Loving Blockspace? Reply with your favorite read from this week!

Had enough? Unsubscribe here.

Presented by

Fractal Bitcoin

The good news: 401(k) plans are cleared for bitcoin exposure (thank you, Mr. President, very cool!)

The bad news: crypto privacy tools and developer rights took a massive L this week with the US v. Roman Storm case, just a week after they took a similarly larger L in the Samourai Wallet case.

Those two stories (and more) in today’s newsletter.

Fractal: Scale Bitcoin + Boost Miner Revenue.

Is Bitcoin’s most active scaling solution already here?

Fractal’s rapid hashrate growth and transaction growth suggest it might be.

A new report by Blockspace Media breaks down Fractal Bitcoin, the chain that’s quietly achieved:

🔸 ~80%+ of Bitcoin’s hashrate via merged mining

🔸 11 M+ daily transactions (comparable to Solana & Base)

Powered by Cadence Mining, a novel hybrid block production model, and seamless onboarding via UniSat, Fractal is emerging as Bitcoin’s most used innovation layer.

Trump greenlights bitcoin in 401(k)s, unlocking trillions in potential capital

President Trump signed an executive order allowing Americans to allocate 401(k) retirement funds into Bitcoin and other digital assets. The president’s order directs the Labor Department and other agencies to redefine what would be considered a “qualified asset” under 401(k) retirement rules. — link

OUR TAKE: Trump is unshackling the $7.5 trillion 401k system for tax-deferred capital gains exposure to digital assets. The move enables millions of Americans to gain Bitcoin exposure through employer-sponsored plans, bypassing the current barriers imposed by fiduciary rules and federal regulators.

Basically, this supercharges ETFs.

Trump’s executive order rewrites the definition of a “qualified asset” under ERISA (the Employee Retirement Income Security Act of 1974).

It extends to alternative assets beyond just crypto such as private equity and real estate. After Trump’s order, it doesn’t seem difficult to imagine in the near future we will see real Baby Boomer portfolios that are 20% BTC, 30% real estate, 50% Private Equity. Bitcoin ETFs have already seen the most successful launch of any ETF class ever, and this sets them up to continue that run.

It also opens up a Pandora’s Box of new products that financial advisors, VCs, and others can sell to their clients. Many American workers’ retirements currently rely on limited mutual fund menus curated by HR teams and plan administrators.

This change could expand that menu, adding new asset classes like Bitcoin, crypto funds, or even private equity. I can totally imagine new bundled tokens products where disclosing risk and volatility is not only challenging but also indiscernible to most investors. On the other hand, the maxi in me says that the market will eventually learn to keep it simple with BTC. Everyone has to learn on their own “Hodler’s Journey.”

Boomers will soon have a new motto: “stay humble and stack $IBIT.”

-CBS

Roman Storm found guilty for operating an unlicensed money transmitter business

On Wednesday, Tornado Cash co-founder Roman Storm was convicted on one count of conspiracy to operate an unlicensed money transmitter business, but the jury could not reach a decision on charges of money laundering and sanctions violations. - link

OUR TAKE: It’s a bad week for privacy, and an even worse week for open-source developers.

Tornado Cash was a privacy-focused wallet that allowed users to “mix” (anonymize) ether and Ethereum tokens. The wallet was sanctioned in August 2022, and the Department of Justice swiftly charged Storm with conspiracy to operate an unlicensed money transmitter business, money laundering, and violating U.S. sanctions.

Developer rights are at the heart of this case, specifically whether or not open-source software developers can create cryptocurrency software without A) being seen as a fiduciary and B) without being held responsible for how people use this software.

Storm lost out on point A, despite the fact that Tornado Cash – like every other noncustodial wallet – never took position of user funds during the mixing process. Storm’s defense even referenced 2019 guidance from FinCEN that explicitly states that “[a]n anonymizing software provider is not a money transmitter” (!!!).

The jury was obviously not convinced. Nor was the presiding judge, who said that the nuances of custody aren’t “important” to the case.

The one silver lining is that the jury couldn’t reasonably convict Storm of money laundering, because he never actually interacted with criminals who used Tornado Cash for illicit activity (wow that’s crazy, it’s almost like he never handled their money to begin with…).

That silver lining kinda turns to tin, though, when you think about the precedent this ruling sets. Software developers creating non-custodial cryptocurrency wallets can now be legally seen as money transmitters based on this ruling, a ruling that is reinforced by the fact that Samourai Wallet’s co-founders took a plea deal for essentially the exact same charges last week.

These rulings put privacy, self custody, and developer rights under the barrel of a gavel-shaped gun. Luckily, Storm can still appeal the ruling, but for now, the damage might be done. Developers might think twice before they publish open-source code lest they bite the bullet.

-CMH

LuxOS Demo: From Setup to Tuning

Watch a full walkthrough of LuxOS — including install, presets, ATM, and real-time tools to boost ASIC performance and uptime.

In the News

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

Breaking down Metaplanet’s play-by-play imitation of Strategy

The Strategy (formerly MicroStrategy) bitcoin playbook is “buy and hold bitcoin.” But how a company raises money to buy that bitcoin is more complicated. Metaplanet was the second publicly traded company to really hop on the bitcoin treasury bandwagon, and throughout 2024 and 2025, it relied on a series of capital markets activities that were remarkably similar to Strategy’s own. We break down how it works - link

Bitcoin developer sends transaction with 10,000 OP_RETURNs

Bitcoin developer stutxo broadcasted a transaction with over 10,000 OP_RETURNs as part of his work on the Labitbu NFT project, the most OP_RETURNs ever. The Labitbu project is a new metaprotocol putting NFTs on Bitcoin and the transaction that stutxo sent recorded the first 10,000 NFTs using this protocol. - link

Elon Musk retweets Coinbase’s “Bitcoin Wizard”

Yes, this is a news story because Elon affects crypto markets. Elon is back at it again, this time retweeting a post from Coinbase featuring the classic “Bitcoin Wizard.” Related memecoins such as “Magic Internet Money” soared as much as 70% within minutes. - link

Bitcoin P2P network monitoring tool launched

Bitcoin developer 0xB10c published “peer-observer,” a tool for monitoring anomalies and attacks to Bitcoin’s P2P network. The developer calls to attention the surprising lack of scrutiny on this potential attack vector. “I could use a few helping hands,” said 0xB10c. “What happens when I’m asleep or on vacation?” - link

Chart of the Week

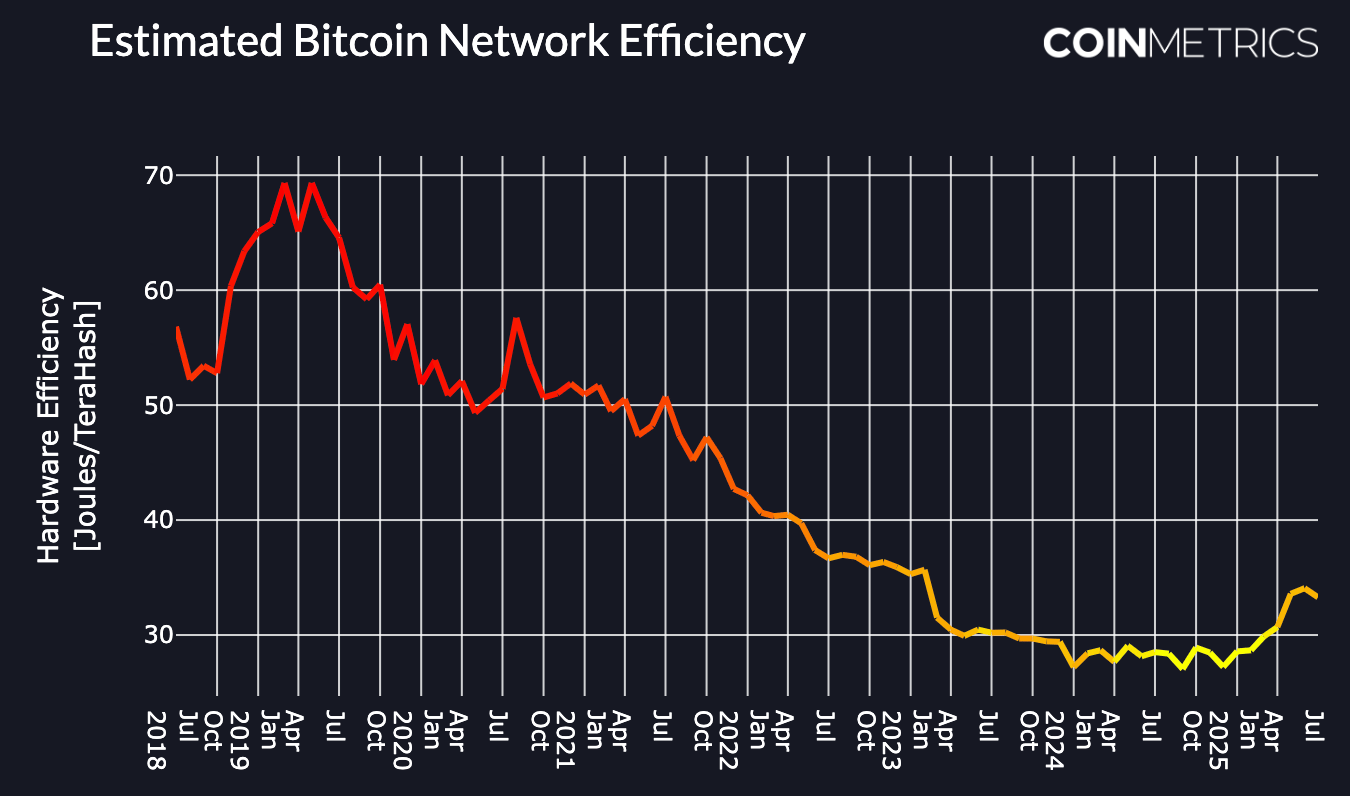

The 19j bros are BACK. According to CoinMetric’s MINEMATCH — a dataset that uses nonce patterns from bitcoin miners to estimate the Bitcoin network’s makeup of active ASICs and their average efficiency — the average estimated efficiency of the Bitcoin network was 33.28 J/TH in July and 34.07 J/TH in June, up from the all-time low of 27.04 J/TH in September 2024. With bitcoin’s price hovering near all-time highs, older, less efficient bitcoin miners are coming online as profitability has improved.

Blockspace Podcasts

For this week’s news roundup, Will, Colin, and Matt touch on Bitcoin’s hashrate hitting an all-time high of 972 EH/s, Trump's proposed 100% semiconductor tariffs, false Chinabitcoin mining ban rumors, MicroStrategy's 2.5x NAV share issuance rule, and tracking down a $3.5B mining pool heist (now worth $14.5B!) four years later.

On August 9, 1987 (so on this day tomorrow — bite me!), Seattle grunge band Nirvana performed at the Community World Theater in Tacoma, WA — but under a completely different name. The date is often credited as being the first time the band performed under the name Nirvana, but this isn’t true. The band played the August 9, 1987 gig under the name Bliss (Nirvana performed under a motley of monikers in the early days, including Skid Row, Pen Cap Chew, Ted Ed Fred, and — my favorite — ??). The band would return to the Community World Theatre on March 19, 1988 under the soon-to-be-famous brand, Nirvana, for the first time.

-CMH & CBS