Happy Friday!

Uncle Sam and John Bull are at it again: this week, officials from the U.S./UK apprehend several individuals linked to an international crypto pig butchering scam and human trafficking ring, seizing more than $14 billion worth of bitcoin in the process.

Plus, why Bitdeer’s September production update frames the miner as one of the few companies looking for straight As in mining and AI.

U.S. and U.K. seize +$14B in bitcoin from international scam syndicate

In a landmark joint operation, the DOJ and U.K. authorities seized roughly $14 billion in Bitcoin from Chen Zhi and accomplices accused of running massive online investment scams linked to forced labor and trafficking in Southeast Asia. It marks one of the largest crypto seizures in history, rivaling the Silk Road and Bitfinex in scale. - link

OUR TAKE: That’s $14 billion and counting.

It was already the largest known seizure to-date, but according to our friends over at Arkham, it looks like it’s getting bigger.

Another $2.4 billion moved from associated wallets days after the seizure was announced.

But the interesting thing is that these bitcoin weren’t in wallets that were sanctioned or mentioned in the initial $14 billion seizure prior.

That could indicate there’s more seizures to be announced. Or… if you’re inclined to conspiracy you could speculate that there’s funny business happening (Was an insider spooked? Seizure that’s not above-board?)

At this time it’s not technically clear who gets the over $14 billion in BTC. This was a US-led investigation by the Department of Justice, so it would stand to reason that this goes into U.S. coffers.

Trump’s Strategic Bitcoin Stockpile executive order clearly includes seized assets and dictates that the government won’t sell those BTC, so if these 127,271 BTC go to the US, then that could bring the U.S.’s total bitcoin holdings to over 300,000. (It’s not clear how much BTC the U.S. government holds currently, but most sources put the number at close to 200,000).

That’s still only half as many BTC as Michael Saylor, but the USA is catching up fast.

-CBS

Bitdeer posts strong numbers in September, unveils $2B AI ambitions

Bitdeer, one of the largest public bitcoin miners by both market cap and hashrate installed, published its September operations update this week. In addition to mining 20% more bitcoin last month than August, Bitdeer also announced that it expects to have a 200 MW data center for HPC load online by the end of 2026 with an expected annual recurring revenue of $2 billion. - link

OUR TAKE: While some miners are deciding between AI/HPC and bitcoin mining, Bitdeer says “hold my beer.”

The company increased its hashrate by 17% last month, which on its own is worth an attaboy. But even more impressive, all of the new machines came in-house from Bitdeer’s SEALMINER ASIC series.

Bitdeer has popped out 34.2 EH/s of the SEALMINER A2 model, keeping 28.1 EH/s for its own operations and selling the rest.

The SEALMINER makes Bitdeer arguably the most vertically integrated public bitcoin miner, and this hardware business both reduces the company’s cost and time to market for deploying hashrate and it gives Bitdeer the option to sell into the market when they don’t have free capacity for expansion.

This alone gives Bitdeer a killer mining model. But the company is also eying AI like its peers, and it claims to have a 200 MW AI data center in Asia planned to come online by the end of 2026.

Bitdeer forecasts that the data center could generate $2 billion ARR which would make it one of the most valuable bitcoin miner AI deals.

But we also don’t know if Bitdeer actually has tenant lined up for this space yet, since they didn’t name any partners in the update.

Whether the AI bit is hopium or the real deal, either way, investors like what they see — Bitdeer is up 22% week-over-week.

-CMH

Like these stories? Reply BITCOIN to let us know!

8-14% More Profit: The Intelligent Bitcoin Miner Guide

Intelligent Mining dynamically adjusts to real-time hashrate and power markets—outperforming traditional binary operations. This 42-page guide shows you exactly how to transition.

In the News

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

Nscale secures 200,000 GB300 GPUs contract with Microsoft, 240 MW lease with Ionic Digital

AI infrastructure firm Nscale struck a $14 billion-scale agreement to supply around 200,000 Nvidia GB300 GPUs to Microsoft across its global data centers. The centerpiece is a 240 MW Texas campus leased from Ionic Digital, slated to host 104,000 GPUs beginning in 2026. The site has headroom to grow to 1.2GW over time. - link

AI hedge fund Situational Awareness ups stake in Core Scientific to 9.4% as CoreWeave note nears

Leopold Aschenbrenner’s Situational Awareness has quietly built a 9.4 % position in Core Scientific just weeks before shareholders vote on a proposed merger with CoreWeave. Leopold has risen as an AI-hedgefund wunderkind, likely the youngest self-made billionaire ever. - link

Bitcoin miner MARA quietly removes CTO Ashu Swami from executive team

Bitcoin miner MARA Holdings (NASDAQ: MARA) has removed its Chief Technology Officer Ashu Swami from its management team page. Snapshots from the Internet Archives’s Wayback Machine show MARA listed Swami in the role as recently as September 19, 2025. - link

PayPal accidentally mints $300 trillion of its stablecoin (then burns it)

In a “technical error,” Paxos (PayPal’s stablecoin partner) briefly over-minted $300 trillion of the PYUSD stablecoins before burning the excess. PYUSD briefly dipped 0.5% but the dollar peg held. - link

Chart of the Week

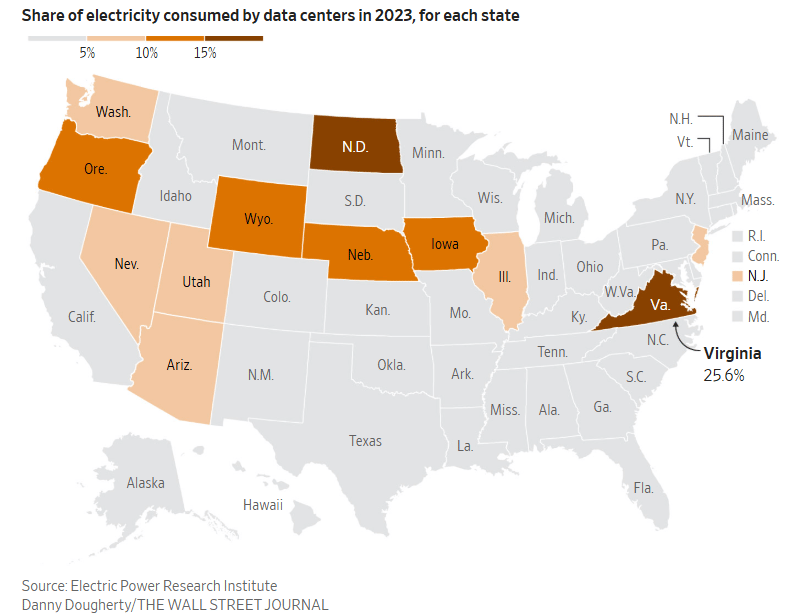

We’ve got a two-for today for chart(s) of the week. Per the Wall Street Journal, the U.S.’s 522 hyperscaler data centers accounted for 55% of global hyperscalers at the end of Q2, with another 280 planned in the U.S. through 2028.

Source: WSJ

And here’s an insane stat: Texas has the largest concentration of data centers in the U.S. by MW, but not by percentage of grid capacity. Texas data centers consumer less than 5% of the state’s energy.

Source: WSJ

Blockspace Podcasts

For this week’s Mining Pod news roundup, Luxor CEO Nick Hansen joins us to talk multi-month hashprice lows (how low do we go?), MARA firing its CTO, Ionic Digital’s Microsoft-linked AI deal, Bitdeer’s gangbusters September and $2B AI plans, and BlackRock taking the lead on a $40B data center company acquisition. Plus, the US government seizes $14.1B (potentially $16.5B total) in bitcoin from an international scam operation.

On this day in 1814, a 22-foot tall vat of porter bursts in the Meux & Co Horseshoe Brewery in London. The rupture dislodges valves on other vats, releasing as much as 323,000 gallons of beer into the streets on London in what would become known as the 1814 London Beer Flood, killing 8 people.

-CMH & CBS