17 May 2024 · Block Height 843800 · Bitcoin Price $66K

Welcome back to the Blockspace Newsletter!

The timeline is bearish right now. Runes were a dud, my Ordinals bags are down and memecoins are dead. We’re destined to spend 40 more years wandering the desert.

Yet Bitcoin is less than 2% from it's previous all time high–are we too bearish?

Quick Hits

Oklahoma passes landmark crypto rights policy

Bitnomial & Luxor launch Hashrate Futures

Wisconsin pension fund discloses $160 million in Bitcoin ETF

Luke DashJr adds a specific filter for transactions of nLockTime 21

Chart of the Week

It’s getting bearish on the timeline

Take a deep breath, it’s all going to be okay.

Crypto's total market cap has drawn down over $500 billion since its peak on March 12th at $2.8 trillion. Taking a look at the timeline, however, you’d think its Black Thursday all over again. In reality, we're only down 17% overall marketcap while Bitcoin is barely 3% from it’s previous all time highs!

But let’s assume people are screaming out of pain and not for attention. Where’s the turmoil in the market? Let’s look below at a few sub-sectors.

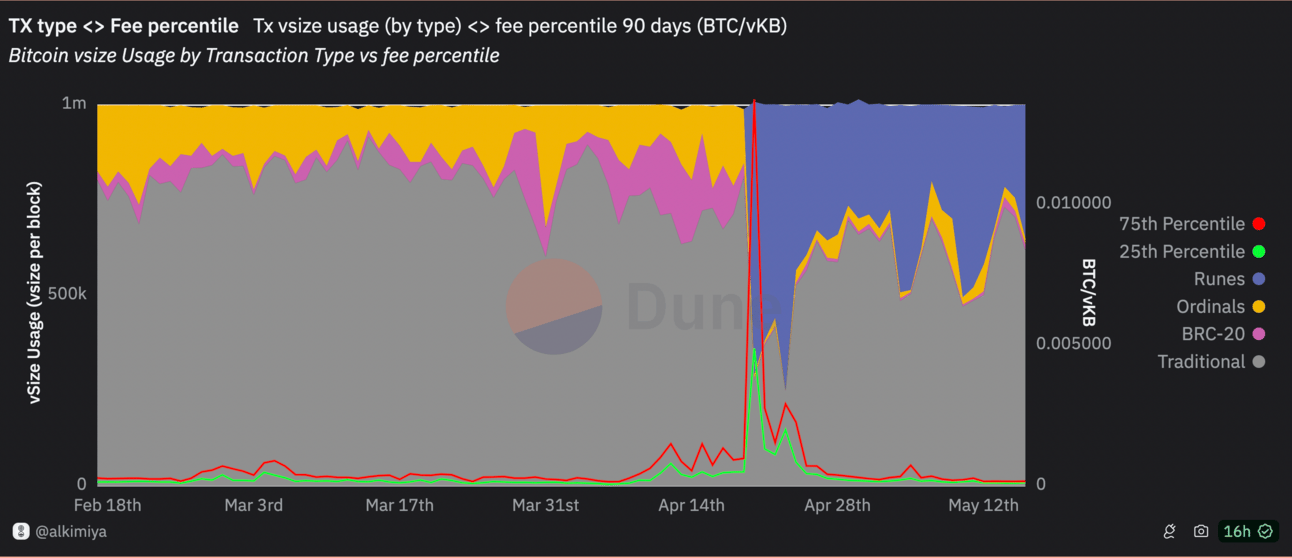

Bitcoin miners: While miner’s revenues are Bitcoin denominated, the Bitcoin issuance just got sliced in half. Yes, there was a magnificent pump in fees due to the Runes protocol launch at the halving but that was short-lived. Now, miners are experiencing all time low profitabilities as hashprice ranges in the low $50/Ph/d. Nevertheless, this is familiar territory to Bitcoin miners—many have been calling for a pause in the unrelenting ascent of hashrate.

Memecoins: One of the few true mania events across crypto in years has lost some steam, with about $20 billion wiped off the score board since March. These dog and cat coins are arguably the retail front lines–hence shameless VCs trying to build funds around them–so any price decline will be heard the loudest. But let’s be honest: is it really that bad that memecoins are coming down? In retrospect, it was inevitable.

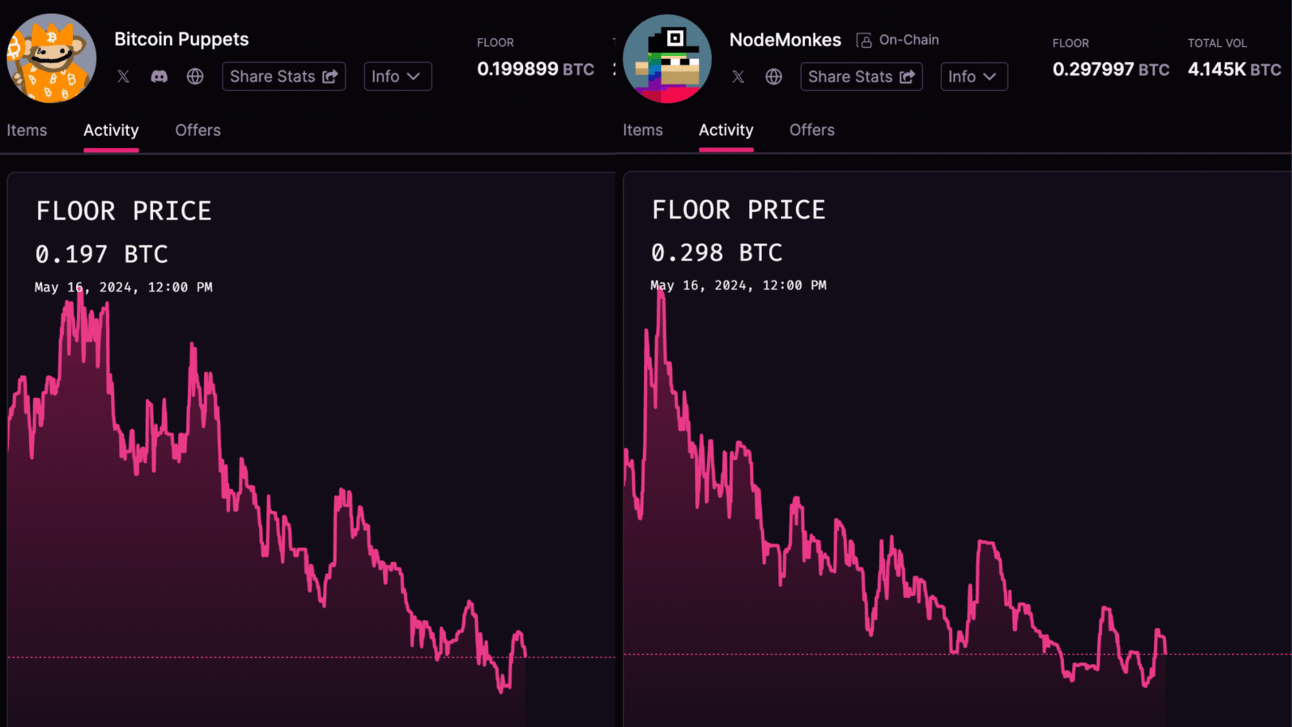

Ordinals & NFTs: Ordinals are dead…. again. The Ordinals ecosystem is still a little difficult to measure, but we can see that iconic 10k collections such as Bitcoin Puppets & Nodemonkes have each pulled back about $180 million in market cap each. The broader ecosystem hasn’t fared well either—marketplace volumes for Inscriptions are the lowest since last October and new user inflow appears to be stalling as Asia has largely faded Runes. Historically speaking though, calling the top on Ordinals hasn’t been a successful strategy.

Other bearish news: ETF inflows become ETF outflows, Ethereum waffles on it’s roadmap forwards, and Bitcoin privacy tooling has been under attack. Even Nikki Glaser made fun of Tom Brady on national television for his involvement in “fake money.” There’s something for everyone to be bearish about heading into the summer!

As a personal observation, I do see growth everywhere. As I typed this in the airport I’ve heard more than one person talk about “crypto” in a generally positive light. Subjectively, I no longer feel like I have to justify working in a “real” industry. I bet that you, reader, can identify with this at least somewhat.

Links we liked

Tweet: Builders are in control

Blockspace Podcasts

Jump into this week’s Bitcoin and Bitcoin mining news including a network healthy check, mining stocks slowly bleeding out while Bitcoin ETFs continue to grow in strength, the Biden administration forcing the divestment of a Bitcoin mining farm from Chinese owners outside a nuclear power plant in Wyoming, and Bitfarms’ lawsuit with its former CEO!

Dean Eigenmann, a Miner Extractable Value (MEV) searcher, joins The Gwart Show to give an insiders look into the MeV landscape, strategies, decentralization challenges, and regulatory concerns. He discusses key differences between Ethereum and Binance Smart Chain, DeFi's future, L2 developments, and offers a critique of Bitcoin.

Thanks for reading! If you enjoyed, help us out by forwarding to a colleague.