Done with Blockspace? Unsubscribe here.

Presented by

Welcome to Monday! It’s rainy and quiet out here in Brooklyn, NY, so we’re cozying up at a coffee shop while getting the latest headlines out the door!

It was a quiet weekend for Bitcoin, with a few normal headlines (Strategy bought Bitcoin, etc). Of course, the other side of the globe is not so quiet.

Despite all the chaos in international scenes, Bitcoin remains resilient, perched above $106K.

Forwarded this newsletter? Sign up here.

Market Opens

BTC $105K 1.3%

GOLD $3,452 1.2%

MSTR $384 0%

COIN $251 3%

MARA $15.31 1.8%

CLSK $9.46 1.7%

RIOT $9.96 2.2%

CORZ $12.04 1.2%

Fractal: Boost Miner Revenue. Power the Future of PoW.

Fractal is a Bitcoin-native scaling solution with full Bitcoin compatibility – helping miners earn more using the same hardware, wallets, and energy they already rely on. Lowered pool fees. Direct FB rewards. Zero setup.

We’re also a founding member of the newly launched Proof of Work Alliance — a global coalition of mining pools, blockchain projects, miners, service providers, and hardware manufacturers advancing PoW innovation, energy efficiency, and infrastructure growth.

The goal: strengthen and scale Proof of Work for the next generation of builders.

Founding members include: F2Pool, SpiderPool, ElphaPex Miner, Ipollo, Bitmars, Fortitude Mining, StandardHash, BIT Exchange, ETC Cooperative, and Psy Protocol.

🔗 Explore the Alliance or join us at PoWAlliance.com

Capital Inflows

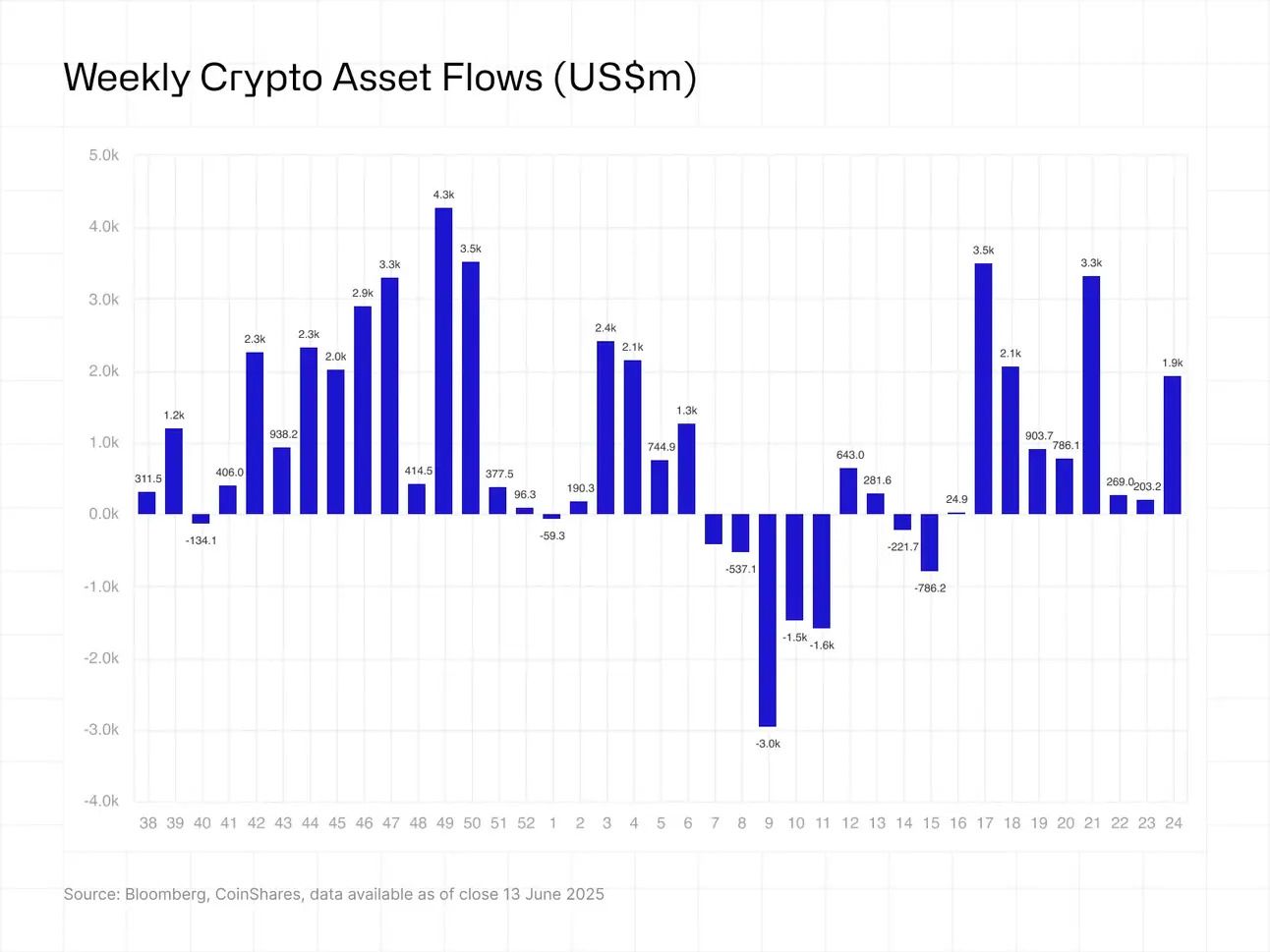

$1.9 billion jumped into digital assets last week, the 9th positive week in a row, per CoinShares. - link

Tron to go public after SEC pauses probe into Justin Sun

Justin Sun’s crypto platform Tron will go public in the U.S. via a reverse merger with SRM Entertainment. The move follows a paused SEC investigation and deeper ties between Sun and the Trump family — link

SEC greenlights Trump Media Bitcoin treasury plan

The SEC approved Trump Media’s filing, unlocking $2.3B in capital that can now be used to buy Bitcoin. The firm also registered 84.7M shares for resale and set up a $12B universal shelf for future offerings — link

Metaplanet hits 10,000 BTC, surpasses Coinbase

The Japanese firm now holds more Bitcoin than Coinbase, after a 1,112 BTC purchase. It has raised $210M in zero-interest bonds to fund more buys and plans to acquire 1% of the Bitcoin supply — link

Michael Saylor backs Pakistan’s Bitcoin strategy

Saylor met with Pakistan’s crypto and finance ministers, offering to advise on policy.

He praised the country’s emerging market potential and supported Bitcoin use as a reserve asset — link

Vietnam legalizes crypto under new digital tech law

Vietnam passed a landmark law recognizing crypto assets, effective January 2026.

It includes incentives for blockchain startups, state subsidies, and AML/cybersecurity provisions — link

Bitcoin treasury strategies go mainstream

61 public companies now allocate cash reserves to Bitcoin, led by Strategy and Trump Media. The move follows surging prices and regulatory shifts, with firms leveraging debt markets to buy BTC — link

Luxor x TeraWulf: Firmware That Performs

Discover how TeraWulf boosted mining efficiency and extended hardware lifespan by upgrading to LuxOS — Luxor’s enterprise firmware delivering performance, uptime, and advanced thermal management.

*Paid advertisement partner

Tweet of the Week

A new BitVM paradigm on the horizon? Robin Linus and Company have been hard at work on a new BitVM decreasing costs for on-chain compute - link

Podcast of the Week

Bitcoiner Post Capone joins us to talk about the risks of OP_CAT activation, MEV extraction concerns on Bitcoin, how increased expressivity could lead to mining centralization, the promise of scaling solutions like Arc and Spark, and why constrained covenants like CTV might be a better path forward than unlimited expressivity.