Presented by

Happy Monday! Last week’s Bitcoin conference was incredible. Shout out to the Bitcoin Magazine team for crushing it, once again.

Colin and I ran the mining stage while Charlie did Charlie things at the Open Source Stage (plus closing out the first day on the big stage, here).

But its a new week and we’re off to the races! This morning, we’ve already seen one large AI/HPC deal between two former Bitcoin miners.

But before we get into more news, help us out? Reply “HODL” or “Bitcoin” to tell your email service you like getting the Blockspace newsletter.

Market Opens

BTC $104K 0%

GOLD $3,380 2%

MSTR $369 0%

COIN $246 0%

MARA $14.12 3.3%

CLSK $8.63 1.7%

RIOT $8.07 1.3%

CORZ $10.65 0%

Fractal: Boost Miner Revenue. Power the Future of PoW.

Fractal is a Bitcoin-native scaling solution with full Bitcoin compatibility – helping miners earn more using the same hardware, wallets, and energy they already rely on. Lowered pool fees. Direct FB rewards. Zero setup.

We’re also a founding member of the newly launched Proof of Work Alliance — a global coalition of mining pools, blockchain projects, miners, service providers, and hardware manufacturers advancing PoW innovation, energy efficiency, and infrastructure growth.

The goal: strengthen and scale Proof of Work for the next generation of builders.

Founding members include: F2Pool, SpiderPool, ElphaPex Miner, Ipollo, Bitmars, Fortitude Mining, StandardHash, BIT Exchange, ETC Cooperative, and Psy Protocol.

🔗 Explore the Alliance or join us at PoWAlliance.com

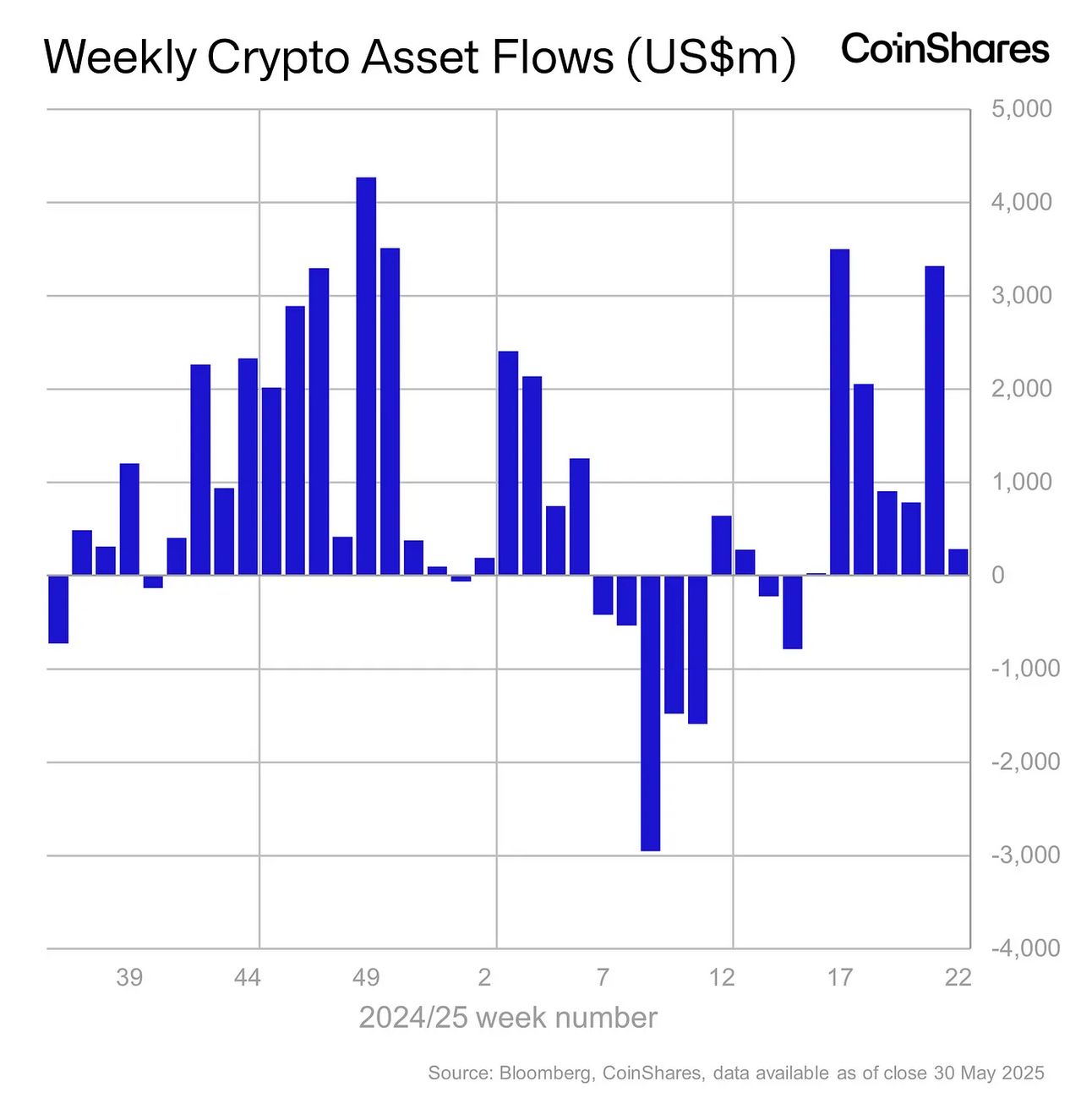

Capital Inflows

Some $268 million dropped into crypto-coffers last week, bringing the 7-week total to $10.9 billion. Bitcoin actually experienced less inflows than Ethereum products, CoinShares noted - link

CoreWeave Partners With Former Bitcoin Miner Applied Digital on $7 Billion AI Deal

We’re rolling out headline alerts service made in conjunction with Synoptic.com out of private beta. Join the Telegram group here to get market moving headlines in real time - link

Trump Media Closes $2.4B Capital Raise To Buy Bitcoin

Trump Media has secured $2.44 billion to establish a Bitcoin treasury and will use the proceeds to add BTC to its balance sheet — link

Crypto’s Most Watched Whale Fully Liquidated

James Wynn’s high-leverage BTC trades on Hyperliquid resulted in a net loss of over $17 million, leaving his account with just $23 — link

Metaplanet buys more Bitcoin, pushing total holdings to 8,888 BTC

The Japanese firm spent ¥16.885 billion (US $117.5 million) to bring its corporate treasury to 8,888 BTC and aims for 10,000 BTC by year-end — link

Pakistan to set up government-led strategic Bitcoin reserve

Pakistan Crypto Council CEO announced the country is launching a national BTC wallet that will hold coins indefinitely, inspired by recent U.S. moves and supported by mining and tokenization plans — link

Stablecoin Giant Circle Files for IPO on NYSE

Circle Internet Group plans to offer 24 million class A shares at $24–$26 apiece, potentially raising nearly $250 million under the ticker “CRCL” — link

3X Hashrate, Zero Guesswork

BitMine scaled seamlessly with Luxor & Soluna’s turnkey mining model — from procurement to firmware to renewable power. Grow your hashrate output with one unified solution - link

*Paid advertisement partner

Chart of the Week

Got a premium? VanEck research shows a strong premium-to-NAV for Strategy MSTR shares when Bitcoin rises, further fueling its stock performance - link

Tweet of the Week

Elon Musk is rolling out a private chat feature called XChat with ‘Bitcoin style’ encryption. We have questions. For example, what does ‘Bitcoin style’ actually mean?

Podcast of the Week

Ever wonder how Bitcoin options trading works? Wilson Huang from DRW Cumberland joins us to talk: Bitcoin options markets, why crypto volatility attracts both miners and hedge funds, how ETFs are reshaping institutional adoption, and why traditional finance principles are finally making sense in digital assets. We dive deep into market structure, OTC trading, and the future of crypto derivatives.