bitcoin machines, IREN has pivoted into an AI ‘neo-cloud,’ pursuing the business operations run by peers CoreWeave (CRWV) and Nebius (NBIS).

However, IREN’s plans were often chided online and by analysts, who became increasingly skeptical of an eventual customer for IREN’s compute. With locked agreements for 11,000 of its planned 23,000 GPU fleet–roughly equating to $225 million in AI Cloud ARR set to commence by the end of 2025–IREN has certainly secured its position and justified its stock price re-rating.

The company is on track to have all 23,000 GPUs operating or on order by the close of Q1 2026. IREN’s ongoing site tours and technical diligence efforts aim to secure the remaining GPU capacity, with room to scale beyond 100,000 units across its Horizon 1 and 2 data centers now under construction in Childress, Texas.

Headlines By Blockspace

Want to get these headlines in real time? Join our Telegram group!

Galaxy Digital unveils GalaxyOne, 4% yield on cash with auto-invest into Bitcoin

Galaxy Digital (GLXY) announced today the launch of GalaxyOne, a unified wealth management app that combines high-yield cash, crypto and U.S. equities trading in a single platform. The service offers FDIC-insured cash accounts yielding 4.00% APY and, for accredited investors, a Galaxy Premium Yield product delivering 8.00% APY. - link

Digital asset funds log record $5.95 billion inflows, AUM climbs to all-time high: CoinShares

Digital asset investment products recorded inflows of $5.95 billion last week, the largest weekly haul on record, according to asset manager CoinShares. - link

JonesResearch sees 60% upside in Bitdeer shares, cites overlooked AI value and Sealminer sales

JonesResearch initiated coverage of Bitdeer (BTDR) on October 6 with a Buy rating and a $32 price target, applying a 20x EV/EBITDA multiple to its 2026 EBITDA estimate of $435.5 million. - link

Hive Digital mined 267 Bitcoin in September, up 8% from August

Hive Digital (HIVE) reported in its September production update that it mined 267 BTC in September 2025, an 8% increase month-over-month from August’s 247 BTC and a 138% jump year-over-year from September 2024’s 112 BTC. - link

BitFuFu mined 329 Bitcoin in September, down 19% from August

BitFuFu (FUFU) reported in its September production update that it mined 329 BTC, a 19% decrease month-over-month from August’s 408 BTC. Average daily production was 11 BTC, down from approximately 13.2 BTC in August. — link

Antalpha advances interim loan ahead of $250 million convertible note for Nakamoto

KindlyMD (NAKA) has entered a strategic partnership with Antalpha to develop bespoke financing solutions for its Bitcoin treasury vehicle, Nakamoto Holdings, and has signed a non-binding letter of intent for a $250 million five-year secured convertible note facility - link

Bitcoin's Global Hashrate Map: Updated Q4 2025

The USA controls 37.8% of Bitcoin's network. Russia and China follow. But who else made the top 10? Our latest heatmap reveals the shifting geography of mining power.

Blockspace Podcasts

Welcome back to The Mining Pod! Today, Will and Colin dive into JPMorgan's latest research report on Bitcoin mining stocks pivoting to AI and HPC. We analyze JPMorgan's IREN price target, break down the economics of co-location vs cloud services, and examine potential upside for Cipher, Riot, Clean Spark, and MARA.

“Uptober” is absolutely delivering as Bitcoin pushes $121K with BlackRock's iShares Bitcoin ETF breaking into the top 20 ETFs by AUM - a meteoric rise for an asset that was "a scam" according to Larry Fink just two years ago. The gang breaks down ETF inflows, network security, and why this cycle's retail is hiding in plain sight.

Where we drop fun topics with nothing to do with Bitcoin.

As summer simmers into autumn, spooky season is upon us, and you may be spending some October weekend carving pumpkins for jack-o-lanterns come trick-or-treat time. This Halloween hallmark dates back to a Celtic tradition of carving root vegetables like turnips to fend off spirits during the harvest-time Samhain festival. Irish immigrants would import the practice in the 19th century, where it was eventually employed on one of the America’s unique native plants, the pumpkin.

-CMH