Brought to you by Lygos Finance

Happy Tuesday!

Operation Chokepoint 2.0 was a multi-year, informal, interagency operation that sought to debank the Bitcoin and crypto industry.

Long dismissed as a conspiracy because the operation was off-the-books, we now have clear evidence of the dates and directives that the Biden White House, Biden-era executive agencies, and the Federal Reserve issued in an effort to hamstring the industry.

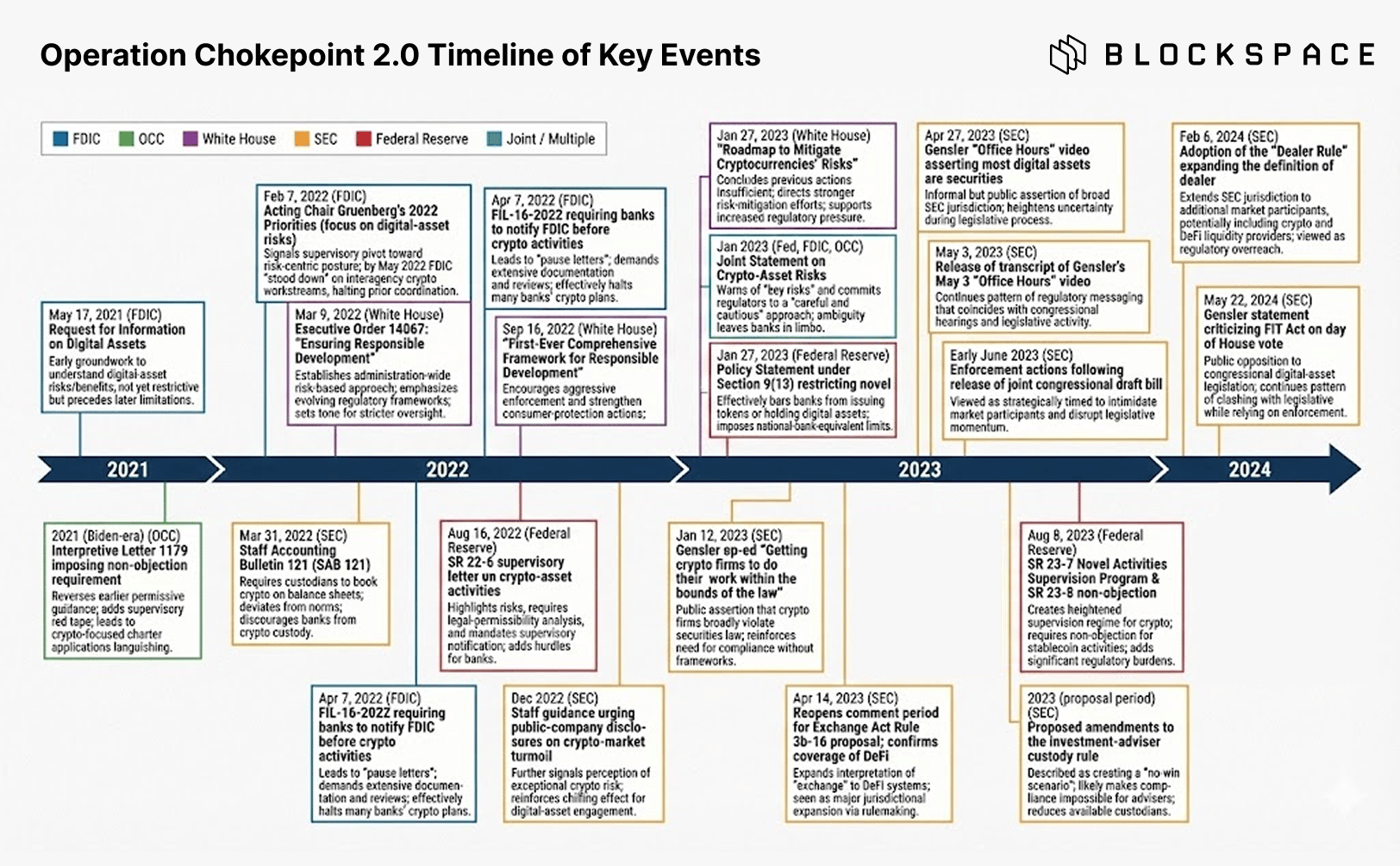

Thanks to a recent report from the House of Representatives, we have all the information on the table, so for today’s newsletter, we break down the timeline of key events.

Plus, new headlines, podcasts, and the usual miscellany!

Lygos: Bitcoin Credit, No Custodian Required

Unlock dollar liquidity without giving up your BTC. Lygos is a fully Bitcoin-native, non-custodial lending platform built on Discreet Log Contracts (DLCs).

• Hold your keys: BTC stays on layer 1 in your control. No wrapping, no bridging, no rehypothecation

• Rates as low as 10% APR

Operation Chokepoint 2.0: A complete timeline

Under President Biden, a specter haunted North America, a specter nobody could see except for those working at the intersection of Bitcoin and traditional finance.

Like a band of beleaguered Macbeths, haunted by solitary visions of Banquo, the bitcoin industry and its professionals labored under the shadow of Operation Chokepoint 2.0, an underhanded Biden-ear initiative with the explicit goal of debanking the crypto industry. Many outside the industry dismissed it as a conspiracy theory lacking evidence.

Well, it’s been a solid half decade for the conspiracy theorists, and it turns out they were right again on this one.

The U.S. House Committee on Financial Services provided the evidence last week in a report on its investigation into OCP 2.0.

A timeline of key events in Operation Chokepoint 2.0 | To read a breakdown of the timeline, click on the link below to read the full article

For the first time, the report concentrated in one place key dates, events, and actions taken by the Biden-era agencies, Biden’s White House, and the Federal Reserve. And it spells out exactly how these actions stonewalled the industry, creating impossible regulatory standards and compliance catch 22s that, in the worst of cases, fomented the failure of Silvergate, Signature, and Silicon Valley banks in 2023.

Operation Chokepoint 2.0 was never on the books, and there were only a few agency level actions that were ever publicized (often under the janus-faced rationale that they were “anti-money laundering” and “anti-terrorism” measures). The operation was informal, and those who carried it out relied on confidential supervisory letters, private memos, and off-the-record meetings between agencies and banks to achieve their goals.

Thanks to the House report, we now have receipts for what these undisclosed actions looked like, plus a timeline of key events.

2021: Operation Chokepoint 2.0 begins

President Biden and his agencies began laying the groundwork for Operation Chokepoint 2.0 in 2021. The biggest action President Biden took in his inaugural year involved complicating Trump-ear guidance that allowed banks, among other things, to hold crypto.

The actions in 2021 culminated, however, with probes by the FDIC into banks dealing with crypto clients. This “learn more” phase set the stage for more aggressive actions in following years.

Let us know if you’re enjoying Blockspace by replying to the newsletter! Reply ‘BITCOIN’ or ‘BLOCKSPACE’ to let us know!

MicroBT Unveils the Whatsminer M70 Series

MicroBT just revealed the new Whatsminer M70 lineup at the Bitcoin MENA Conference — featuring next-generation models across air-cooled, immersion, and hydro configurations.

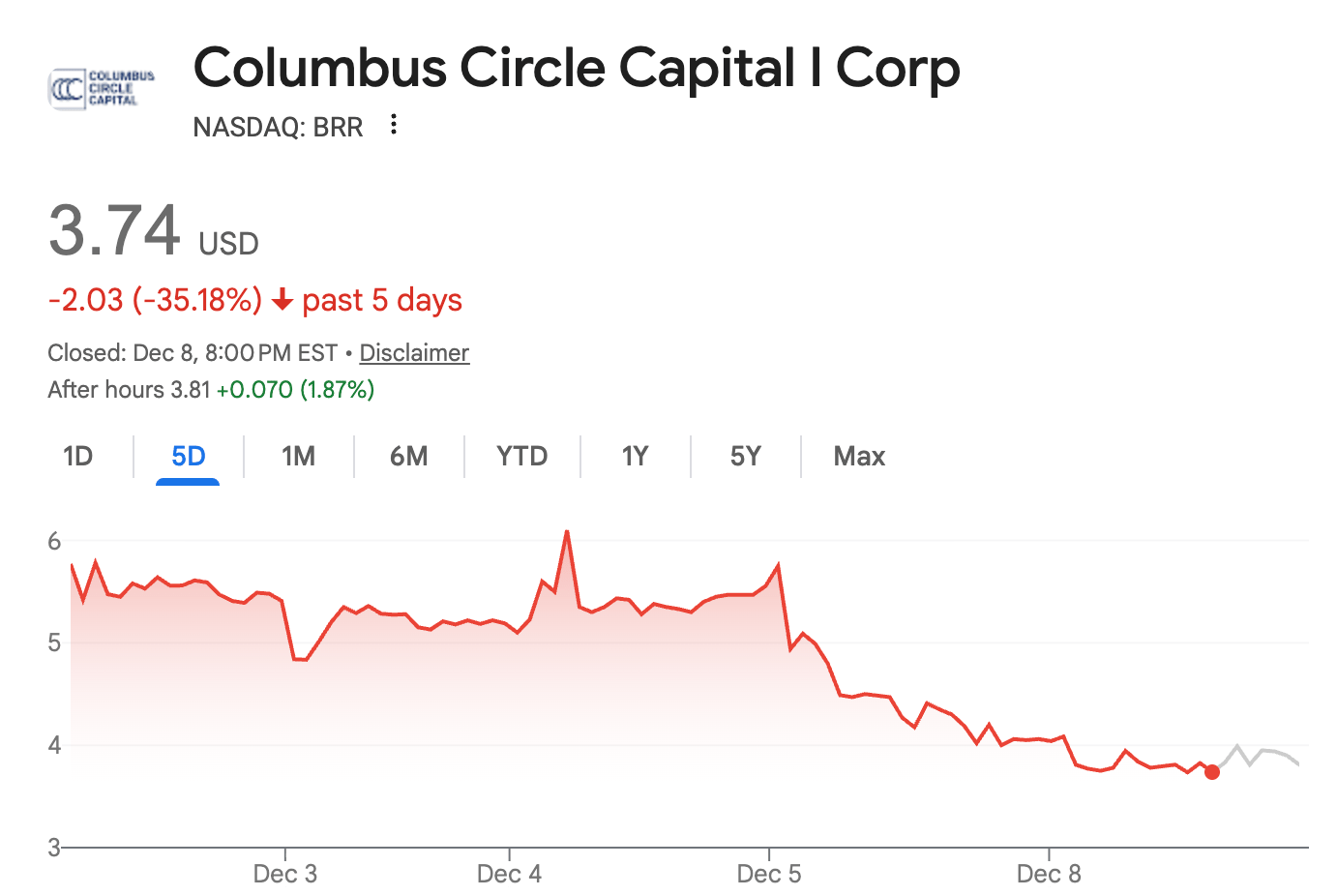

Chart of the Week

Pour one out for the bitcoin treasury investors we’ve lost along the way. Anthony Pompliano’s treasury company, ProCap BTC, has finalized its SPAC merger with Columbus Circle and is expected to begin trading as the combined company this week. The SPAC stock is down 35% WoW at the time of writing, as DAT doldrums continue to weigh on the sector as a whole.

Blockspace Headlines

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

Strategy acquires 10,624 bitcoin for $963 million through stock issuance

Strategy (NASDAQ: MSTR) acquired 10,624 bitcoin for approximately $962.7 million in cash between December 1 and December 7. - link

MicroBT launches M70 Whatsminer series with 12.5 J/TH efficiency at Abu Dhabi event

Bitcoin manufacturer MicroBT released its newest WhatsMiners unit series, Monday the M70, targeting 12.5 J/TH efficiency. The announcement came at the Bitcoin MENA 2025 conference in Abu Dhabi, United Arab Emirates. - link

Arkham announces Zcash onchain tracking

Arkham has now labeled more than half of the privacy chain Zcash’s shielded and unshielded transactions. This accounts for $420B of volume tagged to known individuals and institutions. - link

Blockspace Podcasts

On today’s Mining Pod, Kevin O'Leary, investor and Shark Tank star, joins us to talk about the intersection of Bitcoin mining and AI infrastructure. Kevin breaks down why he invested in newly-listed bitcoin miner and data center provider Bitzero and why the North American grid is all but tapped out. He also covers geopolitical AI chip strategies, the Genius Act and stablecoins, and why institutional capital will ignore altcoins while boosting BTC and ETH.

Did you know that the Obama administration oversaw Operation Chokepoint 2.0’s predecessor, Operation Chokepoint? The Obama-era mandate used similar tactics to debank payday lenders, ammunitions companies, and gun sellers.

-CMH