Happy Friday!

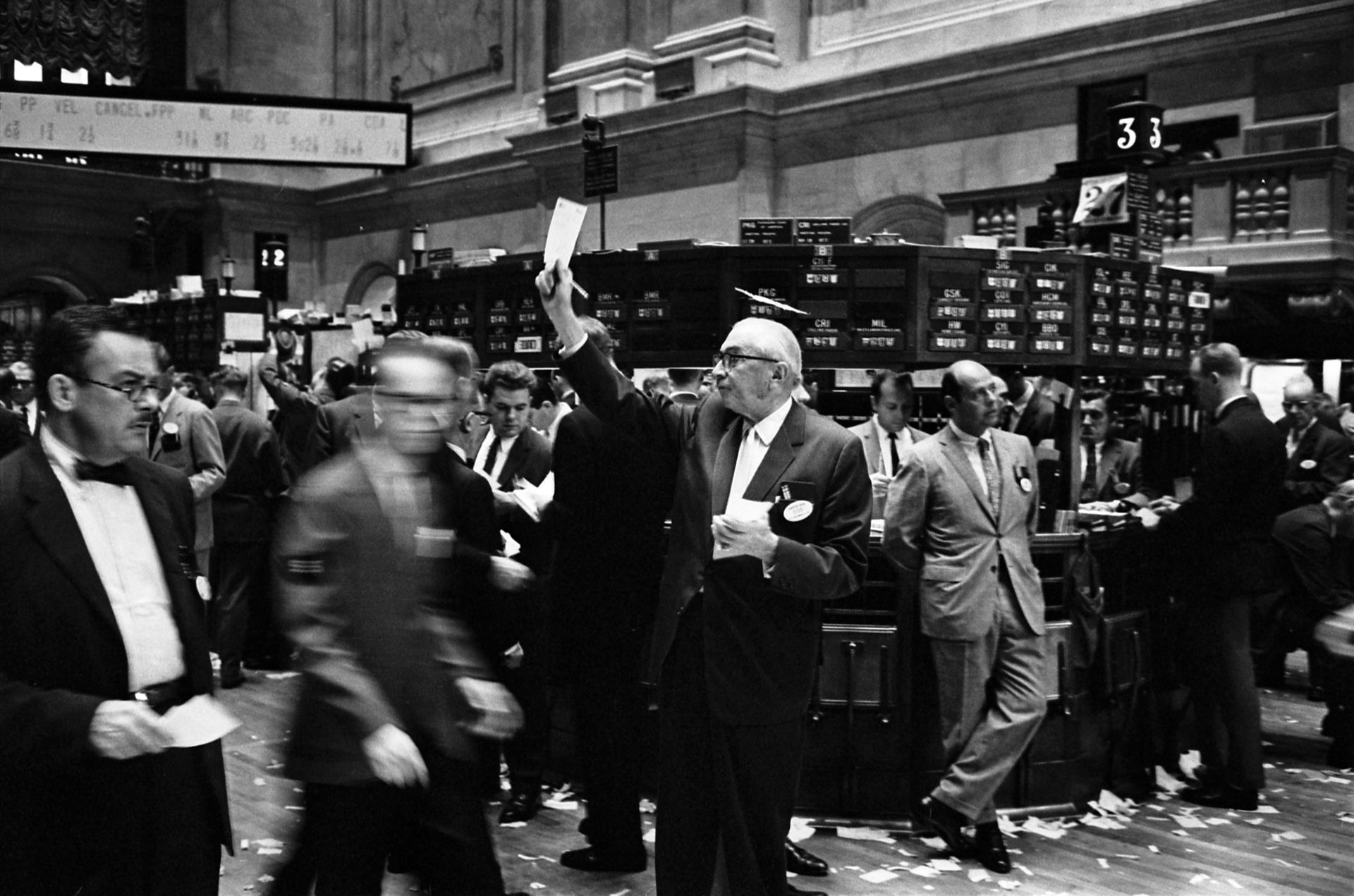

Bitcoin, gold, equities — nothing was spared from yesterday’s market culling. The volatility was so spectacular, that gold lost bitcoin’s entire market cap in about an hour, only to gain it (mostly) back by the end of the day, before tumbling again in after-market hours.

What the hell is going on? Well, the source of the trouble might just begin with Micro and in soft…

Plus:

Is MARA about to corner France’s AI market?

Another congressman longs IREN

How Winter Storm Fern disrupted Bitcoin’s hashrate

Is Microsoft to blame for yesterday’s market carnage?

Bitcoin and bitcoin mining stocks were hammered Thursday, but they didn’t suffer alone.

The entire market – from equities to commodities, and even precious metals – took a good drubbing.

The moves were sudden and violent, with trillions in value wiped in a matter of hours.

Here’s a score card of the day’s losses:

Bitcoin: $82,595 (-6.3%)

IREN: $59.84 (-4.9%)

MARA: $9.86 (-4.9%)

HUT: $61.53 (-4.8%)

Gold: $5,214/oz (-6.3%)

Silver: $110.53/oz (-9%)

Nasdaq: 23,685.12 (-0.72%)

The drawdown was eerily reminiscent of the COVID flash-crash in March 2020 – everything fell off a cliff at once, as though something “broke” within the system of global liquidity.

Of course, this fueled speculation on Fintwit (yes, we’re still calling it that – Xtwit just doesn’t sound right) about the nature of the mass liquidation event and what it means.

The most lucid breakdown I could find comes from one of my favorite anonymous macro analysts, EndGame Macro, who points to Magnificent 7’s eldest company as the source of the trouble.

Of course, I’m talking about Microsoft, which lost a spectacular 10% or roughly $350 billion following its Q2FY earnings despite beating expectations.

Why did Microsoft suffer a historic sell off – the worst since March 16, 2020 – despite the earnings beat, and why did that matter for the wider market?

Well, as EndGame Macro points out, a few key components of Microsoft's revenue (personal computing, gaming services via Xbox, Windows OEM) all declined year-over-year, pointing to softening consumer spending.

But more importantly, Microsoft’s CAPEX ballooned to $29.9 billion in Q2, roughly doubling from the prior year.

Further, its cost of revenue increased 19% and its OPEX by 5%, so its margins are getting squeezed – so much so, that the estimate for Microsoft’s Q3 operating margin are now below prior expectations to 45%.

With all of this, investors are starting to ask, ‘Will earnings fail to meet expectations set by 2025’s CAPEX boom?’

Or, as EndGame Macro put it: “The takeaway wasn’t ‘AI is failing.’ It was that AI is absorbing capital faster than [it is] producing margins, at least in the near term.”

But why does this matter for the rest of the market? Well, Microsoft rests at the intersection of the universe of blue-chip, indexed stocks and the high-growth, high-risk ones.

“For a stock that anchors indices and risk models, that [margin] shift mattered,” EndGame Macro argues.

With such a torrent of sell pressure hitting it, Microsoft was dislodged as an anchor for the wider market and put pressure on the Nasdaq and S&P 500 accordingly. This led, EndGame Macro explains, to a deleveraging event that began with equities and spilled into gold, silver, and bitcoin.

“The synchronized timing matters. Nasdaq down 2.5%, S&P down 1.2%, gold and silver collapsing..all within the same window tells you this wasn’t asset specific news. There was no Fed headline. No geopolitical escalation. The system simply hit a leverage threshold…It was a balance sheet reset.”

If we take this analysis at face value, a logical question might be: if one Mag 7 stock can produce this much fear and damage in the market, what happens if more of them spook investors with thinning margins?

Microsoft, then, could be the canary in the coal mine for how the AI trade unwinds, and with earnings season in full swing, expect more volatility as the market digests earnings.

And as ever, bitcoin might have something to offer for divining the market’s future here, as well; if bitcoin pukes even more from here, I would be willing to bet my bottom dollar that stocks won’t be too far behind.

Reply ‘Bitcoin’ or ‘Blockspace’ to let us know you enjoyed the read!

Blockspace Headlines

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

French Treasury approves MARA’s acquisition of Exaion, EDF non-compete: The Big Whale

The French Treasury has authorized MARA’s 64% controlling stake in Exaion, the data center arm of France’s national electric company, Électricité de France (EDF), as first reported by French market intelligence provider The Big Whale. The approval also did not challenge a non-compete clause in MARA’s contract with Exaion, which prevents the EDF from engaging in any HPC, AI, and bitcoin mining operations for two years after the deal’s close. - link

Bitcoin hashrate drops 8% as US miners curtail during Winter Storm Fern

As Winter Storm Fern wracked middle America over the weekend, bitcoin miners in the PJM and TVA regions curtailed operations to support the grid as the arctic front left more than 1 million customers without power. Evidencing the scale of bitcoin mining curtailment in the U.S., Bitcoin’s hashrate has dropped roughly 8% since the storm swept the midwest and southeast. - link

Nvidia invests $2B in CoreWeave for strategic hardware agreement

Nvidia has invested $2 billion into AI factory CoreWeave, according to a CoreWeave press release, as part of a larger sales agreement between the two firms. - link

Tether holds $24 billion in gold as purchases rival central banks: Bloomberg

Stablecoin issuer Tether accumulated some 140 tons of gold valued at roughly $24 billion, establishing the stablecoin issuer as one of the largest holders of bullion worldwide, according to a Bloomberg interview published Wednesday. - link

Representative Dale Strong buys IREN ahead of major energy act

Representative Dale Strong (R-AL) disclosed purchases of IREN shares on Wednesday. He purchased the shares on January 23, shortly before President Trump signed into law H.R. 6938, a piece of energy legislation marketed as “unleashing energy dominance.” - link

Tweet of the Week

To put this gold and silver rally into context, the two precious metals have added the market capitalization of bitcoin 15 times over. (Dad, if you’re reading this, congrats on this — seriously).

Blockspace Podcasts

In lieu of a news roundup today, we recap Thursday’s market chaos, in which gold shed Bitcoin’s entire market cap in a single morning. We unpack Microsoft's historic 10% drop despite an earnings beat and contrast it with Meta's rally. Are we looking at a systemic liquidity shock or a one-off deleveraging event? We break down the charts, from credit spreads to the VIX, and examine the canaries in the coal mine that could point toward a rocky 2026.

Did you know that a tiny handful of dimes and quarters minted in 1965 have silver content? The U.S. Mint officially stopped circulating silver-backed dimes and quarters in 1965 in favor of copper and nickel-clad ones. But during the transition year, the U.S. Mint accidentally struck dimes and quarters with leftover silver planchets from 1964. Numismatist value these transitional error dimes and quarters dearly because of this error.

-CMH