14 June 2024 · Block Height 847850 · Bitcoin Price $66K

Happy Friday!

Bitcoin Layer 2 announcements have gotten out of hand. Are all these new “layers” actually doing something new, or is it just marketing?

Of Marketing & Multisigs: Bitcoin Layer 2s

Over the past year, tens of millions of venture capital has poured into the Bitcoin ecosystem as investors scramble to react to renewed user interest & opportunity on the oldest blockchain.

Blockspace and other analysts have counted over 70 “Bitcoin Layer 2s” announced or launched in the past 9 months. These range from a low follower twitter account with a fancy logo to full-fledged whitepapers describing novel trust-minimization schemes & a cracked engineering team.

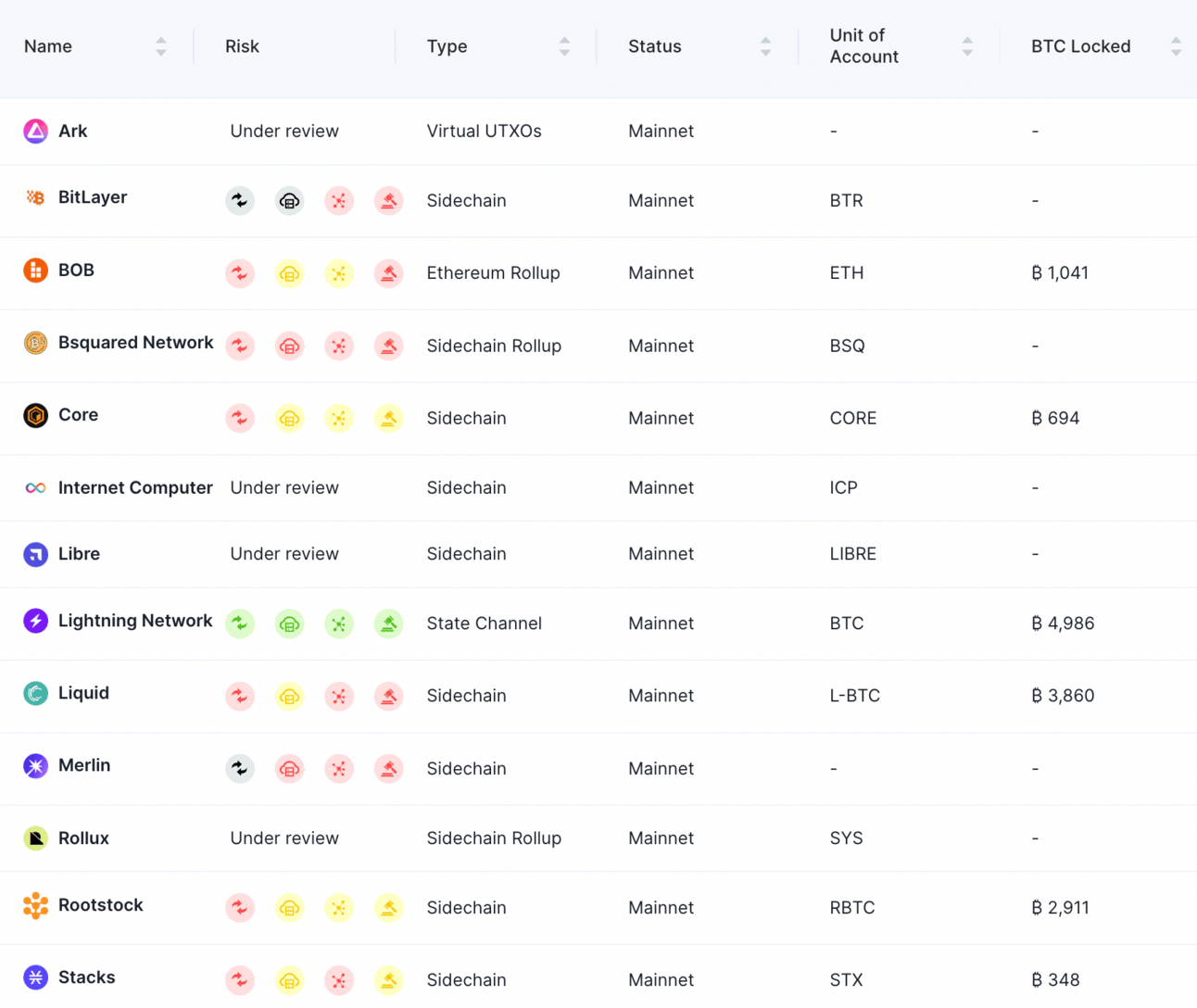

You may have seen this type of L2 chart circulating around.

The above infographic captures this phenomenon, but unfortunately most charts like this that circulate just slap names into categories indiscriminately. Case in point—when this chart first dropped on June 6, one of the “Rollups” (zksats) had already rugged user deposits months ago. Does anyone do their research?

Frankly, no. There are very few folks actually doing due diligence on these projects which leaves marketing teams to run with whatever narrative generates the most depositors. Most users believe these marketing claims at face value; remember to copy trade your dumbest friend.

There are many L2s/sidechains/scaling which we believe do a pretty good job communicating to the user the trust assumptions or differentiated technologies, such as:

Babylon Chain uses timelocks & one-time signatures for slashing.

Botanix uses distributed multisig wallets to implement Spiderchain.

Anduro provides a federation model to peg in/out from merge mined sidechains.

Buyer beware! There are many straight up falsely marketed Bitcoin Layer 2s. Some of these strain even the most generous definitions of Layer 2 and in some cases don’t seem to have anything to do with Bitcoin at all.

Take BSquared, a “Bitcoin Layer 2” claiming to use “zero-knowledge proofs” which in reality is a Bitcoin multisig. On the backend is a Rube Goldberg contraption including an EVM bridge contract tied to Tendermint consensus and a fork of the Polygon zkEVM.

On the otherhand, there are also many “trust-maximized” Layer 2s. One of the most popular, Merlin Chain, is a simple multisig of murky signers and begrudgingly released documentation. This hasn’t stopped users from depositing over $2 billion in Bitcoin & BTC-denominated assets.

It’s important to note is that Merlin is allowing withdrawals, although they have had to pause withdrawals at least once due to constraints with Bitcoin network itself—probably should have thought about that. Many of these Layer 2s move at the speed of light, forming partnerships and launching websites before ecosystem analysts get to track down where exactly the white paper even is. Many such cases in a bull market.

BitcoinLayers continues to expand it’s research & risk analysis

One contributing peculiarity with the Bitcoin ecosystem is that many existing Bitcoiners haven’t spent much time studying user behavior on other blockchains, so when those users move to Bitcoin there isn’t much familiarity with ongoing discourse. Another reason is that the majority of the capital & user interest in L2s nontechnical and the marketing has moved too quickly for critics to keep up.

All that said, it’s an exciting time for renewed interest in building on Bitcoin. Let’s just hope there’s more caution than last cycle with altcoin L2s!

If you enjoyed read, reply “UTXO” to let us know you enjoyed the newsletter! It helps us with our open rate :)