12 July 2024 · Block Height 851750 · Bitcoin Price $57K

Bitcoin miners have 2 options: go broke or change hands.

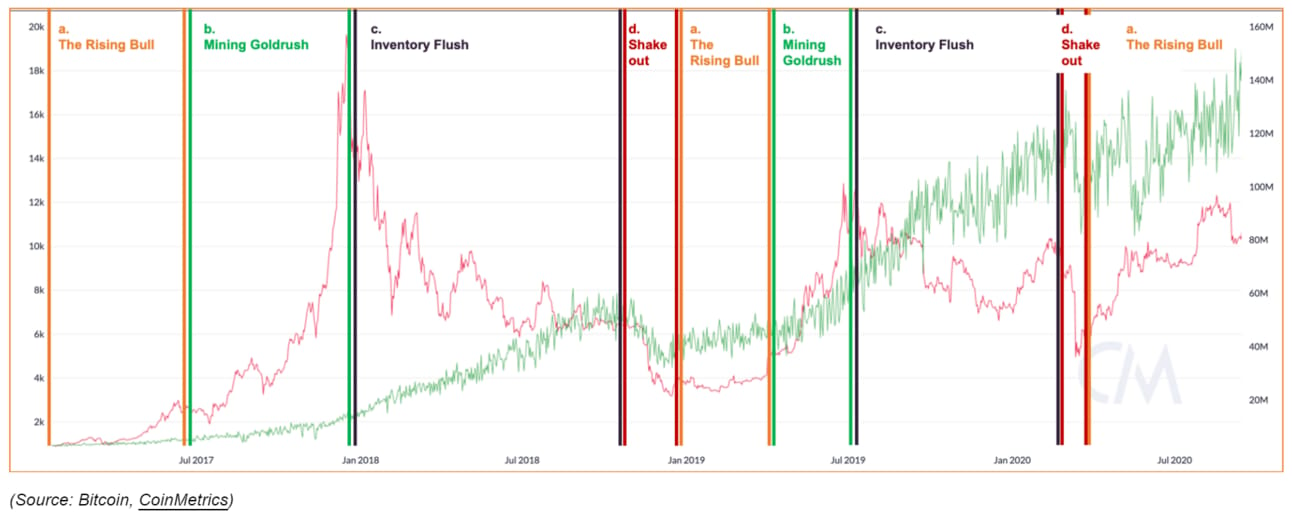

The “Shake Out” phase of mining is in full effect, but this time things look a little different.

Quick Hits

Germany is almost done dumping BTC, has less than 10K left to sell

Ordinals client gets first update in 2 months

Donald Trump speaking at Bitcoin Nashville

Miners: Capitulate or Get Acquired?

If you missed it, we’re in the “Shake Out” phase of Bitcoin mining. But this time around things look a little different: miners have options instead of just going bankrupt.

There’s a few distinctly different factors this time around, let’s break them down:

Bitcoin has had a very good previous year

ASICs have been very cheap & liquid

Miners getting acquired (Capitulacquired?)

Bitcoin has been in a bull market. Historically, the shake out phase has always followed a price decline. This is the first time that the 200-day moving average has been trending upwards at the same time as the miner shake out. This has staved off the shake out for the past year while hashrate skyrocketed as well as created generated bullish investor sentiment. Record amounts of capital continues to be raised during this shakeout period as public companies like Marathon, Cleanspark, and Iris Energy raise hundreds of millions of dollars post-halving.

ASICs are cheap. ASICs are liquid. If you weren’t around for the 2021 mining cycle you may not remember how incredibly difficult it was to get your hands on rigs, with futures orders as far off as 10 months for some deals. These days, you can buy just about any new rig at all time low hashprice, delivered to your site within 10-14 days. This has allowed many mine operators to flip and/or upgrade their fleets with opportunistic capital injections.

Miners are getting acquired. In many cases, miners aren’t going out of business; they’re just changing hands. Mining companies with aging fleets may be purchased for their enterprise value, whether it be favorable power contracts to valuable facilities infrastructure. Historically acquisition has not been available to the mining industry due to it’s youth as an industry and the constraint to raise capital by those looking to acquire. This trend could be one of the most defining of this shake out cycle.

Difficulty declines during the modern ASIC mining era (note 2021 China ban event)

Who knows how long this Shake Out period may last, but my spidey senses tell me that it won’t be much longer than this 2024 summer.

If you’re reading this, give us a reply with what you think about AI/HPC and Bitcoin mining! We’ll post the most interesting responses in next week’s Tuesday article! Something like “overhyped” or “bullish IREN!”