23 February 2024 · Block Height 831700 · Bitcoin Price $51K

Happy Friday! Today we have news hits, an article explaining Marathon Digital’s Inscription announcement and lots of podcasts!

Weekly Hits

Martin Malmi releases 2009-11 Satoshi correspondences.

Congressman Tom Emmer (MN-R) strikes back at Biden Admin overreach on Bitcoin mining, per Fox Business.

Riot Platforms, TBC and Digital Chamber file lawsuit against DOE.

European Central Bank still doesn’t like Bitcoin, per article.

Reddit adds BTC and ETH to balance sheet, per SEC.

Ethereum re-staking project ‘EigenLayer’ raises $100M from a16z, per Bloomberg.

Want to get the news in podcast form? Listen to our news roundup on the Blockspace Podcast Network. Subscribe to get all our shows in one location.

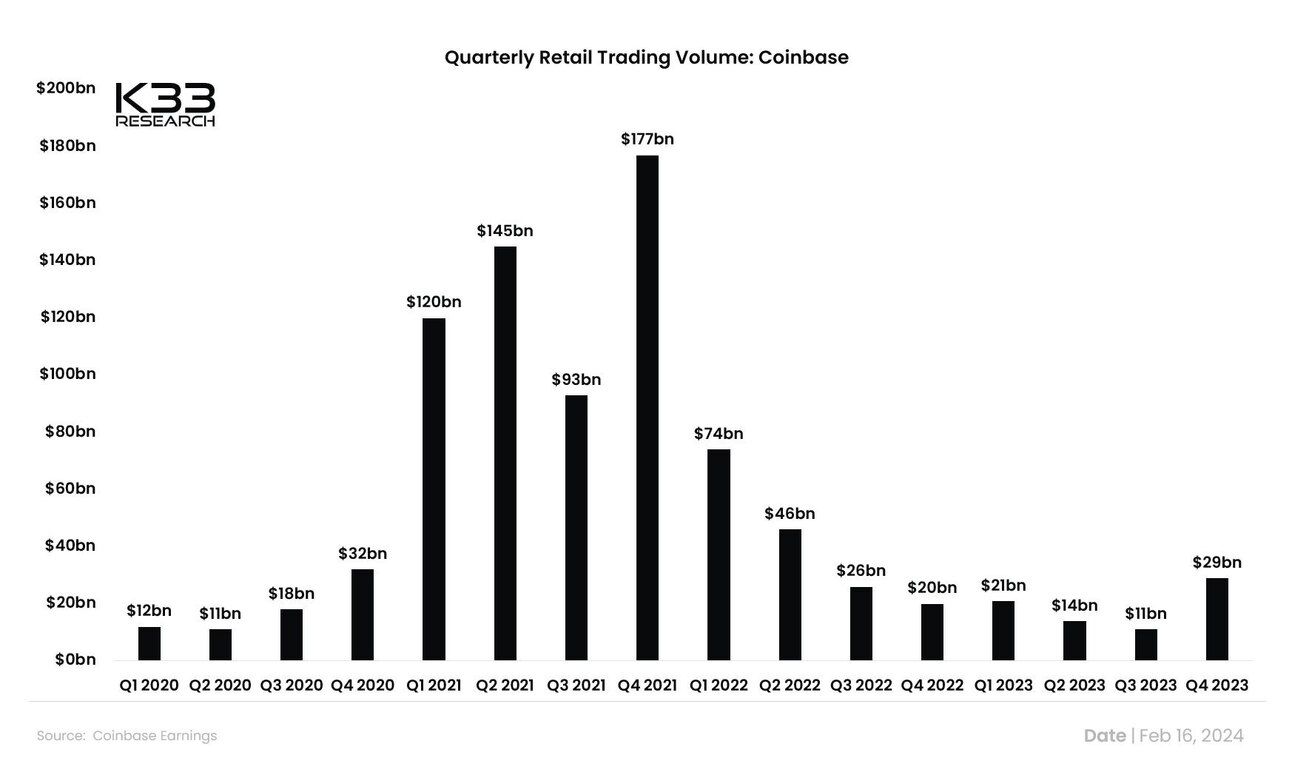

Chart of the Week

Coinbase retail trading volume still lags behind prior cycle’s high.

Marathon Debuts ‘Slipstream’ Mining Service

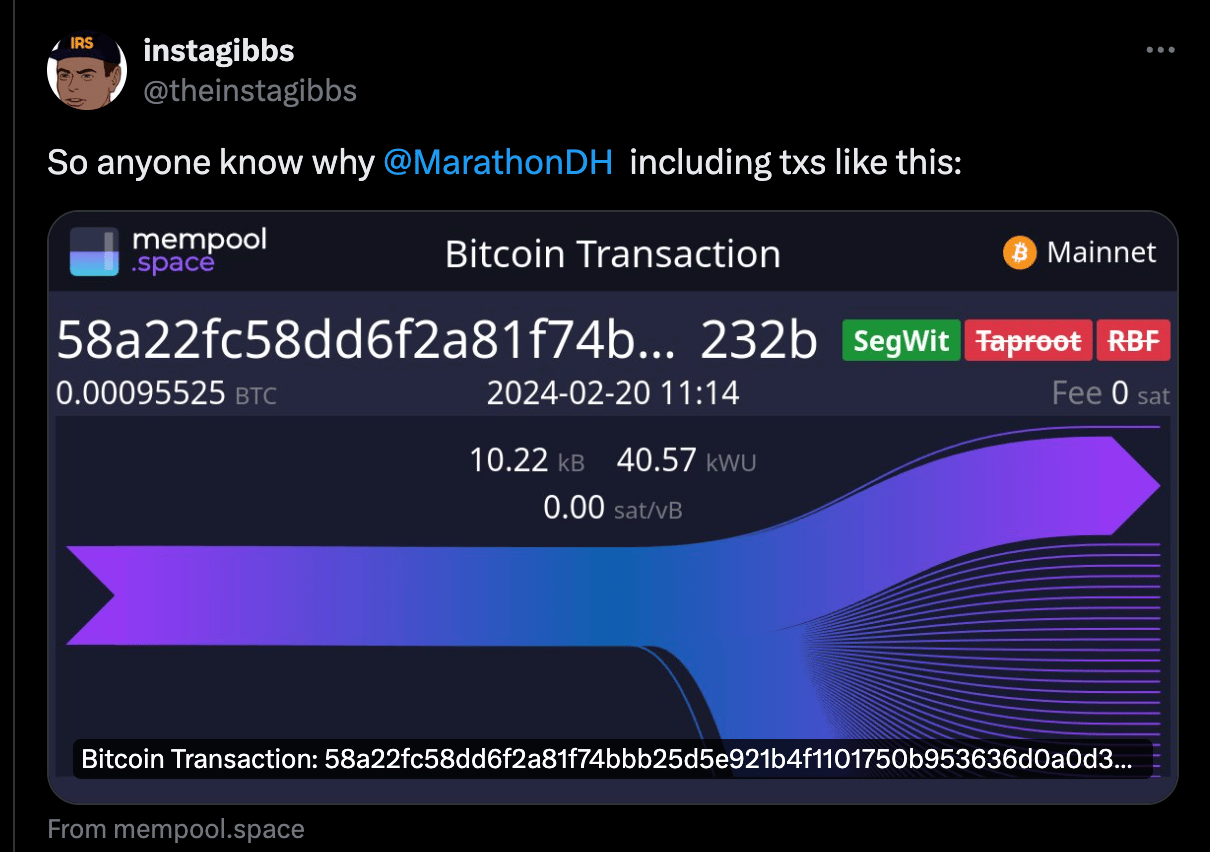

Thursday afternoon, Marathon Digital–the largest US public Bitcoin miner by EH/s–turned heads when it announced ‘Slipstream,’ a tool for submitting “large or non-standard transactions . . . to Marathon for mining on the Bitcoin network.”

In other words, Marathon Digital has fully digested the Inscription-pill.

Non-standard transactions are legitimate Bitcoin transactions under Bitcoin’s consensus rules, but they conflict with the rules nodes use to process transactions from the mempool. To quote from one of my favorite developers, James Prestwich:

Non-standard transactions, in contrast, will not be allowed in the mempool of default-configured nodes, unless they’re included in a block first. As a result, these transactions are not broadcast or relayed through the network. That said, if a miner sees that transaction, she is free to include it in a block (if it passes all validity checks). All nodes will accept the non-standard transaction once it’s in a block.

Marathon is using its privileged position as both a large Bitcoin miner and a Bitcoin mining pool operator to include transactions that would otherwise have nowhere to go. If Marathon didn’t have sufficient hashrate on its pool, it probably wouldn’t land enough Bitcoin blocks to make this worth the effort, and if it used another mining pool (like Foundry or Antpool), it wouldn’t be able to craft its own block templates. To make this work, Marathon also had to build its own version of Bitcoin Core to circumvent the transaction standards that come with Bitcoin’s most popular client.

Okay, but what’s the incentive?

All roads lead to Ordinals. No, Marathon won’t be able to process things like stablecoins, but it can process certain Ordinals transactions more efficiently, such as data-heavy Inscriptions or large OP_Return transactions. Marathon can charge a premium for publishing these transactions to the network that would otherwise be left dead on arrival.

So what’s next? Probably more Ordinals tooling from Marathon, along with partnerships with Inscription collections. Moreover, there are some interesting Bitcoin Layer 2 projects on the horizon using OP_Return to create tokens, such as Casey Roadamor’s Runes. Don’t be surprised to see Marathon Digital leading not only the hashrate race, but the tooling race for Bitcoin devtech.

Blockspace Podcasts

Want to get the news in podcast form? Listen to our news roundup on the Blockspace Podcast Network. Subscribe to get all our shows in one location.

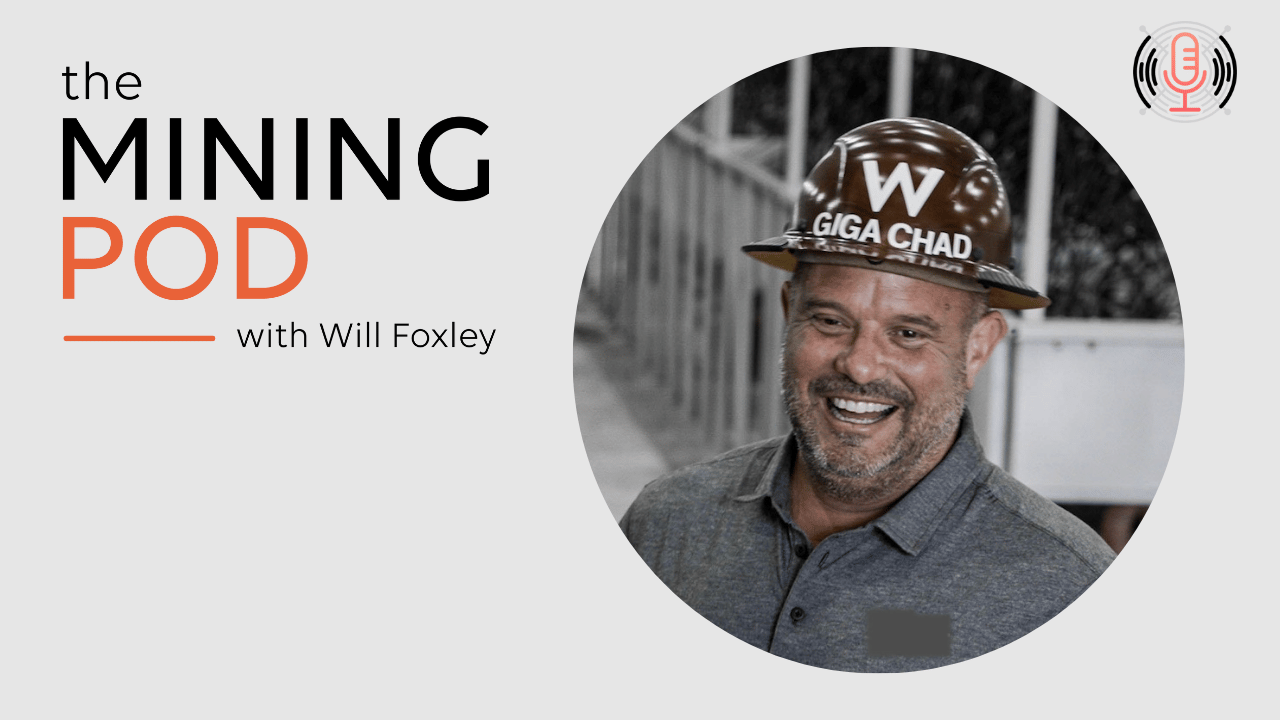

🎙️ TAKEOVER: The Return of the GigaChad

(YouTube) The return of the GigaChad! In our final TAKOVER episode, guest hosts Marc Fresa of Vnish and Taylor Monnig of Cleanspark dig into Chad Everett Harris’ Bitcoin genesis, his time at Riot Platform’s and H3 Data Solutions, his new venture.

🎙️We’re Pretty Sure Mike and Max Can Fix MEV

(YouTube) Mike Neuder of the EF and Max Resnick of SMG join Gwart to fix Ethereum MEV in one podcast. Mike, Max and Gwart talk MEV, EIP-1559, Bitcoin and more.

🎙️ Bitcoin Layer 2s! Fact, Fiction and Mystery

(YouTube) Coin, Charlie and Will talk about Bitcoin Season 2, Bitcoin Layer 2 solutions, what’s grifty and what’s thrifty. If you’re trying to figure out what’s going on in Bitcoin these days listen to this show!

Thanks for reading! If you enjoyed, help us out by forwarding to a colleague.