Presented by

Fractal Bitcoin

We’re being filtered!

Please respond to this email with ‘HODL’ or ‘Bitcoin’ to tell your email server you’re enjoying the newsletter.

Tired of Bitcoin content? Click here to unsubscribe.

This week, the most important crypto-related bill ever surfaced from Congress, one that could protect developers from government overreach. Also, Robinhood is pushing for tokenization of real world assets — and why this is either bullish or bullshit.

Plus, Magic Eden’s Spark partnership, Texas is one step away from a SBR, and Lightning’s biggest wallet is coming back to the land of the free.

It’s about an 8 minute read. But before we dig in…

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

House Representatives introduce bill to shield crypto developers, services from banking regulation

Rep. Tom Emmer (R-MN) and Rep. Ritchie Torres (D-NY) introduced the Blockchain Regulatory Certainty Act this week. The bill would prevent regulators or other officials from classifying blockchain developers and blockchain services as money transmitters or financial institutions.

From the bill: “No blockchain developer or provider of a blockchain service shall be treated as a money transmitter or as engaging in “money transmitting”, a financial institution, any other State or Federal legal designation requiring licensing or registration, or triggering liability for unlicensed or unregistered conduct, unless the developer or provider has, in the regular course of business, control over digital assets to which a user is entitled under the blockchain service or the software created, maintained, or disseminated by the blockchain developer or provide.” – link

OUR TAKE: This is the most important crypto-focused bill to ever surface in the United States. Yes, even more than Senator Lummis’ strategic bitcoin reserve bill.

It would enshrine in law what most of us already know: that bitcoin/crypto developers and service providers who operate wallets and other applications are not money transmitters or banks, because they never custody funds. This may be fundamentally true, but Big Brother doesn’t always care about fundamentals as we’ve already seen.

Case in point, Sen. Elizabeth Warren (D-MA) introduced a perfect foil to this bill in 2022 with the Digital Asset Anti-Money Laundering Act. Money laundering – oh dear! We don’t want that. Indeed, the bill’s name and framing belied its actual substance. The “anti-money laundering” slant was a convenient wolf-in-sheep’s-clothing effort to distract from the real point of the bill, which attempted to classify non-custodial wallet providers, bitcoin miners, and even validators and node operators (among others) as money transmitter businesses. The bill failed, but it was one of the most hostile legislative attempts yet to yoke the crypto industry with burdensome, completely baseless oversight that would have been a death knell not only for the U.S.’s crypto developer community and mining industry, but also to the right to self custody and run a bitcoin node in the land of the brave.

And let’s not forget that the ongoing case from the U.S. DOJ against the developers of the privacy-focused Samourai Wallet hinges on the same overreach, whereby the DOJ charged Samourai Wallet’s team with money laundering and operating without a money transmitter license. All of this, again, despite the fact that Samourai Wallet never custodies funds, neither for simple storage nor when users utilize the wallet’s coinjoin function to enhance their privacy.

Both Warren’s bill and the Samourai case are direct attacks on self-custody, not to mention developer rights to write code. The Blockchain Regulatory Certainty Act could prevent the government from similar future abuses of power.

-CMH

Robinhood submits Real-World Asset tokenization proposal to SEC

Robinhood submitted a 9-page letter to the SEC outlining a vision for a federal regulatory framework for on-chain Real‑World Asset (RWA) tokenization. The letter advocates for treating blockchain-based tokens as legally equivalent to their underlying assets and calls for a unified federal regulatory framework tailored to blockchain assets. – link

OUR TAKE: Wall Street wants to revamp legacy rails with crypto gloss. They want to tokenize tradfi – not necessarily replace it. It is not clear to me whether this is a natural industry evolution or just this cycle’s collective delusion (just bigger). I’ll play a bit of both sides here:

RWAs allow 24/7 trading, better liquidity, and are generally more inclusive. Tokens facilitate around-the-clock trading, improved price discovery, and fractionalize access to traditionally illiquid assets, broadening market participation. We see this empirically with Bitcoin – Bitcoin markets are consistently more efficient as they respond quicker to macro events and weather higher volatility more effectively. Bitcoin is also significantly more accessible to people around the world. Perhaps RWAs could enjoy similar features if they were tokenized.

Programmability and transparency are a game changer for tradfi, especially on a global scale. Smart contracts can automate compliance (e.g. KYC/AML, transfer restrictions), corporate actions, and voting while providing immutable audit trails. Crypto has always been about cutting out the middleman, and RWAs could provide this. But are we just swapping out legacy middlemen for a new set of permissions?

Counterpoint: it is still unclear to me whether blockchains should be designed to accommodate assets other than the chain’s native token. This debate is as old as Bitcoin itself and it is far from resolved. Overweighting assets issued on a chain could compromise chain security or create unsustainable, toxic incentives. Or it might not – this is something that we’re going to have to let the market determine in the years to come.

One thing is for sure: Tokenizing everything is finally coming, and it will be brought to you by Wall Street.

-CBS

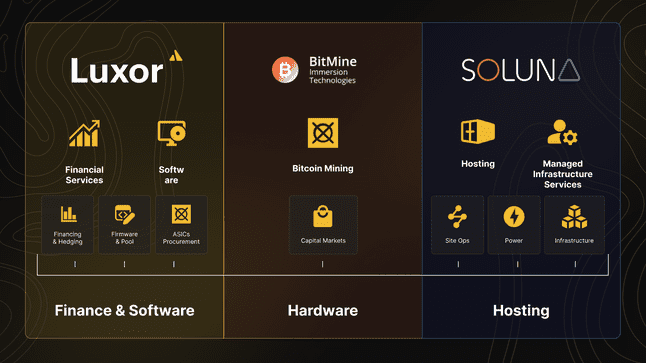

3x the Hashrate, Zero Guesswork

BitMine scaled seamlessly with Luxor & Soluna’s turnkey mining model — from procurement to firmware to renewable power. Grow your hashrate output with one unified solution.

MagicEden announces Spark partnership

Magic Eden is integrating with Spark (by Lightspark) to launch fast, low-cost native Bitcoin settlements. Initially, the collaboration will support stablecoin-to-BTC swaps, with plans to expand into broader on-chain Bitcoin DeFi experiences and developer tools. Spark is a statechain-based Bitcoin L2.

Texas Approves State-Backed Bitcoin Reserve, Awaiting Governor's Signature

The Texas House has passed SB 21, a bill establishing a state-managed bitcoin reserve, with a 101–42 vote. If Gov. Greg Abbott signs it into law, Texas will become the third U.S. state to hold bitcoin as a treasury asset (or at least have the legal clearing to do so), following New Hampshire and Arizona. The bill would allow the state’s Comptroller of the Currency to allocate a portion of the state’s treasury into any cryptoasset above a $500 billion market cap (currently only bitcoin).

Wallet of Satoshi is coming back to the United States

Wallet of Satoshi, the most popular Lightning wallet, is returning to the United States after its team abruptly pulled it from the market in 2023. Several lightning wallet providers such as Phoenix have also returned, saying that regulatory clarity lends them confidence to resume service in America.

Blockspace Podcasts

We’re giving away a Bitaxe! Just reply ‘Bitaxe’ to the newsletter to be considered!

-CMH, CBS