9 July 2024 · Block Height 851350 · Bitcoin Price $56K

And here we return, to where history repeats.

It’s nearly 3 months after the Bitcoin halving and guess who is unplugging? Miners.

Quick Hits

Single entity mines 80% of Bitcoin Cash for a few days

Quantum Cats give a cat a cape

Bitfarms appoints Ben Gagnon as CEO amidst Riot takeover

Miner Capitulation Looks Different This Time

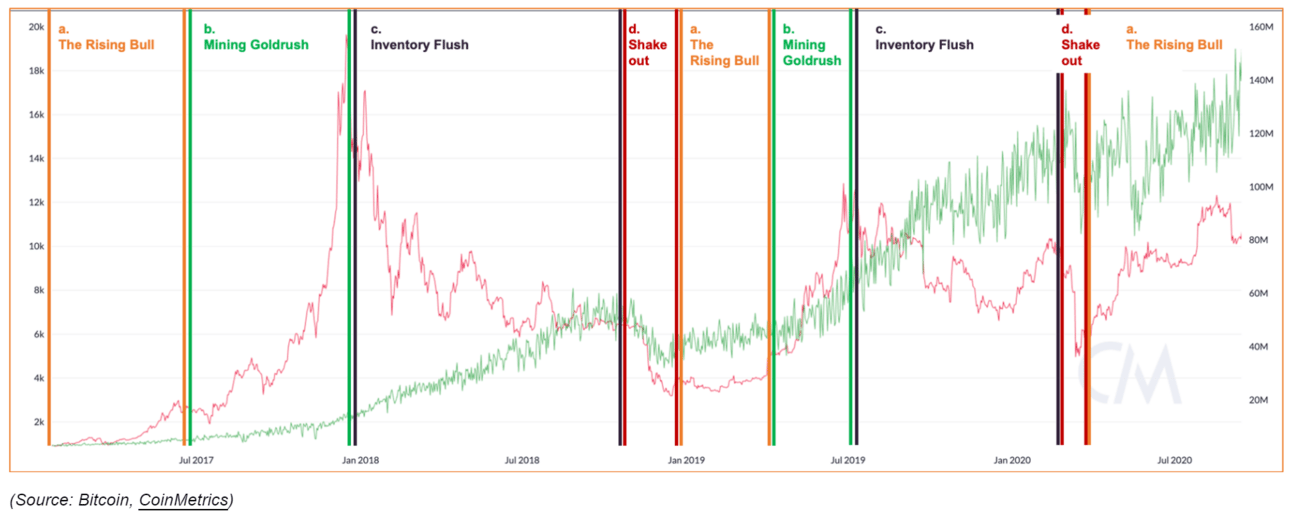

It’s official: Bitcoin mining has entered the “Shake Out” phase. By now we know that history rhymes but does not repeat. Let’s take a look at what’s driving the capitulation and how it’s playing out a little differently this time around.

The mining cycle continues. Mining analysts have identified a cyclical boom-bust pattern to Bitcoin mining ever since Bitcoin entered the “modern” post-ASIC era (~2014). Around the 2020 halving, a cycle model was codified by the Coinmetrics and Alkimiya teams and consists of 4 seasons:

The Rising Bull

Mining Goldrush

Inventory Flush

Shake Out ← You are here

Many analysts, myself included, were surprised to see hashrate continue to skyrocket from the FTX bottom in late 2022 to the April 2024 halving. Hashrate nearly tripled from 240 EH/s to 640 EH/s in a relentless climb, seemingly unaffected by price & sentiment collapse. In hindsight it is clear that this was the “Inventory Flush” period.

Inventory flush due to overproduction happens in many markets that suffer from high reaction delay. Miners were able to tap into previously inaccessible sources of capital, namely public markets, to stave off bankruptcy meanwhile ASIC manufacturers like Bitmain continued to ship units. This resulted in a significant glut of machines available to the market and a significantly lower rig price environment that still shows no sign of recovering.

We are finally seeing hashrate decline. After the April 2024 halving mining profitability collapsed in all 3 significant revenue drivers:

📉 Block subsidy down 50%

📉 Bitcoin Price down 20%

📉 Fees per block down 50%

All these combined mean miners are generating about 50% less revenue today than they were over the past year. This is resulting in the first 2 consecutive negative difficulty adjustments since June 2022 (!) and about a 15% decline in hashrate from the April 2024 peak.

We’re officially in the “Shake Out” phase.

(Tune in for Friday’s Part II on why the mining market might recover than people anticipate).

If you are reading this, reply “MINING DEATH SPIRAL” to let us know you enjoyed the newsletter! It helps us with our open rate :)