Brought to you by Lygos Finance

Happy Friday!

Mining bitcoin is hard, but do you know what’s harder? Designing the ASIC chips that power hashrate, as evidenced by Bitdeer’s recent SEALMINER delays — and the lawsuit they precipitated, which we break down below.

And for today’s second take, why Bitcoin Core Bitcoin has decided to remove Luke Dashjr’s Bitcoin Core DNS seed (if you don’t know what that means, trust us, you’ll want to know).

Plus, headlines, new pods, tweet of the week, and a biology fun fact!

Lygos: Bitcoin Credit, No Custodian Required

Unlock dollar liquidity without giving up your BTC. Lygos is a fully Bitcoin-native, non-custodial lending platform built on Discreet Log Contracts (DLCs).

• Hold your keys: BTC stays on layer 1 in your control. No wrapping, no bridging, no rehypothecation

• Rates as low as 10% APR

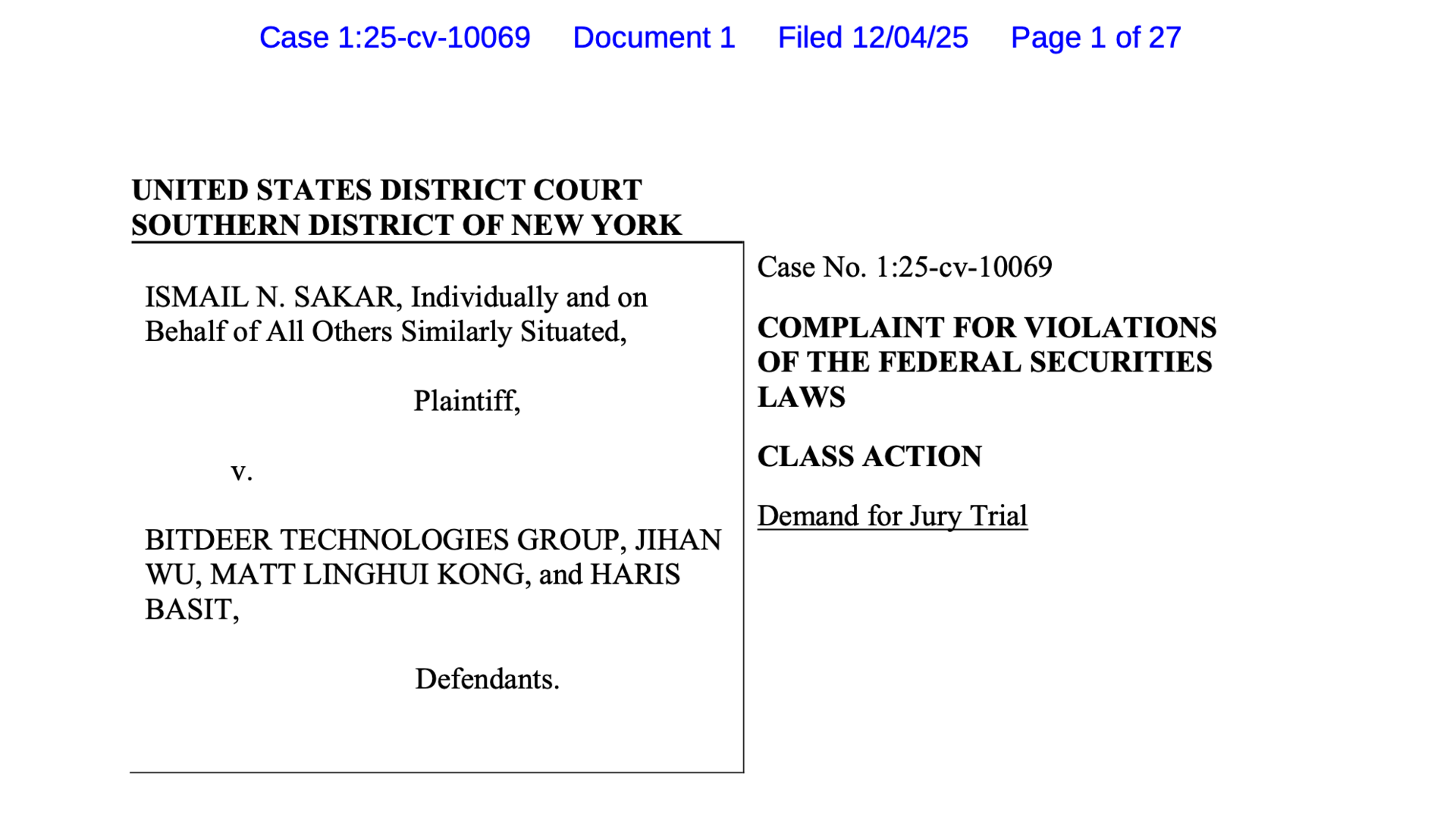

Class action lawsuit targets Bitdeer over SEAL04 chip delays, seeks damages

A new class action lawsuit accuses Bitdeer Technologies Group (NASDAQ: BTDR) of misleading investors about the development and timeline of its forthcoming Bitcoin mining ASIC chip, the SEAL04 — the key component to Bitdeer’s SEALMINER A4 bitcoin mining computer. - link

OUR TAKE: Ok, merits of the lawsuit aside (more on that in a bit), making sense of Bitdeer’s ASIC chip delays has been about as easy as untangling Christmas lights after slugging a pint of extra-proof eggnog.

This is part of the lawsuits complaint. The Plaintiff alleges that Bitdeer not only misled investors about the timeline of its forthcoming 5 J/TH SEAL04 ASIC chip, but that management hid “issues with the SEAL04 chip design progress [that eventually caused] R&D to delay production and take a “dual-track approach” and create two completely independent designs to ensure mass production of the SEAL04 chip.”

Bitdeer first announced the SEAL04 chip, the key piece of its promised SEALMINER A4 ASIC miner, in June 2024, advertising a 5 J/TH efficiency with a tape out projected in Q2 2025.

In January 2025, Bitdeer updated its timeline for a tapeout in Q3 2025, and it announced yet another delay during its Q3 earnings, moving the tapeout to Q4 2025 and mass production to Q1 2026.

Here’s the rub, though — that guidance is for what Bitdeer is now calling the first run of the SEAL04, with an energy efficiency of 6-7 J/TH.

As the lawsuit alleges, Bitdeer’s pilot tapeout for the SEAL04 didn’t achieve the previously advertised and targeted 5 J/TH, so now they are bifurcating the SEAL04 production into two design phases: 1) The first design with tapeout in Q4 2025 and mass production in Q1 2026, and 2) the second, “next generation” (Bitdeer’s words) design which is “significantly delayed” with no clear tapeout of production timeline.

So if you untangle all the jargon and shifting dates, the argument becomes clearer.

Bitdeer faced delays and failed to meet performance standards for the SEAL04, the ASIC chip design behind its forthcoming SEALMINER A4. Because of this (and largely, perhaps, to save face and money), Bitdeer went ahead with production for the 6-7 J/TH design and is now marketing it as the first design for the SEAL04.

Bitdeer’s second, “next generation” design for the SEAL04 will ostensibly target the 5 J/TH efficiency Bitdeer originally advertised, but who knows when it will go into production.

Look, given the confusion — and (alleged) lack of transparency from Bitdeer about this until the 11th hour — I get why the plaintiff is pissed. But I doubt he or any other investor receives damages. Not legal advice, I’m not a lawyer, yadda yadda dee, but hard to imagine Bitdeer goes down for falling short of forward looking statements (what do y’all think those disclaimers are for at the beginnings of earnings calls, to put us to sleep?).

The lawsuits’ outcome is less interesting to me than the point it’s making: Bitdeer basically fumbled the SEAL04 release, so now it’s releasing two SEAL04s and, if logic follows, two SEALMINER A4s.

So what exactly makes the SEALMINER A4 v1 and SEALMINER A4 v2 completely different generations of ASIC design, instead of two versions on the same design?

Marketing.

-CMH

Bitcoin Core removes Luke Dashjr’s DNS seed following policy violation

On Thursday, Bitcoin Core maintainers removed the DNS seed operated by Bitcoin developer Luke Dashjr after it violated neutrality policies by failing to return nodes running Core versions later than 28.1. DNS seeds help new nodes bootstrap into the Bitcoin network by providing lists of active peers, and must remain neutral to different Bitcoin versions. Dashjr has been openly critical of Bitcoin Core v30, calling the software "malware."

OUR TAKE: Everyone (in the dev scene) knew this was coming. For the uninitiated, here’s a TL;DR of what this means and why it’s significant.

First of all, what is a “DNS Seed”?

When you start a Bitcoin node, in order to connect to the network you have to connect to another node first (the “seed”). Bitcoin Core hard codes in a handful of somewhat-trusted nodes run by notable longstanding members of the development scene to help “introduce” your node to the network.

It’s very important that these DNS seeds/bootstrapping nodes remain neutral and give you as unbiased a look at the Bitcoin network as possible. There’s even formal expectations for people who operate these DNS seeds.

Luke DashJr has been publicly critical of recent versions of Bitcoin Core, explicitly calling it “malware” and throwing many accusations at the project.

It was brought to attention that Luke’s DNS seed was conspicuously not seeding nodes with versions of Core after 28.1, or about when he began his recent anti-”spam” crusade about 2.5 years ago.

Intentionally obfuscating otherwise reachable nodes is a violation of at least the 1st rule of expectations for DNS seed operators: “The DNS seed results must consist exclusively of fairly selected and functioning Bitcoin nodes from the public network,” as outlined in the Bitcoin Core GitHub repo Expectations for DNS Seed operators.

So while the violation of neutrality from Luke and reaction by Core is kind of obvious, I personally see this as the most salient, formal revocation of a trusted role that Luke has enjoyed in the Bitcoin Core project.

The Core project has tolerated a lot from Luke over the years, as he is well known to be an unmoving stick in the mud in technical discussion and has a history of strongarming his own opinionated changes to Core software.

However, outside of ownership of the Transifex repo, Luke had not really seen a conspicuous removal/deprecation like this as far as I’m aware.

Open source development has a long history of navigating difficult personalities and disagreements, Bitcoin is no stranger to these things.

I think the Core project has demonstrated a surprising amount of patience on this topic, and I applaud them for their stability as we approach Bitcoin’s 17th year.

-CBS

Like these stories? Reply BITCOIN to let us know!

Unlock Efficiency From Your S21 Fleet

LuxOS delivers meaningful efficiency gains across the S21 lineup. In fact, an S21 Pro running LuxOS can reach better efficiency than stock S21 XP.

In the News

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

Strive acquisition offer for Semler Scientific plunges 76% as key customers exit

The implied value of Strive’s (NASDAQ: ASST) all-stock acquisition offer for Semler Scientific (NASDAQ: SMLR) plunged approximately 76% between September and December as Semler disclosed the loss of key customers responsible for a majority of its revenue. - link

American Bitcoin (ABTC) stock plunged 39% on Tuesday. Here’s why.

American Bitcoin’s (NASDAQ: ABTC) stock price fell 39% on Tuesday, driven by selling pressure from early investor share unlocks from American Bitcoin’s June 27, 2025 private placement. - link

IREN prices $3.63 billion convertible note and equity offerings to refinance debt

IREN (NASDAQ: IREN) priced a $2 billion convertible senior notes offering and a $1.63 billion equity offering on Wednesday. The company intends to use the fundraised capital primarily to repurchase existing convertible notes, fund capped call transactions, and support general corporate purposes. - link

Tweet of the Week

Last week, we posted a chart in this section that shows the cost of RAM for PCs is skyrocketing. Well, it’s about to get worse. Micron, one of the largest computer hardware manufacturers in the world, is shelving its consumer computer memory products to focus on AI data center demand. AI-productivity-enhanced deflation when?

Blockspace Podcasts

On the latest Mining Pod news roundup, Colin, Charlie, and Matt break down yet another brutal week for miners. We analyze why ABTC shares tanked 39% following a share unlock and look at IREN's aggressive $3.6B capital raise. The team also covers Greenidge’s Dresden, NY fire and SC land sale. Finally, we debate the Zcash Foundation’s legal threats and just how private and cypherpunk Zcash is.

Did you know that cells from a fetus can remain in the mother’s body for decades after birth in a process known as microchimerism? Maybe that’s where a “mother’s instinct” comes from…

(This fun fact was generated by WifeGPT).

-CMH & CBS