Happy Tuesday!

Russia is in the news today, but not for the usual reason.

The home of Dostoevsky and Nabokov, Mendeleev and Rachmaninoff is also home to one of Bitcoin’s largest mining industries.

In our latest report, we illuminate why bitcoin miners took root in the Motherland, the domestic and international political factors that are making their lives easier (or harder), and what Russia’s regional mining bans mean for the industry.

Since the outbreak of the Russia-Ukraine War in February 2022, Russia, Europe’s ice-hardened half-brother to the East, has been completely walled off from the West. The war and its knock-on effects have made Russia an agent of change, perhaps unwittingly at times, to the post-war global order.

That Russia is at the center of a tectonic shift in geopolitics won’t be surprising to most. But they may be surprised to learn that, in the shadows, Russia has been influential in another area that intersects with finance and politics.

In recent years, Russia has quietly asserted itself as one of the top bitcoin mining hubs in the world. And as we lay out in the following pages, a number of converging geopolitical factors nurtured Russia’s fledgling mining industry, including the U.S.’s new tariff policies, the war in Ukraine, and Western sanctions.

Russia is now one of the most consequential players on the map for Bitcoin mining, but language barriers and Russophobia in the West have made it difficult to source reliable information on the country’s bitcoin mining sector.

Blockspace commissioned this report by veteran Bitcoin and political reporter Anna Baydakova to provide a guidepost for the current state of Russia’s mining industry, including key players, relevant regulations, energy landscape, international business pipelines, and more.

With bitcoin mining out of the spotlight in the U.S. as AI/HPC takes center stage, it’s critical that companies to be aware of mining opportunities outside of the U.S.

Headlines by Blockspace

Want to get these headlines in real time? Join our Telegram group!

MARA reports $252 million in Q3 revenue, net income rises to $123 million

The company also announced a signed letter of intent with MPLX, a midstream oil and gas service, to supply an initial capacity of 400 megawatts (MW) of power for data campuses in West Texas. The agreement can scale to 1.5 GW, MARA said in a press release. - link

IREN signs Microsoft to $9.7 billion cloud compute deal, stock extends 21%

IREN Limited (NASDAQ: IREN) signed a five-year agreement with Microsoft for GPU cloud computing services valued at around $9.7 billion. Microsoft will receive access to NVIDIA GB300 GPUs managed by IREN, with the contract including a 20 percent prepayment. - link

Cipher Mining adds Amazon Web Services as data center client, announces 1 GW data center JV

Listed at $5.5 billion for a 15-year lease, AWS will host dedicated artificial intelligence workloads at Cipher’s Barber Lake facility. The lease covers 300 megawatts and will go live starting July 2026, with rent effective August 2026. Cipher will provide both air and liquid cooling to AWS. - link

Strategy Buys 397 Bitcoin For $47.5M, Sells $69.5M In Equity Offerings

Michael Saylor’s Strategy continues to buy Bitcoin on a two week clip, disclosing a 397 bitcoin purchase Monday morning. The company said it acquired the digital currency between Oct. 27 and Nov. 2 for $45.6 million, at an average price of $114,771 each. - link

Strive climbs 9% on announcement of IPO for Variable Rate Preferred Stock

Digital Asset Treasury (DAT) firm Strive (Nasdaq: ASST) is following the Strategy playbook, now issuing its own variable rate preferred stocks. The company will sell 1.25 million shares of Variable Rate Series A Perpetual Preferred Stock, or “SATA,” in an initial public offering subject to market conditions. - link

Cango Reports October Bitcoin Production, Reaches 6,400 BTC Holdings

Bitmain-affiliate Bitcoin miner Cango (NYSE: CANG) produced 602.6 bitcoins in October, down 2.3% from 616.6 in September. The company held 6,412.6 bitcoins at month-end, up about 10% from 5,810 a month earlier. Average daily output was 19.44 bitcoins, compared with 20.55 in September.- link

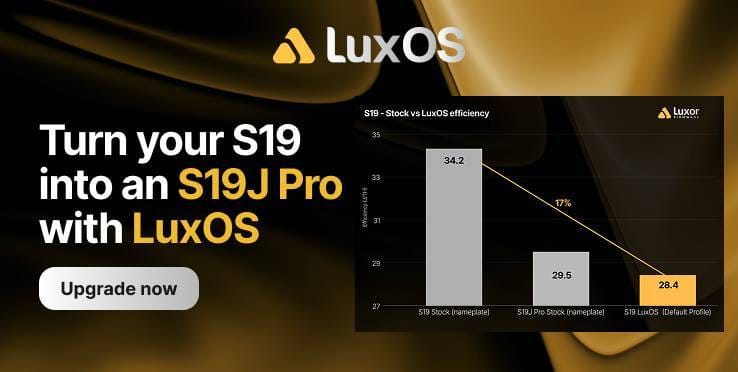

LuxOS: Turn Your S19 Into an S19J Pro

Your S19 can outperform a stock S19J Pro with LuxOS firmware — up to 23% better efficiency and lower energy costs.

Blockspace Podcasts

On the latest Mining Pod, Kevin Dede, Managing Director at H.C. Wainwright, joins us to give a pulse check on the bitcoin miners pivoting to AI. We cover the latest deals from IREN, Cipher, Terawulf, and others, and pick apart whether the neocloud or powershell business model is the best fit for bitcoin miners. Plus, what the CoreWeave-Core Scientific deal’s failure means for the AI-miner market as a whole, why bitcoin mining won’t die easily in the U.S., and why Dede thinks the AI-miners are just getting geared up.

Where we drop fun topics with nothing to do with Bitcoin.

On this day in 1918, the Allied armistices with Austria-Hungary, signed the day before, comes into effect. Germany would surrender a week later when it signed its own armistices, officially bringing an end to the nearly 4 and a half year conflict, the bloodiest the World has ever seen, leaving an estimated 15 to 22 million civilians and soldiers dead.

-CMH