Brought to you by Lygos Finance

Happy Black Friday!

Bitcoin may have been down from its all-time high Thanksgiving, but one state saw that as a buying opportunity for what is the first official state-level bitcoin strategic reserve.

Plus, a mining pool comes out of stealth with the first-ever Stratum V2 block template creation, headlines, and the story of the great conservatory effort to save the American turkey.

Lygos: Bitcoin Credit, No Custodian Required

Unlock dollar liquidity without giving up your BTC. Lygos is a fully Bitcoin-native, non-custodial lending platform built on Discreet Log Contracts (DLCs).

• Hold your keys: BTC stays on layer 1 in your control. No wrapping, no bridging, no rehypothecation

• Rates as low as 10% APR

Texas makes history as first state to buy bitcoin for reserve

Texas became the first U.S. state to buy bitcoin for its Strategic Reserve, acquiring $5 million at roughly $87,000 per BTC through BlackRock's iShares Bitcoin Trust (IBIT). The state has earmarked $10 million in total for bitcoin purchases and plans another $5 million purchase in spot bitcoin that it will self-custodied once systems are in place. - link

OUR TAKE: Texas just got a better fill than Michael Saylor.

Strategy recently bought some 9,062 BTC at prices over $100k, but Texas was able to buy the dip at $87,000.

This puts Texas at a solid #2 for States owning BTC (well… $IBIT really, but let’s take the win y’all).

Wyoming grabbed about $100 million worth of $IBIT back in May 2024 but it wasn’t necessarily in the same “Strategic Reserve” category – it was the state investment fund.

Texas gets to be the first state across the line to actually fund its Strategic Bitcoin Reserve. While Arizona, Wisconsin, and New Hampshire all passed similar SBR bills, Texas was the first to pull the trigger with a buy.

It’s worth noting that Texas opted for $IBIT instead of self custodying BTC or even using a BTC custodian.

This is because the custody requirements and the risk of owning and managing bitcoin are substantial. $IBIT checks all the boxes for Texas while reducing the primary pain points of custody and compliance.

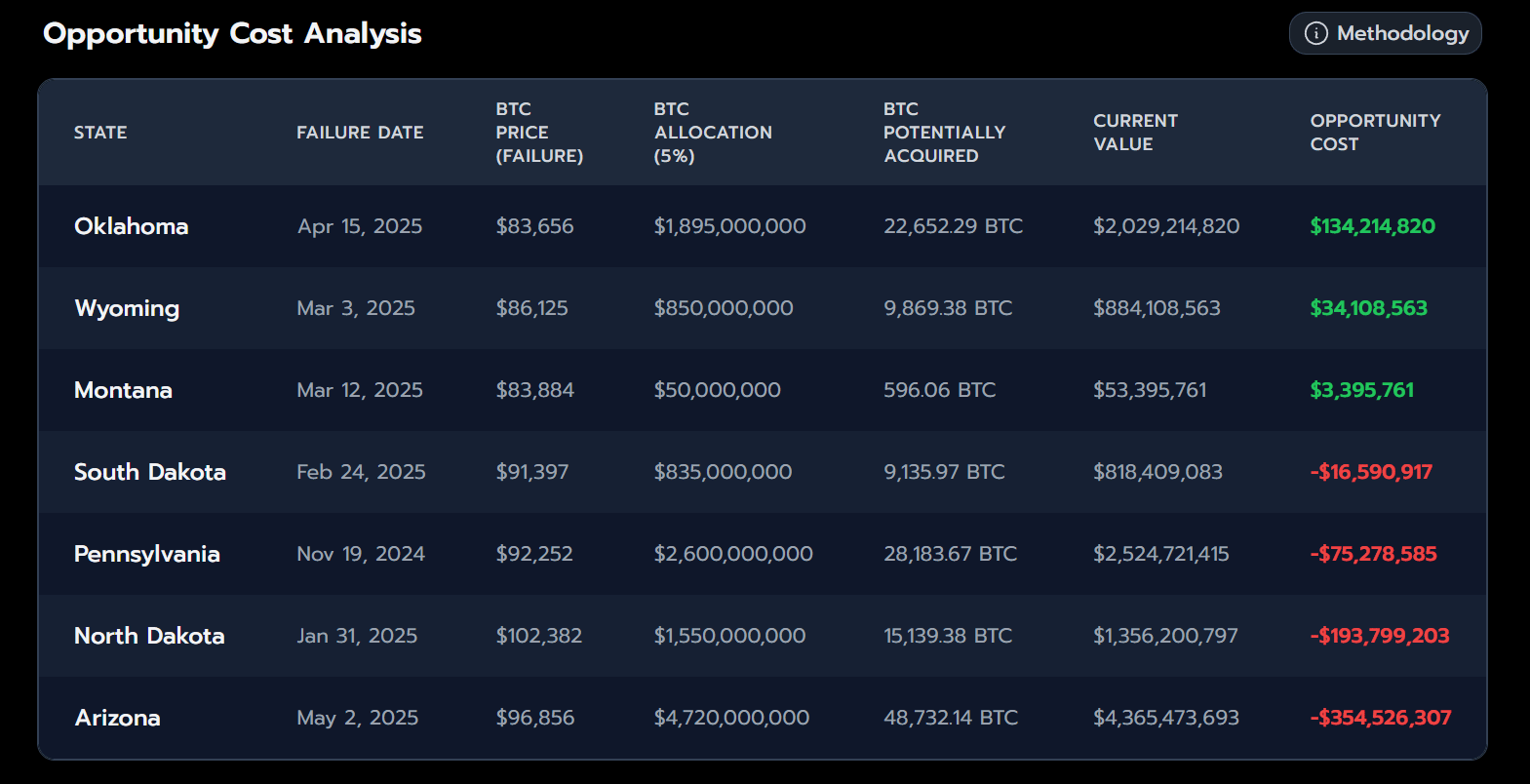

Now, for the “why all this matters” bit, one of my favorite things to do is to pull up the hypothetical PnL scoreboard.

Here’s a helpful dashboard that simulates how much each state would have made or lost on their Bitcoin purchase, had they passed an SBR at the time of voting.

As you can see, with the price of Bitcoin down recently, some states are in the red.

But my home state of Oklahoma would still be up $134 million had we passed our SBR last spring.

We’re all rooting for Texas now, even though we Oklahomans do have a rivalry with our neighbors down south.

Now all we need is for bitcoin to go up so that Texas looks smart for buying all that $IBIT!

-CBS

DMND Pool emerges from private beta, launches up for open sign-up

DMND Pool, the first bitcoin mining pool to utilize the Stratum V2 protocol for block production, is officially open to the public. Prior to launch, DMND Pool operated for three months in a private beta and passed an audit for SOC 2 Type 2 compliance.

OUR TAKE: Another pool comes to save the day, but without all of the blind zealotry of the filter crowd…

DMND Pool is charting a course to relieve bitcoin mining of its oldest and heaviest albatross: centralized block template construction.

Most bitcoin mining pools build blocks for their miners, which means they choose what transactions to include in the block — not the miners themselves.

Cue Stratum V2. An update of the Stratum V1 protocol that bitcoin miners use to submit work to their pools, Stratum V2 allows bitcoin miners to build their own block templates.

Whether this is a selling point to miners depends on where they fall on the suitcoiner-cypherpunk spectrum.

Ultimately, if mining pools choose transactions for their miners (and this becomes the dominant model, as it has), then that creates a central point of failure for potential censorship. The mining pool has the final say, and if a government wants to blacklist certain address, they know where to go.

Stratum V2 isn’t a complete panacea. The mining pool still has to accept the template a miner submits, and Braiins, for example — the company that developed Stratum V2 — doesn’t accept block templates from miners.

But it’s one of the more useful tools out there to combat bitcoin mining pool centralization.

And unlike other pools that are hoping to decentralize block production, DMND pool isn’t making moral judgments on certain transactions over others (or actively trying to block certain transactions they don’t like).

Now that DMND is out of stealth as the first Stratum V2 pool to allow miners to construct their own blocks, the ball is in your courts, miners. Let’s see how you play it.

-CMH

Like these stories? Reply BITCOIN to let us know!

In the News

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

Metaplanet draws $130M BTC-backed loan for share buybacks, BTC purchases

Metaplanet executed a $130 million loan on November 21 under its bitcoin-backed credit facility to fund additional bitcoin acquisitions and support potential share buybacks. - link

White House launches Genesis Mission to accelerate AI R&D, energy grid upgrades

The Trump Administration has issued an executive order to establish a national program to accelerate artificial intelligence research and development across the U.S.. - link

Tether resumed buying Bitdeer after selling at the top earlier this month

Stablecoin issuer Tether has acquired additional shares in Bitcoin miner-turned-AI factory Bitdeer (Nasdaq: BTDR) , with the company scooping up 1.89 million shares in open-market purchases between November 17 and November 21, according to a filing Wednesday. - link

Chart of the Week

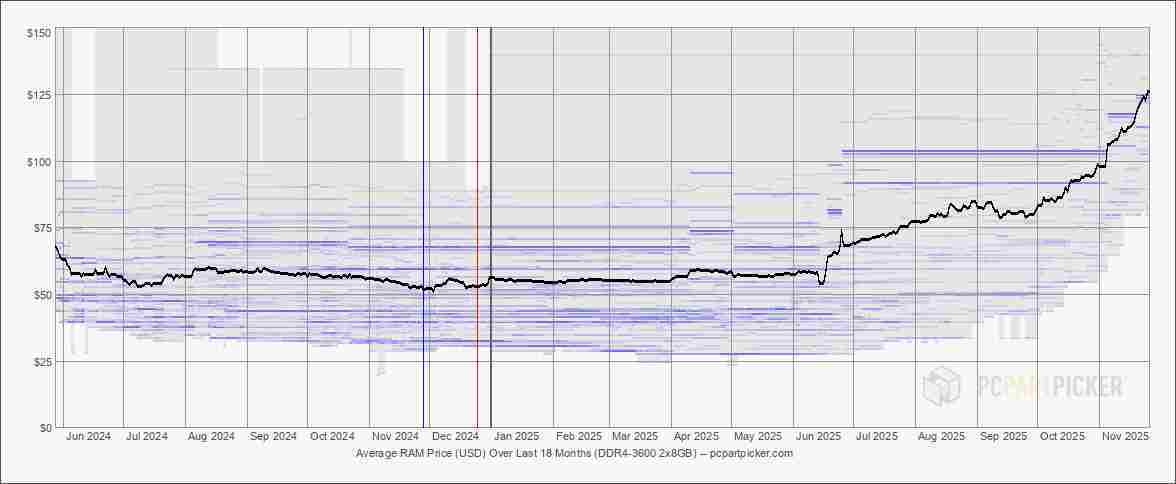

Gamers can’t catch a break. First, ether and altcoin miners priced them out of GPUs in 2020/2021. Now, AI bulls are messing with their precious RAM. RAM prices have skyrocketed this year as hyperscalers and datacenter companies buy up every conceivable computing component in existence.

Blockspace Podcasts

Welcome back to The Mining Pod! Today, Matthew Schultz, CEO of CleanSpark, joins us to talk about CleanSpark'sfiscal year 2025 earnings. CleanSpark raked in $766M in revenue for the year, hit the 50 EH/s milestone, and has begun expanding into AI loads. Schultz shares insights on CleanSpark’s partnerships with Submer for cooling solutions, the company’s capital strategy, the potential for hybrid mining-HPC loads at CleanSpark sites, and what the AI revolution means for bitcoin mining in the United States.

Welcome back to The Mining Pod! Today, Colin and Charlie break down Operation Red Sunset—the US government's probe into Bitmain over national security concerns. We also cover brutal mining economics with hashprice at all-time lows, Trump's new executive order spurring AI and energy R&D, Hive's $300M at-the-market offering, and Tether reupping its BTDR investment. And for this week’s dual cry corner, why Cardano still sucks and why gamers are crying as RAM prices surge from AI demand.

Did you know that turkeys east of the Mississippi nearly went extinct in the U.S. in the early 1900s? The story of their comeback is a pretty incredible testament to modern conservation efforts, and rather than give a truncated telling of it here, I’ll let this post from one RodeoProfessor tell it better than I could.

-CMH & CBS