7 May 2025 · Hashrate 7-Day SMA: 915 EH/s · Hashprice: $50/PH/Day

Welcome to Mining Wednesday, where Blockspace covers the intersection of bitcoin mining, energy, and AI.

Today, we have an interview from Christian Lopez, the head of blockchain and digital assets at investment bank Cohen and Company Capital Markets. Among many other deals, Cohen and Company oversaw the Bitfarms-Stronghold acquisition and Fold’s public offering. Lopez provides gives his take on the state of bitcoin mining capital markets and the M&A landscape, plus why there may be fewer AI opportunities for miners than meets the eye.

Plus, Chart of the Week, Tweets and more!

It’s about a 6 minute read.

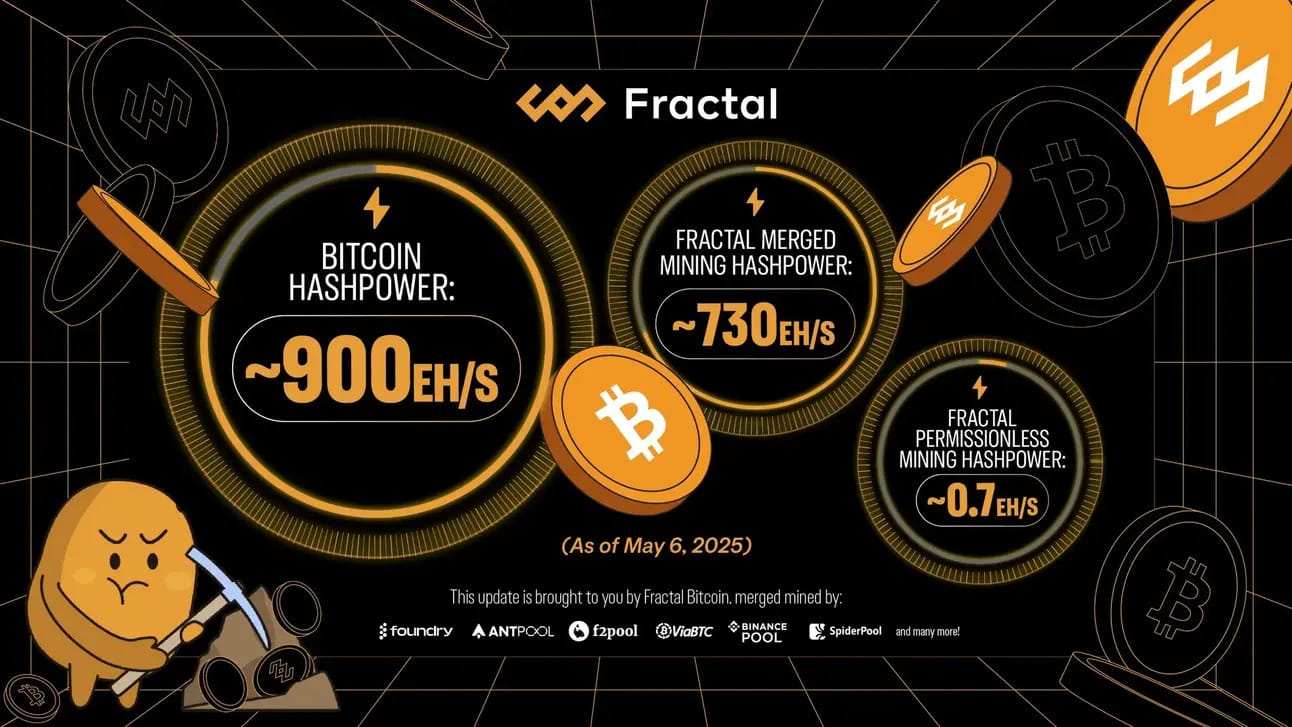

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

Market Opens

BTC $97.1K 3%

GOLD $3,393 1%

MSTR $392 2%

COIN $198 0%

MARA $13.43 2%

CLSK $8.16 1%

RIOT $7.92 0%

CORZ $8.92 0%

What hyperscalers really want from bitcoin miners

AI is the investment thesis du jour in U.S. markets, and bitcoin miners want a seat at the table.

The easiest route might mean miners selling their facilities to hyperscalers and other traditional data center companies. But the location has to be right, and even then, the buyer might have to rip out the existing electrical infrastructure to satisfy the voracious energy appetite of AI computers.

Said another way, there may be fewer opportunities for bitcoin miners to cash in on AI than not.

As miners are weighing this, there’s currently a glut of bitcoin mines on the market looking for a buyer, according to Cohen and Company Capital Markets Head of Blockchain and Digital Assets, Christian Lopez. As mining economics have dimmed, some miners are looking for an exit, but the price will have to be more than right if they want to see the door.

In the following edited transcript of last week’s Mining Pod, Lopez breaks down the current state of bitcoin mining capital markets, M&A, and the convergence of bitcoin mining and AI – and whether or not we should expect more miners to go the way of Strategy and raise capital to buy bitcoin.

To set the stage for our conversation, focusing specifically on Bitcoin mining capital markets, could you provide a high-level overview of where the market is at right now?

Yeah, there's clearly a massive amount of interest from miners and investors around Bitcoin and convertible securities, largely driven by the success of MicroStrategy. MicroStrategy's approach ties into the depth of the capital markets. I'm sure many of your listeners are familiar with this, but to catch everyone up: part of why it works for MicroStrategy is because they trade billions of dollars a day in volume, which provides a ton of liquidity.

What Michael Saylor has been able to do is essentially sell the volatility. Through that, he's secured highly efficient financing for their convertible securities, including 0% coupon converts, which is pretty unheard of in most industries, especially in one with a high cost of capital like Bitcoin-related companies. Because of their board's ability to sell the volatility, they accessed this cheap financing.

Following that lead, the largest Bitcoin miners, which also trade billions of dollars a day in volume, realized they could do something similar. They raised billions of dollars in convertible securities to buy Bitcoin and hold it on their balance sheets. However, much of that liquidity has been absorbed. Today, I think there's a bit less appetite from the investor community, particularly from arbitrageurs who facilitate these convertible deals for companies like MicroStrategy, Marathon, and Riot. The market is still there, but it has dried up somewhat. There's only so much interest available for deals like this.

Unless Bitcoin surges, there may be more interest, but there's almost a ceiling. There's always a question about how many MicroStrategy-like offshoots the market can support. We've covered a few international examples, like Meta Planet, and now there's The Smarter Company UK and UTXO. The management and investing arm behind BTC Inc. is driving some of these initiatives. Their strategy is to replicate this model in international markets where access to such opportunities might be limited. However, whether this approach can be replicated in the U.S. with multiple companies remains uncertain.

What's the current landscape for mergers and acquisitions (M&A)?

Yeah, the M&A market for Bitcoin mining right now has a lot of supply. Stepping back, getting M&A deals done in Bitcoin mining has been challenging for all parties—buyers, sellers, and advisors. After running several of these processes, the most successful has been the Stronghold deal we executed. Through that and other deals, we've identified the core challenge in getting deals done: pricing and valuation. Buyers face the critical “buy versus build” question.

For example, what do you think a standard, turnkey, air-cooled site with good power costs to build? A reasonable all-in cost per megawatt is probably around $300,000 to $500,000. That's the build cost. So, as a buyer, you're asking: if I can build a site for $300,000 to $400,000 per megawatt, what premium am I willing to pay to acquire an existing site today versus waiting 9 to 12 months to build it? There's definitely a premium, but determining that premium is key.

The premium for acquiring a site can vary based on factors like the cost and source of power—whether it's front-of-the-meter or behind-the-meter—expansion capacity, and whether the site can be converted into a high-performance computing (HPC) center. Beyond that, there's a range or band within which these valuations typically fall.

From a buyer's perspective, the decision hinges on spending between $300,000 and whatever premium they're willing to pay. However, as a seller, particularly for publicly traded miners, there's often a liquidity premium because their shares are easily tradable, and they can leverage their capital structure with instruments like convertible securities. This leads public miners to trade at much higher valuations, sometimes $1.5 million to $2 million per megawatt.

Sellers, especially private miners, often look at these public company valuations and demand similar prices, saying, “I should be valued at $1.5 million or $2 million per megawatt.” Public companies, however, push back, arguing, “That's excessive. I can build a site for $350,000 per megawatt and wait nine months. I'd rather build it myself and know exactly what I'm getting than overpay.” This valuation gap has been the core challenge in Bitcoin mining M&A.

Rewinding 12 to 18 months, power was the scarcest resource, especially with the rise of HPC. Morgan Stanley published a notable report highlighting that Bitcoin miners might be sitting on something highly valuable: immediate access to power. This led infrastructure investors, data center companies, and Bitcoin miners to hire data center and energy consultants to evaluate whether miners' power resources were suitable for HPC. While some miners did have valuable power access, it became clear that data center companies, particularly hyperscalers in HPC, have very specific requirements.

For example, when we send site opportunities to data center companies, they often say, “Don't send us anything below 150 to 200 megawatts—that's the minimum for us to even consider.” Additionally, they prefer sites within 100 miles of a large metropolitan statistical area (MSA). One data center company put it this way: “We want to be within 100 miles of an NFL football stadium.” So, you need a large site capable of supporting a 150- to 200-megawatt campus, located near a sizable city.

Turn hashrate into capital

Tap into Luxor Pool’s Forward Market to unlock instant liquidity. Secure financing and scale your fleet — start now.

Bitcoin Mining Headlines

Antalpha eyes $300M valuation via IPO

Antalpha is launching a roadshow to sell investors on its forthcoming IPO with a share price that would value the company as high as $300 million - link

Bitfarms joins halts hashrate expansion, cites HPC focus

Bitfarms won’t be purchasing any ASIC miners this year or next as it focuses its energies on standing up an AI/HPC business line. The company recently entered into a $300 million credit facility with the intent of outfitting the Panther Creek facility it purchased from Stronghold for AI/HPC load. - link

Bit Digital Eyes $500M ATM as Bitcoin Mining Economics Tighten

AI-pivoting bitcoin miner Bit Digital wants to raise $500 million in an at-the-market equity offering, an amount that transcends its $359 million valuation. The company, which has leaned heavily into an AI as its hashrate dwindles, plans to use the funds to accelerate this new business line. The company recently secured a lease for a 5 MW HC data center in Quebec. — link

Benchmark calls Canaan a 'potent long-term play' in bitcoin mining, sets $3 price target

Equity analyst Mark Palmer noted Canaan’s vertical integration–from ASICs to mining–as a potential stand out from peers - link

Everything you need to know about the OP_RETURN debate

A handful of bitcoin developers have proposed increasing the data limit for OP_RETURN, a bitcoin script code that allows for the inclusion of arbitrary data into bitcoin transaction. The proposal has been controversial with some, sparking a debate on the utility and perceived downsides of such a change. - link

Want more Bitcoin mining and energy content? Subscribe to ‘The Vibe Check!’ 👇

Tweet of The Week

Can we actually make new generation? Turns out, it’s pretty expensive. A new report from Constellation says costs have 3x since the early 2010s, when comparing to similar capacity.

Chart of the Week

Britain’s Microstrategy? The Smarter Web Company went public on a small European exchange last month, but has seen a surge of interest due to its Bitcoin treasury play. Read our scoop on the company, here.

Bitcoin Mining in Iran w/ Masih Alavi

Free Report!

Forecasting Bitcoin hashrate through 2027

Our new report forecasts Bitcoin's hashrate from 2025 through 2027. Get it for free by clicking here — link

Enjoyed today's read?

-CMH