Presented by

Happy Thursday! Michael Saylor is feverishly bent on owning as much bitcoin as possible, and Strategy’s strategy has spawned not a few copy cats. For today’s newsletter, Bitwise’s Danny Nelson breaks down how Strategy’s bitcoin horde stacks up to an even greater one.

It’s about a 4 minutes read.

Michael Saylor vs. the world

Michael Saylor’s mission to own all the bitcoin in the world faces a roadblock: his company Strategy isn’t even the single-largest holder of BTC. That title belongs to BlackRock’s bitcoin ETF, IBIT. But Strategy is closing in.

As of this week Strategy holds 555,450 BTC, or 89.5% of the total held by IBIT. Put another way, Strategy needs to buy just $6.3 billion more BTC to match IBIT’s current, world-leading stash.

Comparing the world’s largest bitcoin ETF to the world’s largest corporate bitcoin treasury is hardly apples-to-apples. The former’s BTC inflows are a direct result of investors buying new shares, fueling new buys, while the latter is executed by Strategy. But they’re not entirely different, either: Strategy’s plan to buy $84 billion over the next few years depends almost entirely on selling debt and equity to MSTR investors.

Investors seeking exposure to bitcoin through a Wall Street wrapper might not care precisely which ticker – MSTR or IBIT – has the largest trove. It's a bit of a sideshow to more important conversations about how the entity’s operations impact their respective share price. IBIT tracks BTC almost in lockstep, while MSTR trades with a high beta to bitcoin, moving aggressively with its ups and downs.

Optics or not, the crown of “world’s biggest bitcoin holder” is one that could only help the

Strategy brand. Its recent buying spree has brought it closer to IBIT than at any point since the BlackRock vehicle’s BTC holdings surpassed Strategy’s in early 2024.

Source: Bitwise

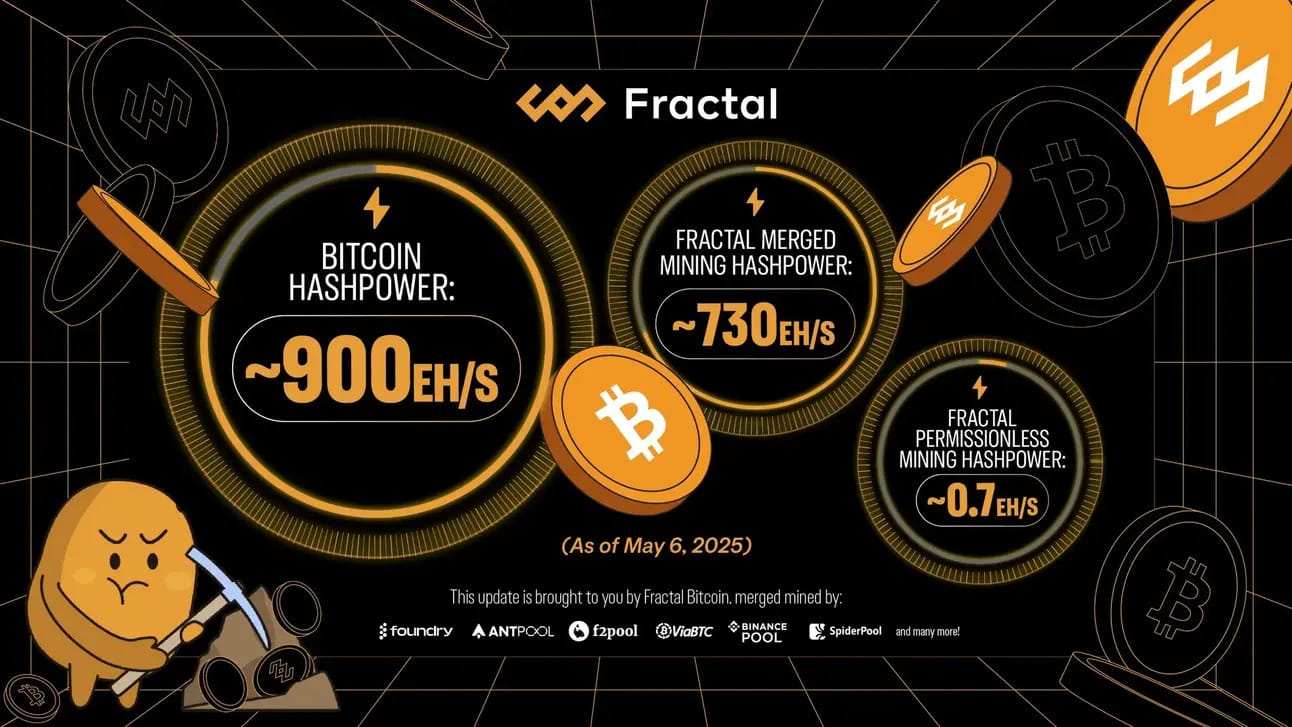

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources. How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

Whether Strategy can cover the gap in short order likely depends on BTC’s price action. Saylor shows little interest in optimally timing his purchases. Up, down, or sideways, he’s always buying.

But IBIT buyers are much more price sensitive. Perhaps unsurprisingly, IBIT’s best days come when BTC is on a tear. The ETF sees little inflows when BTC is crabwalking, and outflows pick up if the original crypto drops too far, too fast.

Source: Bitwise

If the rules of the game stayed the same, and investors remained hungry for Strategy’s fundraise gambits, Saylor’s incessant dollar-cost-averaging would probably be enough to close the BTC gap.

The thing is – they’re not. A new crop of companies led by Jack Mallers’ Twenty One Capital, Inc look poised to copy Strategy’s strategy better than Strategy. The Mallers company plans to go public with 42,000 BTC on the books, which would give it the third largest corporate BTC treasury.

Unlike Strategy’s blended SaaS-Bitcoin treasury business, Twenty One exists almost exclusively to buy as much BTC as it possibly can, and it plans to go It, too, plans to buy bitcoin using an investor-funded warchest, starting with $4 billion provided by Tether, Softbank, and others.

Twenty One it may divert some interest away from Michael Saylor’s stock sales and toward its own. That could conceivably make it harder for Strategy to quickly catch up with IBIT.

But it also might juice MSTR’s share price by validating the company’s trademark BTC treasury thesis, TD Cowen analysts recently opined. Such validation could boost appetite for MSTR’s multibillion-dollar fundraising wizardry, giving it enough capital to close the BTC gap – for now.

That much money can be hard to come by if your name isn’t Michael Saylor. Strategy all but solved its warchest-refuelling dilemma by selling a variety of debt and equity, and then using that money to stack more sats.

Push your S19 XP to the max

Upgrade to LuxOS and unlock up to 11.93% more hashrate with 10% better efficiency. Power up your margins and outperform standard firmware.

Optimized mining starts here — upgrade today.

Meme of the Week

If all of the OP_RETURN bellyaching has you asking, “what the hell is Bitcoin Knots,” you’re not alone…

Enjoyed today's read?

-DN, CMH