9 May 2025 · Block Height 895955 · BTC Price $103K (!)

Presented by

An update on the two states that passed Strategic Bitcoin Reserve acts this week — and why one of this isn’t like the other. Also, whether or not Antalpha’s targeted $300 million is a fair shake and Coinbase’s huge acquisition.

It’s about a 7 minute read. But before we dig in…

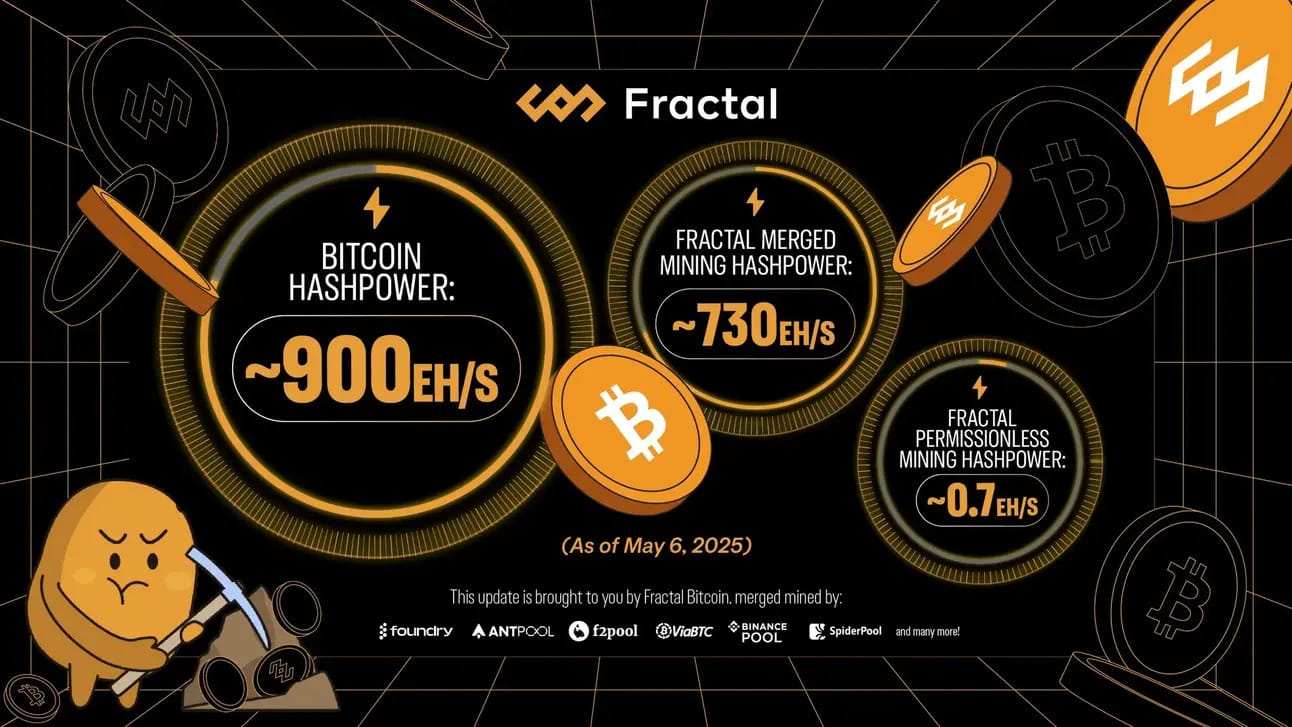

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

New Hampshire and Arizona Strategic Bitcoin Reserve bills signed into law

On May 6, 2025, New Hampshire became the first state to pass a Strategic Bitcoin Reserve when Governor Kelly Ayotte signed House Bill 302 into law. The bill authorizes the state treasurer to invest up to 5% of public funds into digital assets with a market capitalization exceeding $500 billion. Currently, only bitcoin fits that bill. Arizona quickly followed as Gov. Katie Hobbs signed House Bill 2749 creating a Bitcoin and Digital Assets Reserve Fund on May 7.

OUR TAKE: Move over Saylor, states are buying now. Once this trend starts, it won’t stop – it will only take the occasional breather. We’ve covered the state bitcoin reserve saga in various Blockspace posts, so we’re particularly dialed in.

NH’s bill mirrors the framework put forth by the Satoshi Action Fund: bitcoin forward but crypto neutral. The bill allocates up to 5% of the state’s treasury funding (up to $360 million) for buying bitcoin.

Arizona’s act is a little more interesting. Governor Katie Hobbs previously vetoed Senate Bill 1025, which allowed the state to invest up to 10% of treasury and pension assets into cryptocurrencies. Hobbs claimed her concern was about “exposing retirement funds to untested investments” although there may be other unstated reasons such as the conflict Hobbs (a Democrat) has with House Republicans over budgetary and fiscal issues. Nevertheless, Hobbs signed House Bill 2749, which got Arizona across the finish line.

However, HB 2749 isn’t your conventional Strategic Bitcoin Reserve bill. Instead of allowing Arizona to buy cryptoassets for a reserve, it “updates Arizona’s unclaimed property laws to account for the growing presence of digital assets, including cryptocurrencies.”

The law establishes a clear process for identifying and handling unclaimed virtual property, protects the value of digital assets held by the state, and creates a reserve fund that may be used for future appropriations with legislative approval. This allows for more confiscation than your typical libertarian Bitcoiner would like, as the scope for “unclaimed property” can be very broad and is itself a subject of constant criticism.

Regardless, we expect to see a nonzero amount of Bitcoin go into the state coffers in 2025. There’s a really cool tracking site from Bubbl.fm and the Oklahoma Bitcoin Association which tracks the “Opportunity Cost” of a state not passing the respective Strategic Reserve. That could be a spicy thing to watch when/if bitcoin continues to leg up this year.

Antalpha (ANTA) seeks $300M valuation with IPO

Bitmain’s chief lending partner, Antalpha, is hitting the road to sell investors on its forthcoming Nasdaq IPO. The company plans to issue 3,850,000 ordinary shares during the IPO at $11.00 and $13.00 per share, for a total raise of $42,350,000 to $50,050,000. These share prices would give the company a valuation between $254,100,000 and $300,300,000 given the 19,250,000 outstanding common shares it reported in its IPO prospectus and the 3,850,000 it plans to sell during the offering. – link

OUR TAKE: With a public debut, Antalpha would become the first pure-play bitcoin lending company to trade on public markets. The company provides both ASIC miner financing and bitcoin-backed loans.

Antalpha booked $47.5 million in revenue last year. Is a $300 million valuation foul or fair for such a firm? Well, Galaxy Digital raked in $85.5 million for its own lending services last year, representing 7.4% of its $1.15 billion in total revenue for the year. If we back this out of its current market cap of $6.8 billion, then we can crudely value Galaxy’s lending business at $500 million. (Note that Galaxy conducts loans across the crypto-ecosystem, however, while Antalpha mostly focuses on ASICs and Bitcoin mining).

As we’ve seen with other public companies like BitFuFu, Bitdeer, and Cango, investors tend to value Chinese run firms at a discount to their North American peers. We could chalk this up to a linguistic and cultural divide, whereby Chinese companies are less successful at marketing their companies to institutional investors in Western markets, or it may signal a lack of investor trust in Chinese companies.

Whatever the case, Antalpha’s IPO may be the company’s attempt to shore up business in U.S. markets. In 2024, 77.4% of its clients were based in Asia and 6.9% in the Americas.

A Nasdaq listing could bolster Antalpha’s legitimacy from U.S. firms, both with potential clients and lenders. Bitmain would stand to benefit from Anatalpha growing its loan book, as bitcoin miners often tap the company for funding to purchase Antminers.

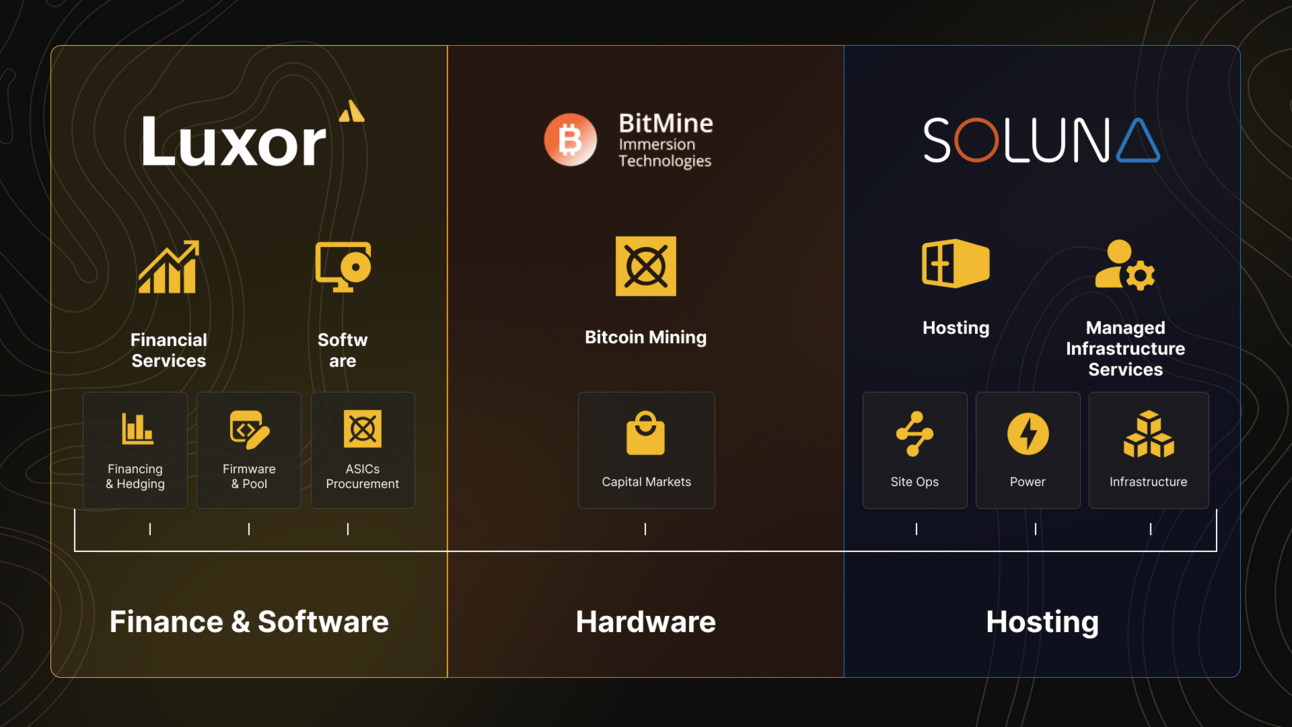

3 times the hashrate, zero guesswork

BitMine scaled seamlessly with Luxor & Soluna’s turnkey mining model — from procurement, to firmware, to renewable power. Grow your hashrate output with one unified solution.

OCC-regulated banks may custody, buy and sell cryptoassets

The U.S. Office of the Comptroller of the Currency (OCC) has clarified that national banks and federal savings associations are authorized to provide crypto-asset custody and execution services, including through third-party arrangements, provided that they adhere to sound risk management practices. – link

Coinbase to acquire Deribit for $2.9 billion in largest crypto acquisition ever

Coinbase announced that it has entered an agreement to acquire Deribit for $2.9 billion for $700m cash and 11 million shares of COIN, making it the largest M&A ever in crypto. Deribit’s strong presence in the global derivatives market complements Coinbase, the exchange espoused, saying that the acquisition “strategically positions Coinbase within the sizable global crypto derivatives markets.” – link

Alpen Labs announces bitcoin-backed Stablecoin

Alpen Labs announced Bitcoin Dollar (BTD), a bitcoin-backed stablecoin launched on Alpen’s Bitcoin rollup. The stablecoin does not rely on governance tokens or centralized bridges but does require a price oracle. – link

Blockspace Podcasts

Enjoyed today's read?

What are some topics you’d like to see us cover in the newsletter? We’ll read every message.

-CMH, CBS