10 June 2024 · Block Height 830700 · Bitcoin Price $69K

Welcome back to the Blockspace Newsletter!

OKX burnt over $17 million in Bitcoin this last weekend, more or less on accident. But how and why did it happen? Stick around because it definitely matters for your personal Bitcoin stack!

Nobody is ready for high fees

This isn’t unheard of—we saw Binance cause a massive fee event in November 2022 doing the same thing. But in a competitive fee environmenr–over 100 sats/vbyte–these transactions can get very expensive very quickly.

It’s also a common problem, extending to even the most die-hard Bitcoin DCA strategist who’s been steadily purchasing little bits of Bitcoin. These “inefficiencies” may grow to become one of the biggest points of friction for Bitcoin users in the coming years.

Binance was ONLY interesting “fee event” in 2022.

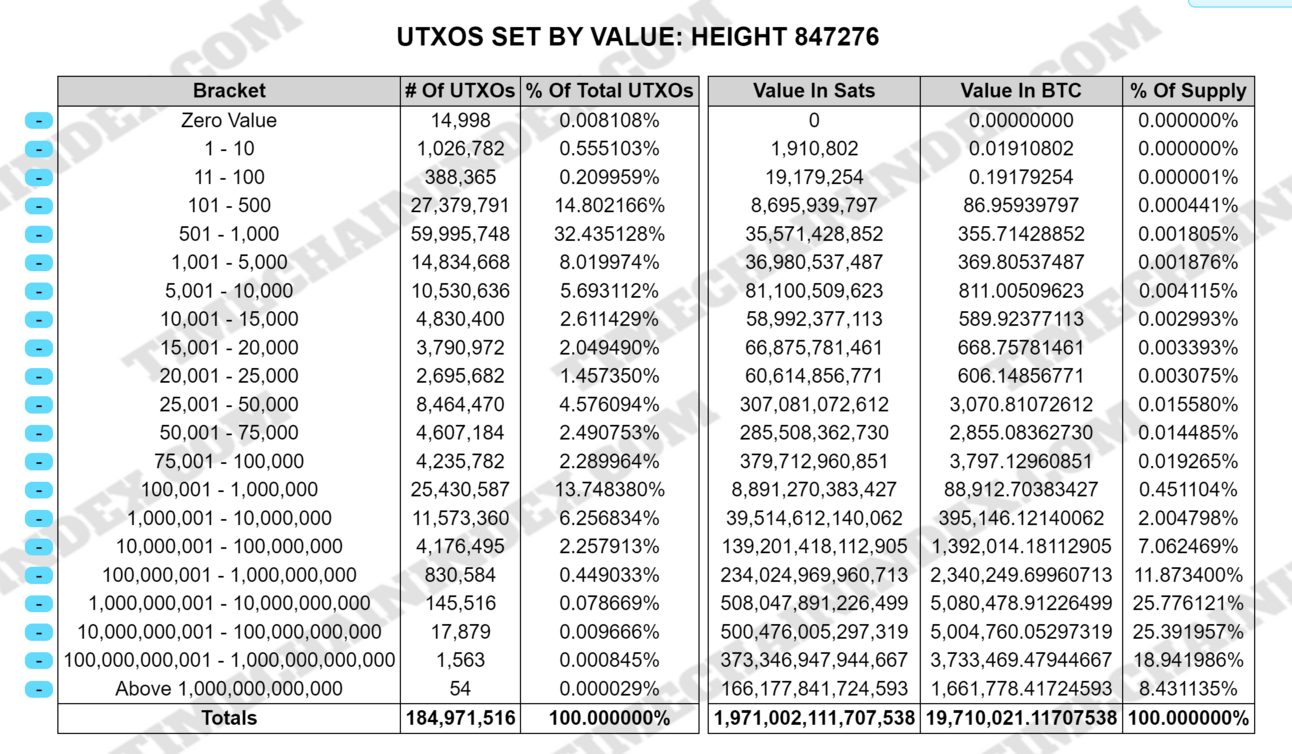

What did OKX do? When users deposit Bitcoin to an exchange like OKX, the exchange receives on-chain transactions in the form of Unspent Transaction Outputs (UTXOs), which can be thought of like large coins in various amounts depending on the Bitcoin value. When you deal in tens of thousands of user deposits you end up with as many or more UTXOs.

Withdrawing from exchange back on-chain requires converting the OKX balance to an on-chain balance in the form of UTXOs. Often exchanges will regularly consolidate these UTXOs to optimize their withdrawal costs & wallet management.

But OKX did not optimize the “consolidation” process. When you consolidate 100,000+ UTXOs as they did this past weekend, you have to do it over many blocks (and sometimes several days).

A meat space example would be akin to a bank calling the Brinks truck multiple times to swap out its coin drawers, instead of doing it all in one transaction. Paying the driver and security dozens of times adds up!

OKX appears to have run a program that sent out a batches of transactions a few thousand at a time, but each batch would re-estimate the fee rate based upon the current prevailing rate. But when you are the majority of transactions on the Bitcoin network (as OKX was for a while this weekend) you are effectively bidding against yourself. OKX could have spread out their transactions in a much more optimal way and saved at least a few million.

While OKX can stomach this expense, it’s a harbinger of what’s to-come and how many Bitcoin users, companies, are not prepared.

If Bitcoin were in a higher-fee regime (OKX started their consolidation at about 15 sats/vbyte and ran up to 500 sats/vbyte) this gets really expensive. That $17 million could quickly turn into $50 million.

Many Bitcoin users may face similar predicament if Bitcoin fees go higher. Imagine you are the dutiful Bitcoiner who only DCAs $50 every week and withdraws directly to self-custody. At 500 sats/vbyte, a Bitcoin transaction could cost nearly $30-40 depending on it’s type. That die-hard Bitcoiner who’s been DCAing $50 per week now finds that they now face a significant haircut on their Bitcoin stack.

As a point of reference, our internet analysis shows that around 7sats/vbyte it does not make economic sense to consolidate UTXOs around 500-600 sats, which is around the Segwit dust limit of 546sats. We’re already well above that with the current fee rate.

With fees heating up, these issues could become pretty dire for some users. Exchanges may have to start passing along Bitcoin withdrawal fees to users. Public mining companies may face scrutiny over their UTXO set in disclosures. Bitcoin DCA tools may need to aggressively educate users to avoid blowback.

Bitcoin’s success at generating a fee market would solve a lot of problems and create a few new ones. We’re just trying to stay ahead of the curve in identifying which ones those are.

🎙️ How Maximalism Dies with Dylan LeClair – link

Maximalism has peaked. Bitcoin is no longer dominated by a Bitcoin maximalist dogma, but is quickly welcoming a diverse crowd of degens, gamblers and token peddlers. Is this good for Bitcoin is the question of course!

🎙️Venture Investing In Bitcoin With Walt Smith - link

Walt Smith of Cyber Fund joins The Gwart Show, sharing his take on venture capital in the crypto–and specifically Bitcoin–space. He discusses the potential of Bitcoin rollups, the future of Ethereum, and the drama among crypto VCs. Walt also dives into the idea of merge mining as a scaling solution for Bitcoin and shares his thoughts on the end game of tokenization.

If you enjoyed read, reply “UTXO” to let us know you enjoyed the newsletter!