30 April 2025 · Hashrate 7-Day SMA: 846 EH/s · Hashprice: $49/PH/Day

Welcome to Mining Wednesday, where Blockspace covers the intersection of bitcoin mining, energy, and AI.

Today, we’re over a year removed from the 2024 Bitcoin Halving, and we have the receipts on what all has changed — and what miners could have done to outperform spot hashprice.

It’s about a 5 minute read.

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

Market Opens

BTC $94.4K 0%

GOLD $3,310 0%

MSTR $381 3%

COIN $206 0%

MARA $14.22 1.5%

CLSK $8.44 1.5%

RIOT $7.42 2.7%

CORZ $8.29 0%

A year later, miners are still reeling from the 2024 halving

The April 2024 halving marked more than just a reduction in block rewards. Bitcoin’s price soared past $100,000, yet miners faced a challenging trifecta: a 50% revenue cut, relentless growth in network difficulty, and historically low transaction fee rewards.

With rising competition and revenue uncertainty, miners faced razor thin margins and they are still skating on the edge more than a year out from the event, while some are adopting more sophisticated hedging strategies to weather the volatility.

Here’s what has changed since the 2024 halving.

The following is a guest post by Kaan Farahani, a research associate at Luxor Technology who authors Luxor’s Hashrate Index Roundup newsletter.

The halving and its fallout

The bitcoin halving immediately cut bitcoin mining revenue in two. Despite this, Bitcoin’s total network hashrate has continued to grow at a time when transaction fees are at multi-year lows, which has put further pressure on hashprice.

Hashprice is a mining metric that quantifies how much a miner can expect to earn from a specific quantity of hashrate. This metric captures the combined effects of changes to bitcoin price, network difficulty, and transaction fees (and in the case of the halving, the block subsidy) into a single revenue measurement, denominated in either USD or BTC per PH/s/Day.

Hashprice is positively correlated with changes to Bitcoin’s price and transaction fee volume but negatively correlated with changes to network difficulty.

Between April 2023 and April 2025, Bitcoin’s daily price more than tripled, averaging ∼ $57,500. However, this bullish momentum was met with an equally aggressive rise in network difficulty. These forces grappled with each other, wrestling hashprice downward and adding to the pressure inflicted by the halving.

Bitcoin’s difficulty was 86.39T at the time of the halving, with roughly 618 EH/s online at the time of the event (according to the 7-day average). A year later, difficulty had increased 43% over the period to an all-time high of 123.23T at 882 EH/s.

Source: Hashrate Index

One of the more surprising post-halving developments was a sharp decline in transaction fee volume. Between April 2023 and April 2025, average transaction fees collected (per block, per day) fell 70%, from 0.550 BTC to 0.165 BTC.

Pre-halving, transaction fees as a share of total block rewards averaged 7.12%; post-halving, that fell to just 4.02%. Despite isolated fee spikes from runes and ordinals activity, the reduced fee market environment diminished miner revenues.

Source: Hashrate Index

The increase in difficulty and low fees overwhelmed hashprice despite the positive bitcoin price action. As a result, hashprice has had a difficult time recovering since the halving.

USD hashprice averaged $66.35/PH/day between April 2023 and April 2025, and it is roughly ∼$45/PH/day at the time of writing.

Meanwhile, BTC hashprice averaged 0.001462 BTC/PH/day, and is currently ∼0.000517 BTC/PH/day.

Source: Hashrate Index

Overall, USD and BTC hashprice have fallen 57% and 89%, respectively, since April 2024. This steep decline has compressed revenue for miners, especially those relying on FPPS (full-pay-per-share) payout models.

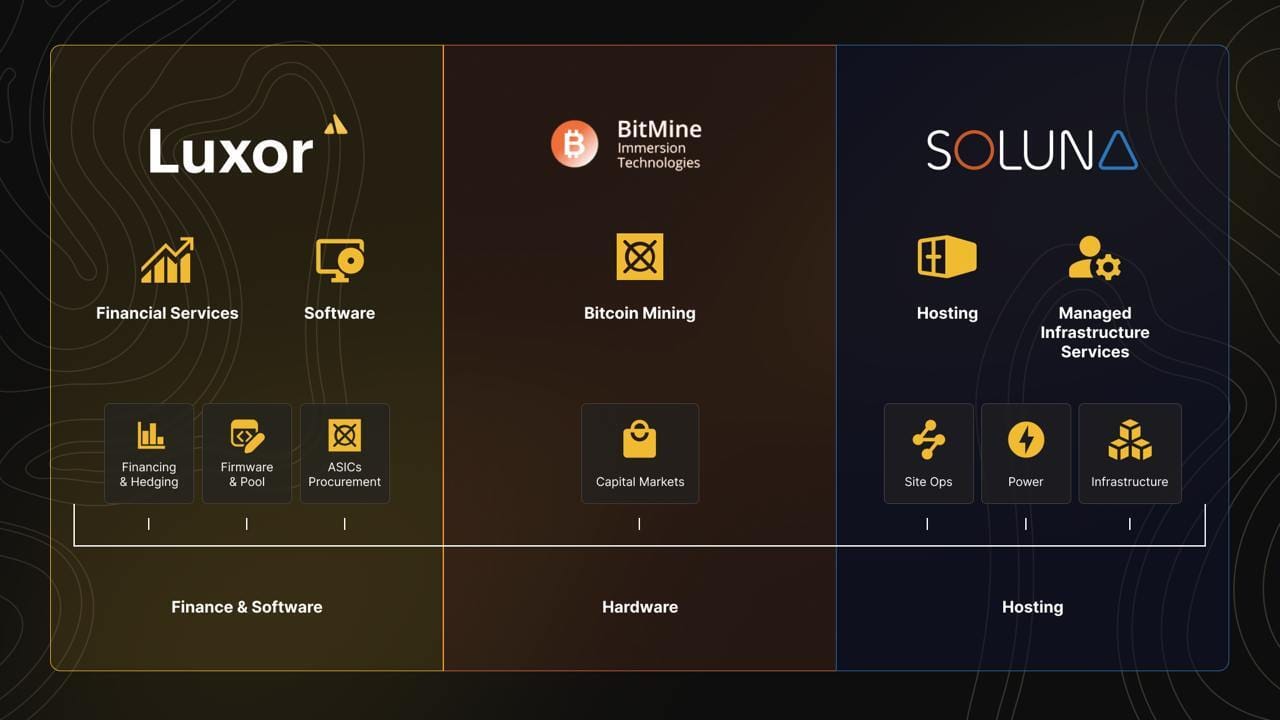

Full Stack Mining Solutions, From Financing to Firmware

BitMine partnered with Luxor and Soluna to build a turnkey mining solution, combining power, procurement, financing & firmware optimization. See how this collaboration helped BitMine triple deployed capacity & lock in predictable revenue

Bitcoin Mining Headlines

Tether Eyes $25 Million Stake in Upcoming Antalpha IPO

Tether, the issuer behind USDT—the world’s largest stablecoin with a market cap of approximately $146 billion—has shown interest in buying up to $25 million worth of shares in an upcoming initial public offering, according to SEC filings. - link

ASIC miners will not benefit from computer tariff exemption

ASIC mining hardware will not enjoy the same tariff exemptions as computers, smart devices, and semiconductors. The exemption only applies to computing devices classified under Harmonized Tariff Schedule of the United States (HTSUS) code 8471, while ASIC miners belong to HTSUS code 8543. The U.S. Customs and Borders Protection agency classified ASIC miners under this code in a June 2018 ruling. — link

Phoenix group adds 52 MW in Ethiopia

UAE-headquartered Phoenix Group is expanding its footprint in Ethiopia, adding 52 MW for a total capacity of 132 MW in the country. Phoenix should complete the two phase expansion by the end of Q2. - link

Riot takes on $100M bitcoin-backed loan from Coinbase, buys out Rhodium

Riot Platforms has opened a $100 million credit facility with Coinbase, collateralized by some of Riot’s 19,223 BTC. Riot then completed the purchase of Rhodium’s share of the Rockdale data campus for $185 million, in cash, stock and power agreements - link & link

Cambridge Digital Mining Industry Report: Global Operations, Sentiment, and Energy Use

Cambridge University updates it’s bitcoin mining electricity consumption data, figures on bitcoin’s renewables penetration, and more in its latest report. — link

Top 5 Moments In Bitcoin Mining History

Bitcoin Mining News

Free Report!

Forecasting Bitcoin hashrate through 2027

Our new report forecasts Bitcoin's hashrate from 2025 through 2027. Get it for free by clicking here — link

Enjoyed today's read?

-CMH, KF