22 March 2024 · Block Height 835720 · Bitcoin Price $65K

Welcome back to the Blockspace Newsletter!

The rising narrative this week is MEV, “Maximum Extractible Value.” We’ve seen MEV on other chains, but now it’s starting to happen on Bitcoin. Let’s take a look!

…..(also, what is MEV anyway?)

Quick Hits

Iris Energy & Bitdeer raise $213 million and $750 million respectively

“Runestone” pre-Runes airdrop surpasses $400 million in market cap

Whitehat Bitcoin research saves ViaBTC from producing invalid blocks

Over 1,500 viewers tune in simultaneously to Ordinals Coding Club

Chart of the Week

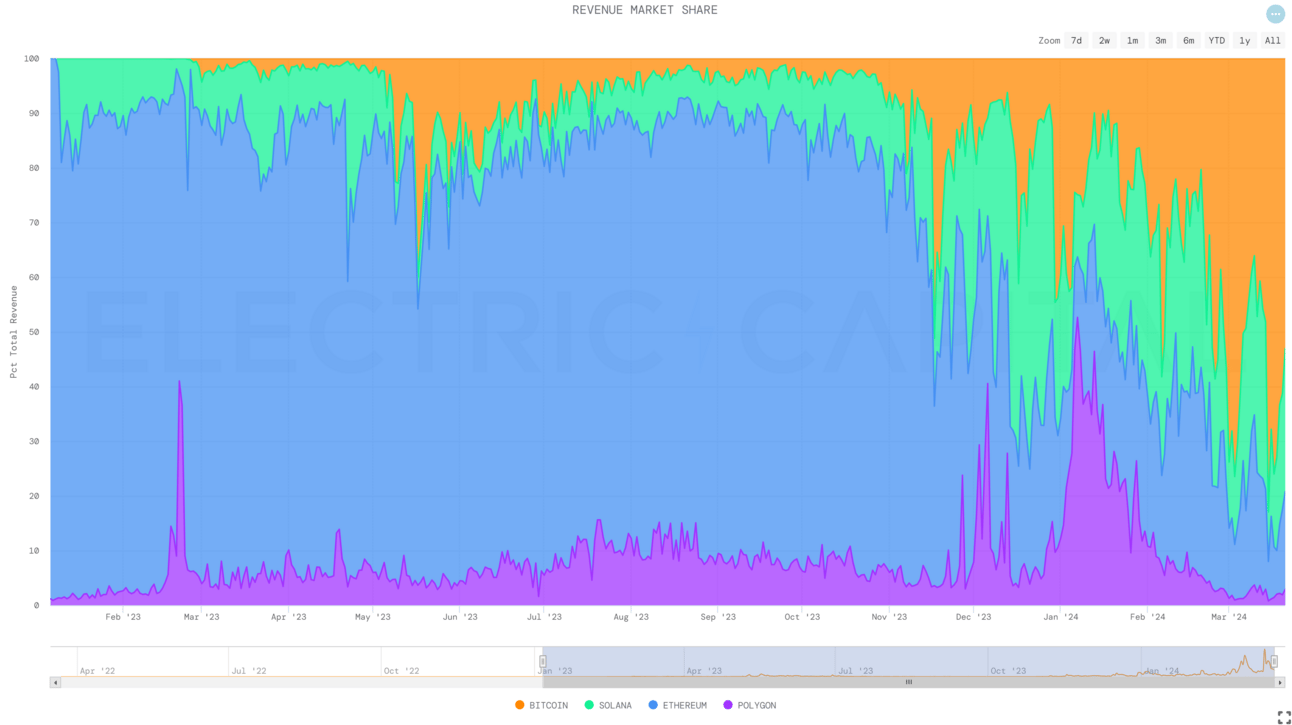

Bitcoin now dominates NFT revenue across all blockchains

Everyone’s talking about MEV on Bitcoin

It seems like this week everyone decided to start talking about MEV on the Mother Chain. While this discussion is fairly mature on other blockchains like Ethereum, it’s been barely made an impression on Bitcoin over the past 15 years. Now it’s here.

950 people tuned in to the Layer 1 Foundation’s MEV talk last week.

What is MEV? “Maximum Extractible Value” is the value extracted by power users and miners from apps & users by abusing power over a given block. MEV can be inserting transactions, censoring transactions, or reordering transactions and capturing the value.

Why is this all of a sudden happening? When a blockchain is more “expressive” (e.g. Ethereum’s smart contracts) or has multiple different assets on-chain, there are more incentives at play than simple monetary transaction settlement. This is why Ethereum has had MEV occurring for years. Now with Ordinals on Bitcoin (and fungible tokens like BRC-20s) there are multiple types of assets being traded. A regular Bitcoin transaction for 10,000 satoshis might contain a Quantum Cat worth 1.9 BTC!

So how are “power users” doing MEV? The most common form of MEV on Bitcoin right now is by “sniping” Ordinals sales from marketplaces like MagicEden. Snipers watch the public mempool for Partially Signed Bitcoin Transactions (PSBTs) that contain valuable Ordinals, replace the payment and destination of the transaction, and use “Replace-by-fee” (RBF) to get that transaction mined into a block before the original sale transaction.

What does it mean for MEV to be on Bitcoin? Well, this is about where we are in the discussion. Generally, most people agree that MEV can harm the incentives that keep a blockchain decentralized. Therefore most conversations have been about how to mitigate or capture it.

Miners like Marathon have released tools like Slipstream which allow users to submit transactions directly to their mining pool, this allows them to capture some revenue on the side (MEV) from transactions which wouldn’t typically get into blocks.

TL;DR: Bitcoin is going to get a lot more interesting for power users, miners, and mining pools. The days of Bitcoin being the “boring” chain are over

Be on the lookout next week for the launch of "Bitcoin Season 2” - a new podcast from Blockspace Media about all the new things happening on Bitcoin (including deeper dives into MEV!). Make sure you subscribe to our Youtube channel to watch it air live!

Links we liked

Blockspace Podcasts

🎙️ The Cats Have Caused Bitcoin MEV

(YouTube) Charlie, Matt and Will join the news roundup to talk this week’s Bitcoin and Bitcoin mining news, including public miners offering large ATMs, Bitcoin MEV from Ordinals and ViaBTC’s stale block problem.

🎙️ Bitcoin Mining Stocks Are . . . Down?

(YouTube) Bitcoin hit another all time high last week, but Bitcoin mining stocks keep lagging. We’re joined by Brandon Bailey, a Bitcoin mining analyst previously with Galaxy Digital Holdings, to break down the price performance.

Thanks for reading! If you enjoyed, help us out by forwarding to a colleague.