5 April 2024 · Block Height 837800 · Bitcoin Price $67K

Welcome back to the Blockspace Newsletter!

Quick plug for our new Blockspace Original, The Big Empty! Watch it by clicking the link below. Otherwise, we have a Bitcoin MEV piece from a guest author that you won’t want to miss!

Quick Hits

Poolin sells 100MW Texas site for $49 million

Robin Linus releases proposal for BitVM2

Braiins and other pools are adding their own BitMaps into blocks.

Casey Rodarmor announces the first hardcoded Runes ticker, UNCOMMON GOODS

TSMC says chip production not affected

Franklin Templeton notes increased Bitcoin NFT volumes

Want to get the news in podcast form? Listen to our news roundup on the Blockspace Podcast Network. Subscribe to get all our shows in one location.

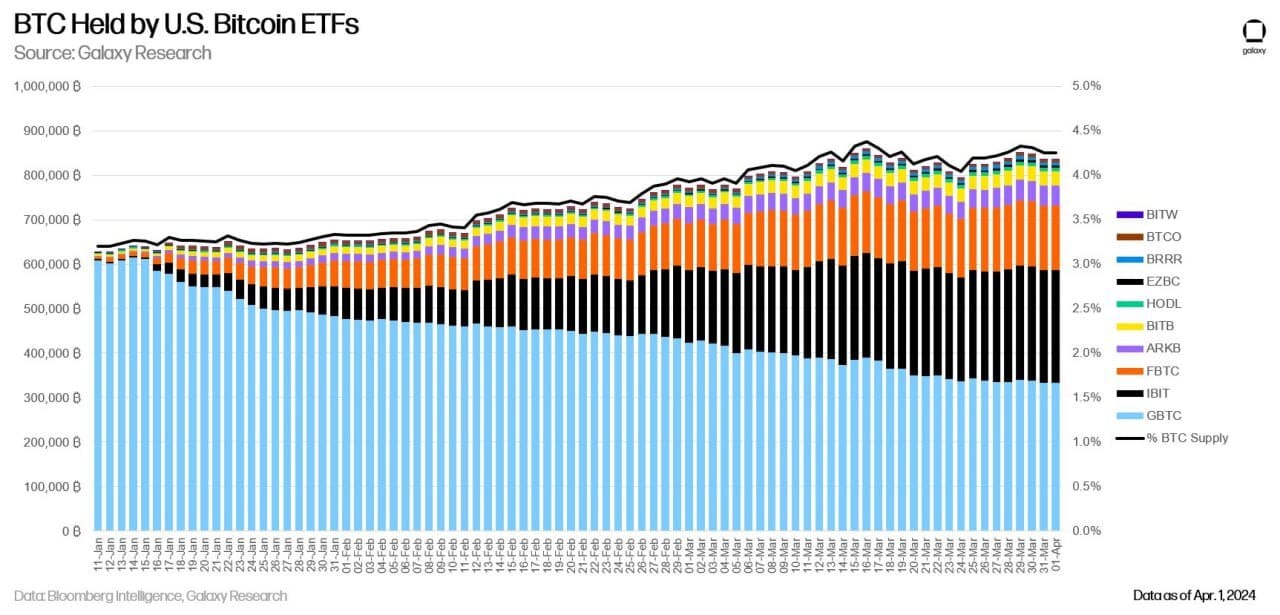

Chart of the Week

Bitcoin ETFs now hold 4.5% of Bitcoin’s supply, per Galaxy Research.

MEV on Bitcoin today

Below is an excerpt from Cyber Fund’s ‘The Spectre of MEV on Bitcoin,’ one of the best peices written on Bitcoin mining dynamics this year.

While not as rich as Ethereum’s MEV market, Bitcoin hosts several forms of MEV today.

I. Replace-By-Fee (RBF): typically Bitcoin inclusion is done on a first seen basis. RBF lets users update fees to push transactions through faster. A large chunk of hashrate already does full RBF, obviating standard norms for ordering to earn greater revenue. This adoption enables more sophisticated MEV strategies.

II. Lightning Watch Tower Attacks: Lighting channels have a maximum capacity of transactions they can resolve at any time, meaning a node can be flooded and looted. By colluding with a miner, one party can grief another, capturing fees. Dust UTXOs can also be closed by anyone, leaving additional fees for miners to compete over.

III. Sniping Sidechain Auctions: the Stacks sidechain auctions off fees and the right to mine its blocks by having Bitcoin miners send BTC to sidechain stakers. Along with mining pools, auctions have driven monopolization, reorgs, and censorship. The upcoming “Nakamoto Release” aims to be a fix, but it's unclear that it will obviate all MEV.

IV. Front-Running Ordinal Mints: partially signed (open) UTXOs are used to mint and exchange Ordinals, making them prone to sniping. Whitelisted mints can be bypassed by miners in the mempool. BRC-20 mints are prone to similar sniping and can drive reorgs. Tooling will eventually automate sniping, pushing users to offchain solutions.

V. Feather Forks: honest miners build on any valid block, but malicious miners can create Feather Forks (Block Discouragement) by refusing to build on specific ones. With about 33% of hashrate blacklisting blocks, fees for censored transactions rise considerably. Profits from this censorship MEV can exceed forgone revenue.

VI. Empty Blocks, Full Mempool: miners sometimes leave blocks empty, collecting issuance without including UTXOs from the mempool. This occurs due to the race conditions miners face to contribute a valid block, but it can also occur as a form of censorship MEV (Ocean Pool enlists a similar style of MEV). Related to VII, this occurs most often when miners get to pre-verify block templates other miners are hashing.

VII. Miner Cartelization: pooled mining enables savvy multi-block MEV by raising the odds of winning consecutive blocks, creating systemic risk. Pools and other mining cartels have enforced common block templates by absuing pooling economics, blacklisting smaller miners practicing nonstandard block building. Consistent surplus fees plus economies of scale induces consolidation, birthing a pathological loop.

Continue reading by clicking here.

Links we liked

Blockspace Podcasts

🎙️ The Mining Pod: Hashrate Futures With Matt Williams

(YouTube) Matt Williams of Luxor Tech joins the podcast to discuss hashrate futures, a new trading product that allows miners to forecast and act on the future price of hashrate. We discuss the product, similar Bitcoin futures products on the CME and how mining pool games with Ordinals could alter the equation.

🎙️Bitcoin Season 2: Hacking The Ordinals Ecosystem

(YouTube) Gwart continues in his journey to find the real meaning o decentralization, this time with Anatoly of Solana. In this two hour show, Gwart and Anatoly go through rollup roadmaps, Solana’s commitment to monolithic architecture and, of course, Bitcoin.

Thanks for reading! If you enjoyed, help us out by forwarding to a colleague.