3 February 2024 · Block Height 882124· Bitcoin Price $94K

Good morning and welcome to February!

Today, we’re discussing the market sell off from the Trump administrations newly levied tariffs on Canada, Mexico and China. Plus news hits and earnings calls worth bookmarking below. Today’s read is about 3 minutes.

It’s getting hairy out there.

Last night, global markets began to price in the possible effects of the Trump tariffs, dragging risk assets like crypto down hard and fast.

As of this morning, crypto’s market cap shed nearly $500 billion, with Bitcoin falling 5% to around $94,850. Meanwhile, Ethereum continues to seek zero, falling 17% over the last 24 hours to $2,562, per CoinMarketCap.

What are we to make of the Trump tariffs? Bitwise senior analyst Jeff Park sees tariffs as long-term bullish. If tax and interest rate cuts follow the tariffs, risk-on assets could moon, he wrote.

Yet, traders might be licking their wounds for a bit after suffering the largest liquidation event in history—an estimated $10 billion in liquidations, per Bybit CEO Ben Zhou. It’s typical to see choppy markets after large liquidation events.

Lastly, crypto-equities sold off again, this time with the broader market, as compared to the DeepSeek AI scare, which wiped $2 trillion from tech stocks the other week. Big names like CORZ, COIN, RIOT, and MARA all fell over 6% to start the week.

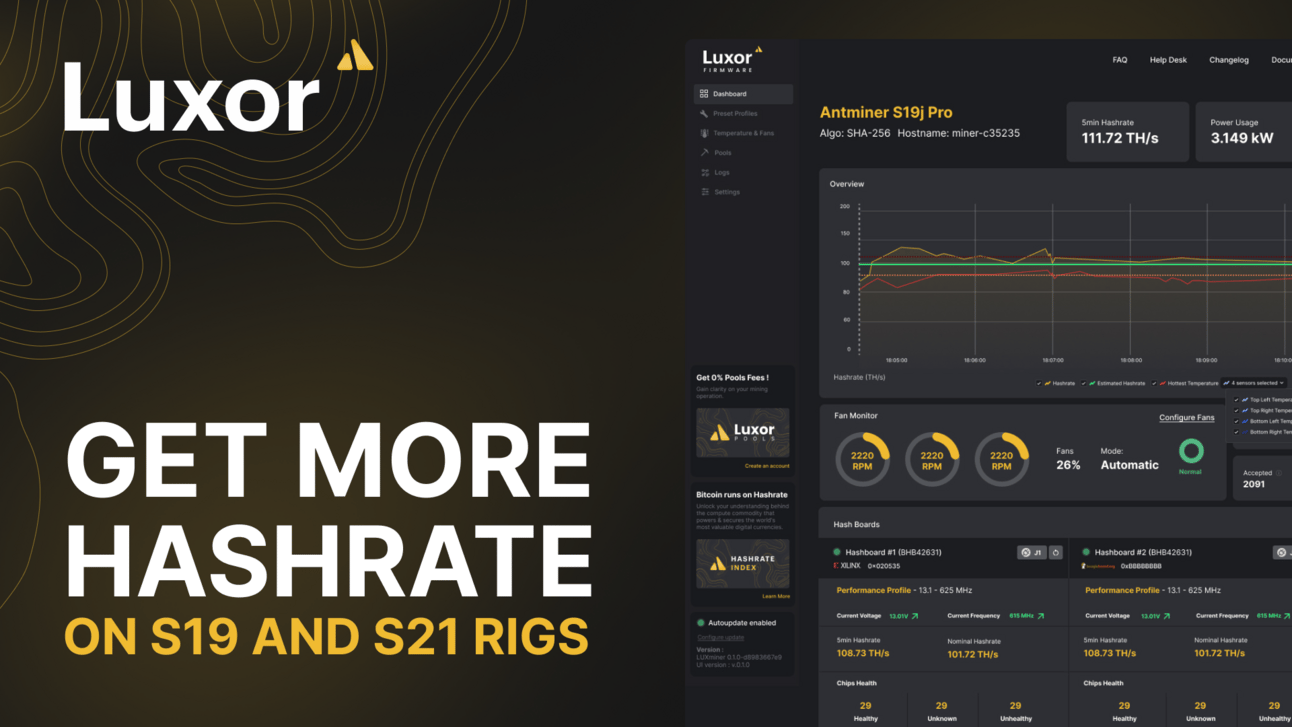

Brought to you by Luxor

Get game-changing mining results with Luxor Firmware. Boost hashrate, cut energy costs, protect your hardware, and maximize mining profits with LuxOS.

Michael Saylor’s Forbes Cover

Bitcoin’s Wall Street titan graced the cover of Forbes magazine this past week, dubbed “The Bitcoin Alchemist.” Twitter was quick to point out the last crypto stan splashed on Forbes—Sam Bankman-Fried—and declare, “It’s so over.”

The Bitcoin Mempool Clears

We got our answer to a hotly contested question: Will the Bitcoin mempool clear again, ever? Turns out, yes. This past weekend, Bitcoin fee rates dropped to 1 sat/vbyte, signaling near-zero demand to use the Bitcoin blockchain at that time.

ETH/BTC Plummets

Popular trading metric ETH/BTC—a valuation of Ethereum’s market cap denominated in Bitcoin—slid harshly over the weekend as ETH lost about 15%. The ratio is now at its lowest since January 2021.

Bitcoin ETFs Add $5 Billion in January

Per SoSoValue, Bitcoin ETFs added $5 billion in value last month, with BlackRock’s IBIT adding $3.23 billion. Bitcoin ETFs now hold $119 billion, or about 6% of Bitcoin’s market cap.

Upcoming Earnings Calls

CleanSpark: February 6, 2025, Q1 FY2025 Earnings Results

MicroStrategy: February 5, 2025, Q4 2024 Financial Results

MARA: February 11, 2025, Special Meeting of Shareholders