Loving Blockspace? Reply with your favorite read from this week!

Had enough? Unsubscribe here.

Presented by

Fractal Bitcoin

Ever wondered how many Americans own bitcoin? Well, a new survey gives us a decent finger-in-the-wind answer — and it’s more than you’d think!

Also in today’s newsletter, did you know that 20% of the entire bitcoin network hashrate comes from four companies? Plus headlines and podcasts for the long weekend!

But before we get into it, happy Fourth of July to all our American readers! Yesterday, we celebrated our nation’s 249th anniversary and all of the men and women who sacrificed to make this beautiful country possible.

Stick around until the end of today’s letter for a few 4th fun facts…

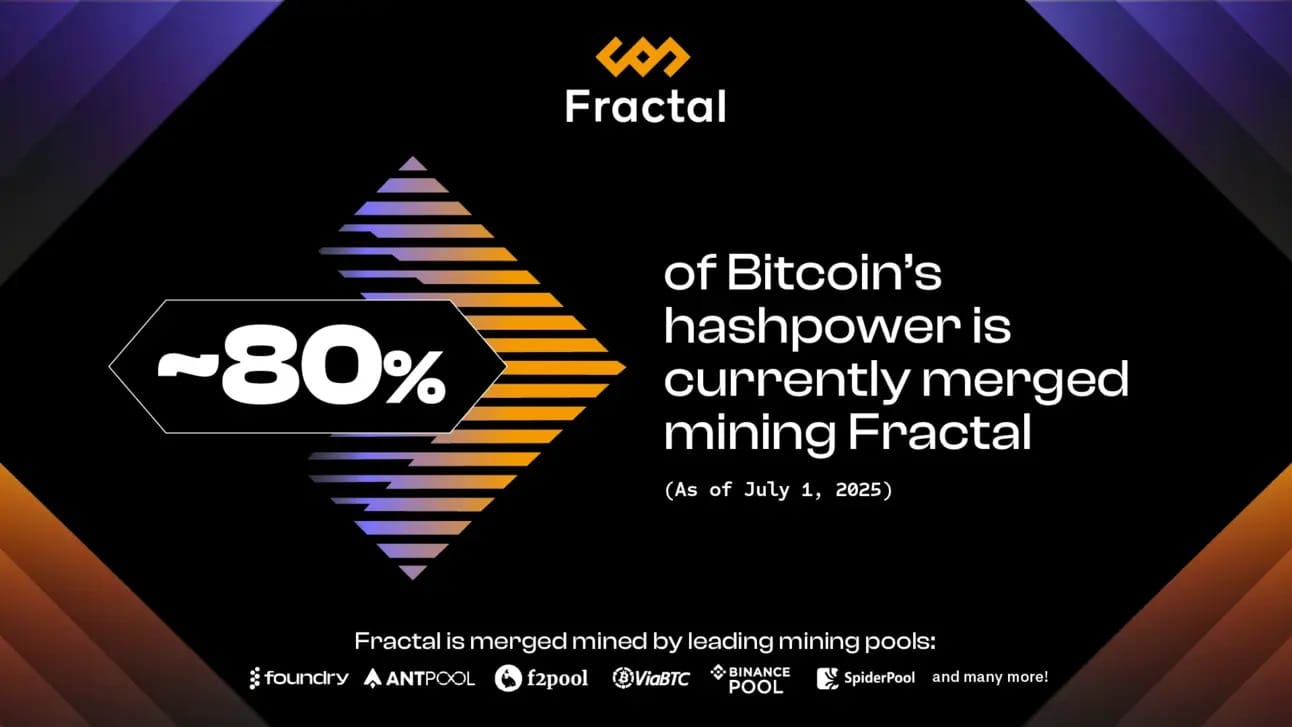

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

Study estimates that 48 million Americans own Bitcoin

A survey by The Nakamoto Project of 3,538 U.S. adults indicates 48 million Americans now own bitcoin, with roughly 11 million holding it in self-custody. Ownership remains driven “more by attitudes toward the technology than political affiliation” despite a slight rightward shift following Trump's presidential victory. Although bitcoin's price doubled and institutional adoption grew significantly, overall sentiment toward bitcoin declined in 2025, particularly among liberals. - link

OUR TAKE: What’s fascinating about this study isn't demographics nor politics - it's about the moral psychology of Bitcoin owners. There appears to be a moral foundation profile that doesn't align with traditional liberal or conservative patterns. Instead, Bitcoin holders exceed both political camps in valuing purity, equality, and cultural liberty, but they fall somewhere in the middle of both camps in valuing economic liberty, authority, and loyalty. Surprise surprise: Bitcoin appears to transcend typical ideological boundaries and speaks to a fundamentally different way of thinking about morality, technology, and society.

What makes this particularly intriguing is how it challenges the common narrative that Bitcoin is primarily a libertarian or right-wing phenomenon. While data shows that Bitcoin owners are right leaning, they’re more accurately moral outliers. Bitcoin owners are not just politically centrist, they are represented on both left and right sides of the political spectrum. Additionally, for some, Bitcoin adoption may be less about financial speculation or political rebellion and more about a coherent worldview that simply sees the asset class as an obvious component of a financial portfolio akin to index funds, conventional savings vehicles.

And finally, while there is a lot of projection we could contrive about the moral leanings of Bitcoiners, the most unsurprising find from the study is that Bitcoin owners are overwhelmingly dudes. Go figure…

-CBS

Cango, IREN become latest public miners to join the 50 EH/s club

Two public miners hit the 50 EH/s milestone this week. Cango announced that it has completed an all-stock deal to acquire 18 EH/s of turnkey units in facilities operated by Bitmain, adding to its 32 EH/s of active hashrate, and IREN also revealed that it hit 50 EH/s this week. The companies join MARA and Cleanspark as the fantastic four public miners to hit the 50 EH/s milestone. – link, link

OUR TAKE: Call your local filterboi / Knots runner – there’s mining centralization afoot!

Kidding aside, that’s a big ole chunk of hashrate to rest in the hands of four companies, about 23% of the entire Bitcoin network currently. Now, heat waves have been sweating out some of Bitcoin’s hashrate, which is no doubt affecting the four miners in question. So that 23% figure is likely a bit less given the day.

But regardless, the nameplate 200 EH/s shared equally between these four companies underscores the point that the bitcoin mining industry is concentrated in more ways than one, whether that be mining pool centralization, hardware manufacturer centralization, or centralization of hashrate in public companies.

If we zoom out to the entire public bitcoin mining sector, the concentration among public companies is even starker. As we covered in a prior newsletter, JPMorgan research placed U.S.-listed public miner hashrate dominance at 31.6% in June. And that’s only sampling 13 companies, so the real count is a smidge higher.

What does all of this mean, exactly? Well, there’s not much anyone can do, except maybe stop buying public mining stocks, but that’s not happening (and we’re not communists so we don’t endorse needless company boycotts). The concentration will likely resolve itself at any rate; as we mentioned in that prior newsletter, AI/HPC is sucking a lot of air out of the room, so we expect the hashrate share of U.S.-listed companies to taper away over the coming years.

Even so, the concentration is not ideal. If the U.S. government really wanted to hinder Bitcoin’s censorship resistance, for example, they need only to approach these companies and Foundry, the largest bitcoin mining pool, and demand that they blacklist certain addresses.

Of course, there are checks, balances, and competing incentives that would mitigate such an attack, but just some food for thought…

-CMH

Luxor x Steelhead: Lending Into Mining, Risk Under Control

See how Steelhead avoided mining’s wild revenue swings by locking in fixed hashprice through Luxor’s combined forward contracts—transforming hashrate into a collateralized, predictable yield product.

Senator Lummis introduces digital asset tax reform bill

Senator Cynthia Lummis introduced new legislation this week aimed at reforming the taxation framework for digital assets. The bill provides clearer guidance for investors and businesses alike, such as a $300 de minimis exemption for small transactions, deferring taxes on mining and staking until assets are sold, and aligning digital asset taxation with traditional financial instruments. - link

Robinhood makes crypto expansion with stock tokens

Robinhood announced a sweeping expansion of its cryptocurrency offerings this week, introducing stock tokens, unveiling its own “layer 2 blockchain solution,” rolling out perpetual futures trading and staking services across EU and U.S. markets. The move represents the trading platform's most aggressive push into digital assets as it seeks to compete with established crypto exchanges. - link

Strategy taps common stock ATM, raises $519.5 million

Strategy (MSTR), formerly MicroStrategy, deployed its common stock at-the-market offering program for the first time in four weeks, selling 1,354,500 shares to net $519.5 million in proceeds between June 23 and June 29, 2025. – link

Chart of the Week

As Trump’s tariffs and AI/HPC interest take a toll on ASIC miner demand, ASIC models of all stripes and colors have become increasingly uncorrelated with hashprice (mining revenue). In fact, for the last three months, only three models have been positively correlated with hashprice.

Source: Luxor

Blockspace Podcasts

Today, Colin and Matt are joined by Ethan Vera, the COO of Luxor Technology, to talk about Hut 8's 205 MW Vega facility and its 310 MW deal to deliver electricity to Ontario. Plus, American Bitcoin's $220 million fundraise, an ASIC market update, Tether's surprise mining expansion into Brazil, and how just four public companies now control nearly a quarter of Bitcoin's total hash rate.

Two fun facts in honor of America’s 249th birthday:

1) The Continental Congress actually voted to split from Britain on July 2, 1776, but the Declaration of Independence wasn’t approved until July 4!

2) Fireworks have crackled away during independence festivities from the get-go, with their first recorded use taking place during a July 4, 1777 celebration in Philadelphia.

-CMH + CBS