10 October 2024 · Block Height 865181 · Bitcoin Price $60K

Welcome back to the Blockspace Newsletter!

For today’s roundup, we take a gander at trends in the bitcoin mining industry based on September updates from public bitcoin miners. For news, a look at memecoin mania (sorry…), an update on Babylon Chain, Coinbase’s overdue updated, and we (don’t actually) find out who Satoshi is.

What caught our eye this week

In September, hashrate takes a back seat to AI for public bitcoin miners

Publicly traded bitcoin miners are still adapting to the new post-halving normal, but even as they confront a new market environment, the playbook – expand and improve energy efficiency to stay ahead in the hashrace – is the same as always.

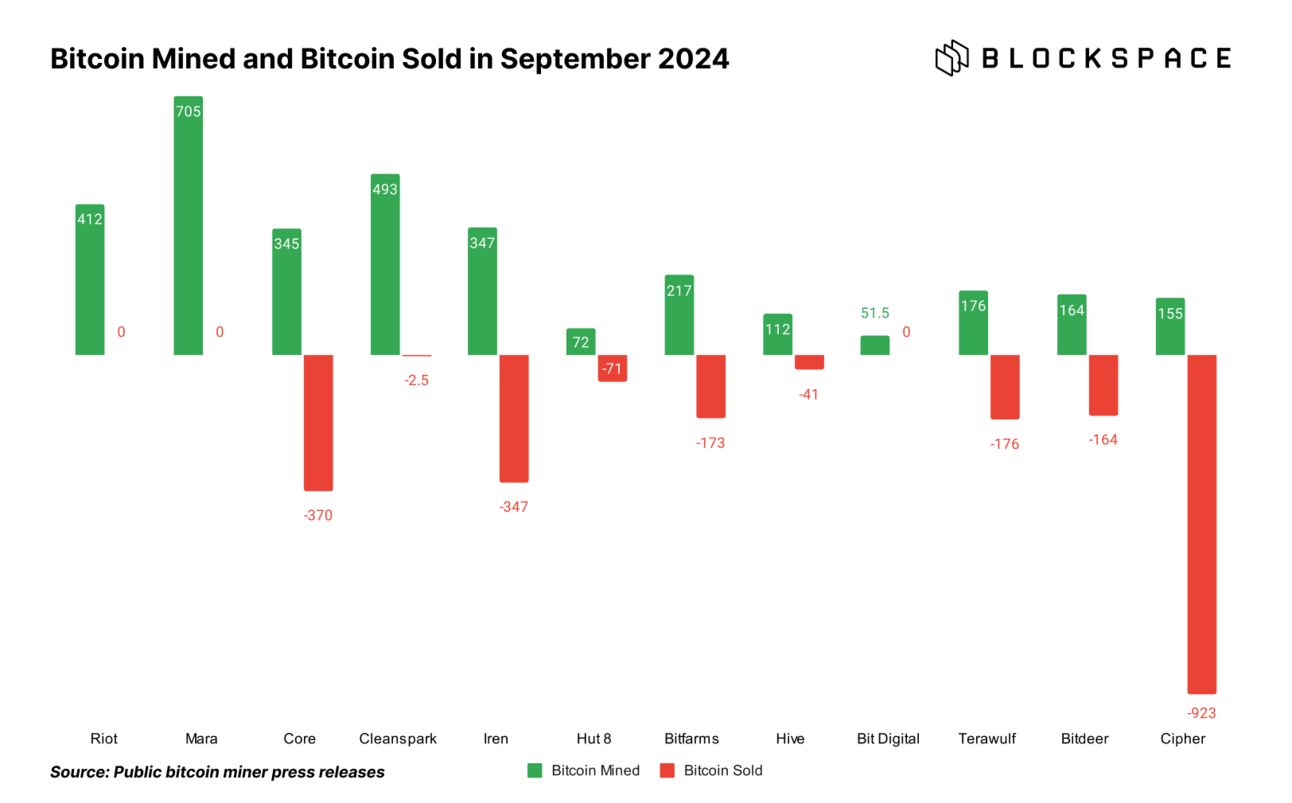

So in September as with other months, we saw more of the same from public miners, including the usual chest beating about expansion plans and end-of-year hashrate targets (which always seem spectacularly quixotic, but I digress…). That said, outside of the usual focus on growing hashrate, two terms seemed to define September’s round of public miner updates: liquidation and AI.

If you’re tired of seeing or hearing “AI” and “bitcoin mining” in the same sentence, sorry friend, but you best glue your eyelids shut or gum up your ears, because that’s all that public miners – and equity markets broadly – want to talk about these days. And more miners are talking about entering the AI game now than ever before.

Miners also sold more bitcoin in September than August, and some miners made these liquidations to whet their incipient AI businesses.

Read on in this week’s Mining Pod newsletter, which you can subscribe to here.

Miners and users who want to hedge against this volatility could find products like Alkimiya or Luxor’s Hashprice derivatives useful as the fees on Bitcoin become more volatile. These blockspace derivatives markets offer traders the unprecedented ability to trade transaction fee volatility. (This is not financial advice, so don’t blame us if you lose your shirt…).

For more info on Babylon Chain, check out our interview with Babylon founder David Tse on Bitcoin Season 2.

News roundup

Last week, memecoin ascendancy was passed from Ansem to Murad Mahmudov, a prominent bitcoin trader who took a hiatus from the Bitcoin sphere after his fund imploded during the March 2020 flash recession. This week, many of Murad’s wallets were identified by crypto sleuth ZachXBT. Murad owns over $24 million in various memecoins (they line up with what he publicly endorses), and he’s overly weighted in the $SPX6900 token.

Bitcoin staking protocol Babylon just opened up the second phase of BTC staking, resulting in over 20,000 BTC sent to stake over the course of just 10 blocks on Tuesday morning. Check out our interview with Babylon founder David Tse to learn more!

It had become a meme in the past few years that Coinbase still did not have Taproot support, but now that meme can finally die: Coinbase users can now withdraw to Taproot addresses. Taproot, among other things, is a more cost effective way of constructing multisig and script-based Bitcoin transactions.

Another day, another ridiculous speculation on Satoshi’s identity. This time it’s a documentary from HBO about Bitcoin that pieces together misleading comments suggesting Peter Todd is the creator of Bitcoin. Peter says he is not Satoshi. However, we have interviewed

SatoshiPeter Todd before – check it out!

Chart of the week

Ordinals Lending Volume on track for 4 consecutive weeks of growth

Ordinals are back, so that means that lending volumes for them are, too. Per data from Liquidium’s Geniidata, lending for ordinals / inscriptions, BRC-20 tokens, and Runes are on track for four weeks of growth.

Geniidata dashboard from Shudufhadzo, Liquidium analyst

Did you like this newsletter? If you did, please help us out by sharing and replying to this email!