Brought to you by Lygos Finance

Happy Friday!

KindlyMD (NASDAQ: NAKA) released its belated Q3 earnings this week, and they wen’t about as well as you’d expect for a stock that has been the femme fatale of 2025’s bitcoin treasury run.

The filing provided the hard numbers behind the problems that have plagued one of the year’s most anticipated bitcoin treasury newcomers since the KindlyMD-Nakamoto merger closed in August — including NAKA’s average cost basis, which is literally $1k from Bitcoin’s all-time high.

We cover all the juicy details in today’s letter, plus a note on hashprice hitting an all-time low (but not necessarily mining margins), headlines, and more!

100% Non-Custodial Bitcoin-Backed Lending

Lygos Finance is solving the Bitcoiner’s dilemma: how to get liquidity without selling your coins or relinquishing your keys. Lygos is a non-custodial, BTC-backed lending platform that leaves users in control of their BTC with DLC-powered custody, and they use a third-party oracle so users don’t have to worry about hidden counterparty risk.

To learn more about how you can take out non-custodial loans on your bitcoin, visit lygos.finance.

KindlyMD’s bitcoin cost basis: $126,000

It was a bread and circus week for markets, and the Bitcoin-equities crowd couldn’t help but throw peanuts at NAKA and its carnival barkers for the fledgling treasury company’s Q3 earnings. NAKA recorded a net loss of $86 million in Q3, driven mostly by a $22 million unrealized loss on its bitcoin holdings and a $59.8 million write down on KindlyMD’s acquisition of Nakamoto Holdings. The most salacious data point though, as noted by former Bitcoin Magazine Managing Editor Joakim Book, was NAKA’s reported cost basis on its 5,398 BTC treasury: $681,247,326. That comes out to $126,203 per coin. NAKA bought the top. - link

OUR TAKE: Everyone loves a sacrificial lamb.

NAKA has become the scapegoat (or posterchild, depending on your allegiance) for 2025’s spectacular collapse in bitcoin treasury companies, so its earnings release turned into a bloodsport on social media for disaffected investors, bitcoin treasury bears, and generally anyone with an axe to grind toward David Bailey, KindlyMD’s CEO.

The company first shook investor confidence with its $563 million private equity placement (PIPE), which precipitated tremendous selling pressure once PIPE equity unlocked in September, driving the stock below $1.

And as all of this was happening, NAKA plowed its PIPE funds and the $200 million convertible note that accompanied it into bitcoin at its all-time high — so that’s not a great look either.

Bitcoin has cratered even deeper since Q3’s close, obviously, so now might be a swell time for NAKA to lower that cost basis, you might think.

Well astute reader, NAKA does have $24.2 million in cash on hand, but that won’t even cover an annualized run rate for its Q3 G&A ($5 million) and payroll ($5.8 million). And what’s more, the company has little wiggle room to fundraise in the current market environment. NAKA opened a $5 billion at-the-market offering in August, but it only sold $5.7 million through this facility (at an average stock price of $4.15, mind you).

Oh and one more teensy thing: 2,908 BTC out of NAKA's treasury is now encumbered under a $206 million, 7% loan the company took from Antalpha that is due December 6, 2025–yes, less than a month. And NAKA only took that loan to refinance another loan from Two Prime it made in September at 8.5% — another refinancing event which NAKA used to pay down its $200 million convertible debt.

It’s like a Russian Nesting Doll of bad debt.

-CMH

Bitcoin hashprice falls to all-time low as bitcoin price collapses

According to Hashrate Index, hashprice (a measure of mining revenue) fell to an all-time low of $36/PH/day on Thursday afternoon. This means Bitcoin miners now earn fewer dollars per unit of hashrate than ever, a direct result of rising difficulty, stagnant fees, and a 30% price decline. - link

OUR TAKE: Would you be surprised if I told you that despite this, profit margins for some miners are probably higher than the previous hashprice low?

That’s because mining rigs have become much, much more efficient.

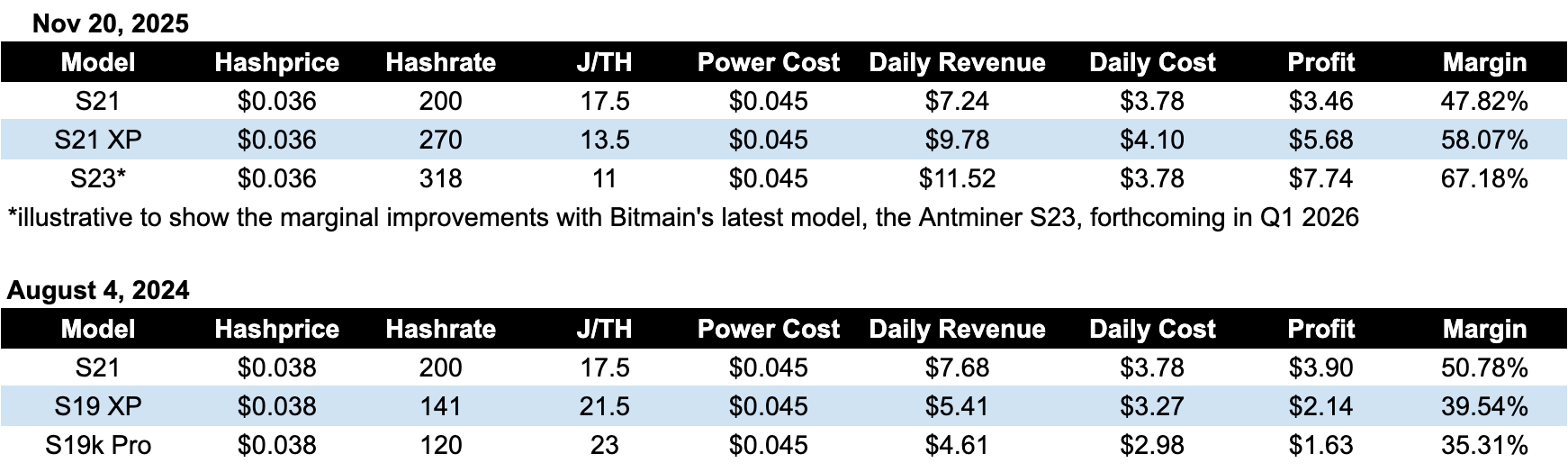

Let’s take a look at the prior hashprice all time low, back on August 4, 2024 ($38/PH/day).

At the time, Bitmain’s S21 series was the most powerful and efficient miner yet, but plenty of miners were still running S19 series models like the S19 XP and S19k Pro.

Assuming no change in power cost year over year (our model uses $0.045/kWh), here’s how the margins looked in 2024: The S21 (newest model at the time) had just shipped out and was making $7.68 per day and netting $3.9 after power costs, while S19 XP was churning out $3.27 per day netting $2.14, and the S19k Pro earned $2.98 daily and $1.63 net.

Now, compare the S21 today, which is netting $3.46/day, to the S21 XP, which is bringing in $9.77/day with $5.68 of that going straight to the bank.

So right now, hashprice is 5% lower now than the prior low, but the most efficient air-cooled ASIC (the S21 XP) has a 58% profit margin, whereas the S21 on August 4, 2024 (the most efficient then) had a margin of 51%. And the S21 itself right now, which many public miners used to refresh their fleet from the S19 series, has a 48% margin currently, while S19 models that were popular during the last low were netting only 40% and 35%.

When Bitmain’s new baby the Antminer S23 hits racks starting next quarter, margins will improve even more significantly.

Data: Hashrate Index

This is no surprise though. Chip efficiency increases have always carried miner profitability cycle-to-cycle.

Of course, this doesn’t account for the overall profitability of a mine and other operating costs – we have to consider SG&A, financing costs, etc.

Stepping back, we do expect hashprice to trend down. On a long timeline hashrate should grow and miners should ruthlessly compete for efficiency, so the revenue per unit of hashrate should trade in backwardation.

Even if we expect it, it’s still a bummer when hashprice breaches new lows.

-CBS

Like these stories? Reply BITCOIN to let us know!

Luxor Hardware: Mining Made Easy

Backed by experts, trusted by miners. Whether you’re running a single home rig or a large scale operation, Luxor makes it simple — verified hardware, global shipping, and expert support every step of the way.

In the News

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

Crypto exchange Kraken files confidential IPO papers with SEC

Kraken filed confidential paperwork with the Securities and Exchange Commission for an initial public offering (IPO), the company said on Tuesday. - link

Minority shareholder challenges Anthony Pompliano’s ProCap BTC SPAC

Anthony Pompliano’s plan to take ProCap BTC public through a SPAC with Columbus Circle Capital Corp. I (NASDAQ: BRR) faces new pressure after a new minority shareholder filed a Schedule 13D calling for the termination or restructuring of the proposed merger. - link

Cipher jumps 10% on 56 MW hosting contract with Fluidstack

Bitcoin miner-turned data center Cipher (NASDAQ: CIFR) has inked a 10-year, 56 MW expansion in its Fluidstack contract, adding about $830 million in contracted revenue and lifting its total contracted revenue with Fluidstack to roughly $3.8 billion over a ten year term. - link

Chart/Tweet of the Week

Per ZeroHedge, bitcoin is now the most oversold its been since August 2023. If this feels like cope, it is. I needed something remotely bullish, even if that thing is max pain and fear, to justify why I haven’t followed up with that McDonald’s manager with my resume (Steak n’ Shake didn’t even return my calls…).

Blockspace Podcasts

Welcome back to The Mining Pod! Today, Haley Thomson, the director of energy trading at Luxor Technology, joins us to talk about how AI demand is impacting the ERCOT power market. For news, we break down Nvidia's Q3 earnings and the market's Thursday morning reversal, dissect a load growth report that suggests there are currently 166GW of US load growth demand through 2030, and discuss Cipher's $830M extension with FluidStack. And for this week’s cry corner, The Financial Times is doing its best to report on AI like it has with Bitcoin.

On this day in 1916, the Britannica, a sister ship to the Titanic, sinks in the Aegean Sea while enroute to pick up wounded soldiers near the cape of Athens. A naval mine is thought to have caused the explosion that ruptured the ship’s hull. 30 passengers perished in the foundering, while over 1,000 were rescued.

-CMH & CBS