Brought to you by Lygos Finance

Happy Tuesday!

As the filter feud rages on, we finally got a release client in-hand to review for BIP 110, a softfork that would create a consensus mechanism to scrub arbitrary data on bitcoin such as inscriptions.

Up until now, the filter softfork has seen a lot of mudslinging with little actual code in the wild. Now, we actually have some code to apply to the proposal.

…and Bitcoin developers are tearing it apart.

If you still care about the filter debate but took a few weeks break, this newsletter will get you up to speed.

(Plus, all the usual goodies, from headlines to a fun fact about China’s famous Sichuan cuisine).

Lygos: Bitcoin Credit, No Custodian Required

Unlock dollar liquidity without giving up your BTC. Lygos is a fully Bitcoin-native, non-custodial lending platform built on Discreet Log Contracts (DLCs).

• Hold your keys: BTC stays on layer 1 in your control. No wrapping, no bridging, no rehypothecation

• Rates as low as 10% APR

Bitcoin developers poke holes in BIP 110 client

Last week, pseudonymous Bitcoin developer Dathon–one of the few developers in Luke Dashjr’s camp against Bitcoin ‘spam’–finally dropped the activation client for BIP 110 (previously BIP-444), a softfork update that would create a consensus mechanism to scrub arbitrary data on Bitcoin such as inscriptions.

It’s a fork of Luke Dashjr’s Bitcoin Knots client, which is itself a fork of Bitcoin Core, and implements a User Activated Soft Fork mechanism where the users reject blocks from miners who have not updated to the new client (in contrast to a Miner Activated Soft Fork, where the miners reject invalid blocks).

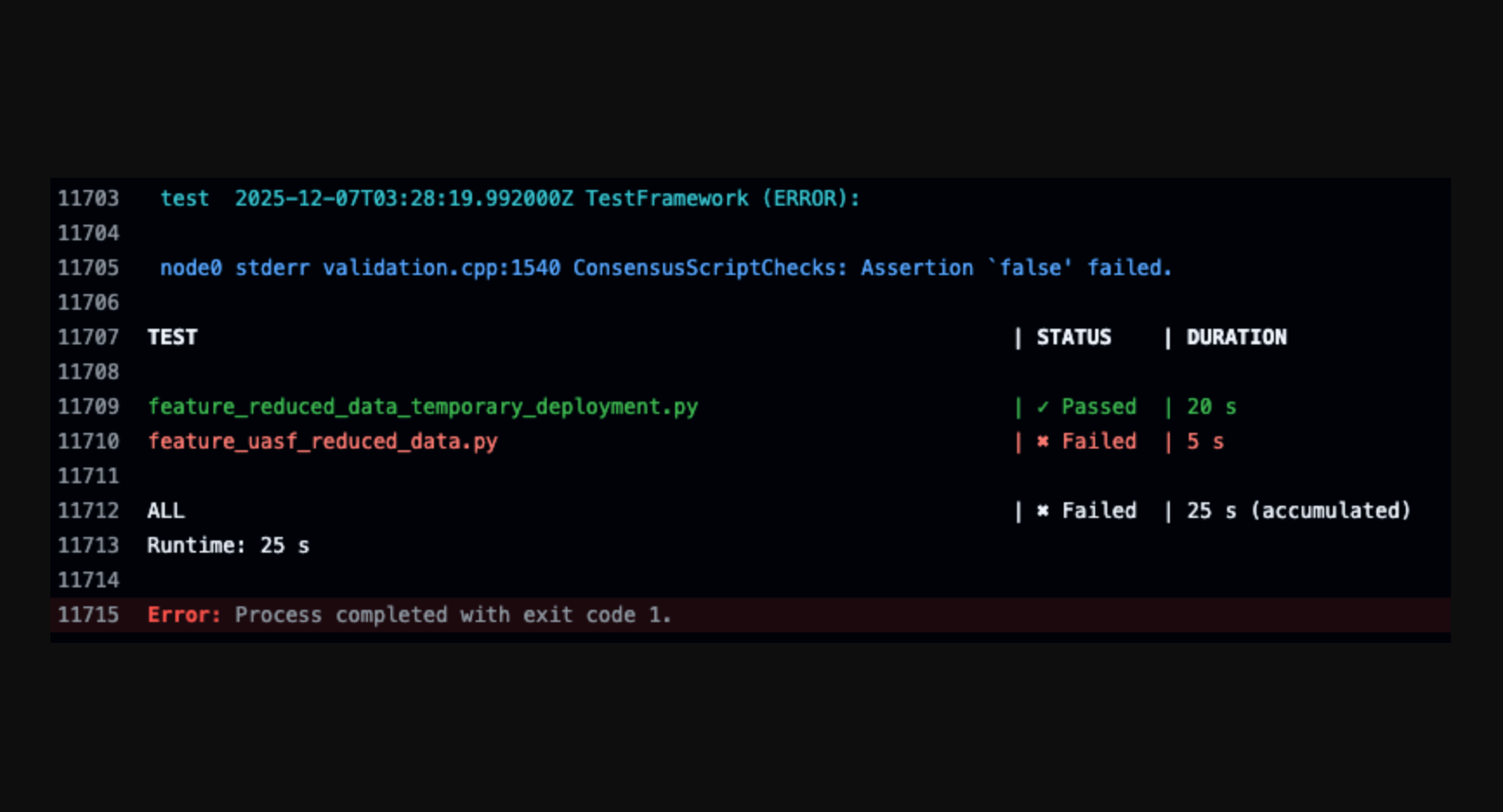

The feedback on the activation client was… overwhelmingly negative.

Basically, BIP-110 is rife with bugs to a degree that it calls into question the technical capabilities of the author, Dathon, to sufficiently spearhead development of an activation client.

Let us know if you’re enjoying Blockspace by replying to the newsletter! Reply ‘BITCOIN’ or ‘BLOCKSPACE’ to let us know!

Year-End Tax Planning for Bitcoin Miners

Hashrate Index and The Network Firm break down bonus depreciation, year-end purchase timing, and tax-efficient scaling strategies for miners.

Tweet of the Week

Here’s a little dose of hopium for those of you stuck to bitcoin’s price chart like glue. Per River Financial research, 14 of 25 top banks in the U.S. now offer (or will soon offer) bitcoin products to their clients.

Blockspace Headlines

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

China BTC miners shut down roughly 1.3 GW in Xinjiang amid CCP scrutiny

Bitcoin miners in China’s Xinjiang province are closing shop amid government scrutiny, taking as much as 100 EH/s of mining equipment offline, approximately 400,000-500,000 ASICs worth as much as 2 GW of power. - link

Strategy buys 10,645 bitcoin for $980 million as total holdings top 671,000

Strategy (NASDAQ: MSTR) purchased 10,645 bitcoin during the week ending December 14, 2025 for approximately $980.3 million, bringing Strategy’s total treasury holdings to 671,268 bitcoin. - link

President Trump says he’ll “look at” Samourai Wallet developer case to weigh clemency

In a White House Press Conference on Monday, President Trump said he would “look at” the case of Samourai Wallet developer Keonne Rodriquez, responding to Decrypt reporter Sander Lutz’s question about whether Trump would consider a pardon for Rodriquez. The developer was sentenced in November to 5 years in federal prison for cofounding the privacy-focused bitcoin wallet, Samourai Wallet. - link

Bitdeer monthly bitcoin production jumps 251% as hashrate hits 45.7 EH/s

Bitdeer (NASDAQ: BTDR) announced Monday it mined 526 bitcoin in November 2025, representing a 251% increase compared to the same period last year. - link

Blockspace Podcasts

On today’s Mining Pod, Doug Wilson, Head of Credit Investments at Coinbase Asset Management (CBAM), joins us to talk about their new hashrate backed loans and how they differ from traditional loans for Bitcoin miners. Doug breaks down CBAM’s flexible collateral package, which allows miners to post their facilities and bitcoin as collateral. We also discuss the broader capital markets for crypto, the impact of institutionalization and ETFs, the importance of regulatory and tax clarity, and the untapped potential of the stablecoin economy to drive efficiency in payments and finance.

Did you know that the red chiles we associate with Sichuan cuisine in China are not native to China? As is the case with so much international cuisine, the discovery of North America introduced new foods and ingredients to the Red Dragon nation, with perhaps the most notable of all being the importation of red chiles in the 16th century.

-CBS, CMH