Happy Tuesday!

NAKA has been the black sheep of bitcoin treasury companies, and its +94% drawdown since July has hade it a paragon for the perils bitcoin treasury companies can encounter if they structure their debt poorly and mistime buys.

But, this investment bank thinks the bottom is close to in, and we break down its forecast for NAKA’s price performance next year in today’s newsletter.

Plus, an Op-Ed from Paul Sztorc of Layer 2 Labs on Bitcoin mining economics, and headlines from around the block!

Buy the NAKA dip, says B. Riley

Is the bottom in for Bitcoin treasury companies like Nakamoto Holdings (NAKA)?

B. Riley Securities analysts think you should buy the dip. (But of course they do, it’s worth disclaiming, because they are on the sell-side for NAKA’s open at-the market offering; still, their forecast and valuation model may prove useful for investors).

The investment bank has initiated coverage of a handful of crypto treasury companies, per an October 10, 2025 investor memo, and its rating NAKA alongside Sharplink Gaming, BitMine, and other crypto treasury companies as buys.

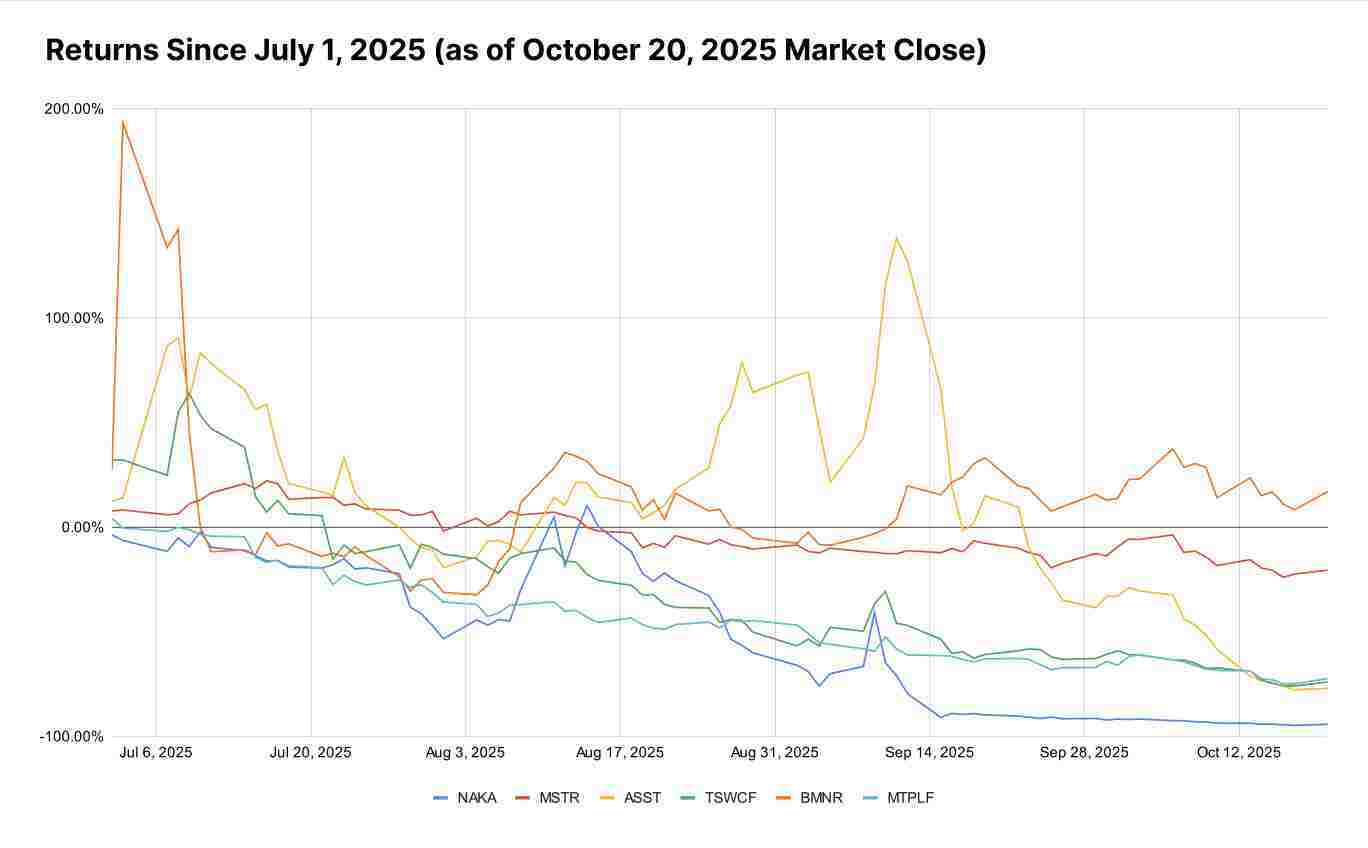

Digital Asset Treasury (DAT) Companies had been second only to AI growth stocks in 2025 for their eye popping returns.

That was until about the year’s halfway point, and it’s been down only for (most) all of these stocks since.

Source: Yahoo! Finance

NAKA has been the posterchild of this selloff: the stock is -94% since July 1 and -44% YTD. As B. Riley notes, “the selloff was primarily driven by the announcement of a $5B ATM equity offering, the $30M investment in BTC treasury firm Metaplanet, and heavy insider selling following the expiration of PIPE transaction lock-up periods.”

Following the stock’s bloodletting, the company’s multiple on net asset value – i.e., the total value of the company relative to its bitcoin holdings – was 0.7x as of October 10, 2025, according to B. Riley.

For bitcoin mining to survive, we need to rethink L2s

Historically, miners have neglected transaction fees – and with good reason!

In the past, the microscopic fees meant almost nothing in comparison to the massive block reward. During 2009-2013, fees were essentially $0.

The subsidy was 50 BTC per block. But now, the block subsidy is 3.125 (down -94%). It will continue to fall (at ~16% per year, compounded), until, finally, it reaches zero.

So in our latest op-ed, LayerTwo Labs CEO Paul Sztorc argues why the age of transaction fees is already here — and it means we need to think seriously about additional sources of transaction fee revenue.

Headlines by Blockspace

Want to get these headlines in real time? Join our Telegram group!

Galaxy Digital posts $505 million Q3 profit as digital asset trading volumes surge 140% from Q2

Galaxy Digital (GLXY) swung to a net income of $505 million in the Q3 2025, translating to $1.01 diluted earnings per share. The company delivered $629 million of adjusted EBITDA, driven by record performance in its Digital Assets operating business and strong gains on investment positions - link

JonesResearch recommends Hold on Cipher, Iren, Mara, CleanSpark and issues Buy Ratings on Hut 8, TeraWulf, Riot

JonesResearch on October 20 reiterated Hold ratings on Cipher Mining (CIFR), IREN Ltd. (IREN), Mara Holdings (MARA) and CleanSpark (CLSK), while assigning Buy ratings to Hut 8 (HUT), TeraWulf (WULF) and Riot Platforms (RIOT). - link

Crypto ETFs post $513 million outflows after October 10 liquidity cascade: CoinShares

According to asset manager CoinShares, crypto exchange traded products and funds (ETPs and ETFs) saw $513 million in outflows last week in the wake of a liquidity cascade at Binance on October 10, bringing net redemptions since the event to $668 million—suggesting ETP investors largely shrugged off the shock. - link

Strategy acquires 168 Bitcoin as it skips MSTR issuance for the third week in a row

Strategy (NASDAQ: MSTR) added 168 Bitcoin to its holdings during the week ended October 19, bringing its total to 640,418 BTC at an average purchase price of $74,010 per coin and an aggregate cost basis of $47.40 billion. - link

JonesResearch sees 72% upside for TeraWulf, doubling original price target

JonesResearch raised its price target on TeraWulf Inc. (WULF) to $24 from $12, maintaining a Buy rating after updating its model to reflect recent business developments and hashprice trends. - link

CleanSpark appoints new SVP of AI Data Centers, targets Georgia region for AI expansion

CleanSpark Inc. (CLSK) announced in a press release that it will broaden its business beyond bitcoin mining by entering the AI data center market. The company has named industry veteran Jeffrey Thomas as Senior Vice President of AI Data Centers. - link

Luxor Energy Is Live

Monitor usage, manage costs, optimize strategies—all designed to align power with mining performance. REP access, Bitcoin collateral, and Intelligent Mining in one platform.

Blockspace Podcasts

On today’s Mining Pod, we have a two-for-one show with two interviews we recorded at the North American Blockchain Summit. To start, Colin interviews Blue Macellari (Head of Digital Assets at T. Rowe Price) on how institutional adoption is fundamentally changing Bitcoin's market structure, the debasement trade narrative going mainstream, and why fast money hasn't arrived yet this cycle. Then, Will hops on the horn with Dale Nally (Minister of Red Tape Reduction in Alberta) to discuss Alberta's competitive advantages for Bitcoin mining and a concierge program for large miners.

Where we drop fun topics with nothing to do with Bitcoin.

Many folks in the U.S. might recognize October as Breast Cancer Awareness month. But they might not know that October is also the national month of pork and sausage here in the U.S., dedicated on the same month that farmers have traditionally taken their hogs to market in October.

-CMH