Presented by

What if the bull market is just getting started?

That’s the hypothesis behind a recent report from Bitwise and UTXO Management. The research tag-team makes the argument that 2026 could see hundreds of billions in inflows next year as tradfi, corporations, and governments continue to cozy up to bitcoin

It’s a 5 minute read.

But first…we’re being filtered!

Reply ‘HODL’ or ‘Bitcoin’ to this email to tell your email service you want to keep reading Blockspace. Don’t want these emails anymore? Unsubscribe here.

Also, the Blockspace team will be on the ground in Vegas this week for Bitcoin 2025! We’ll be running the Bitcoin Mining Stage all week and sitting in on a handful of talks. Come give us a shout!

Fractal: Boost Miner Revenue. Power the Future of PoW.

Fractal is a Bitcoin-native scaling solution with full Bitcoin compatibility – helping miners earn more using the same hardware, wallets, and energy they already rely on. Lowered pool fees. Direct FB rewards. Zero setup.

We’re also a founding member of the newly launched Proof of Work Alliance — a global coalition of mining pools, blockchain projects, miners, service providers, and hardware manufacturers advancing PoW innovation, energy efficiency, and infrastructure growth. The goal: strengthen and scale Proof of Work for the next generation of builders.

Founding members include: F2Pool, SpiderPool, ElphaPex Miner, Ipollo, Bitmars, Fortitude Mining, StandardHash, BIT Exchange, ETC Cooperative, and Psy Protocol.

🔗 Explore the Alliance or join us at PoWAlliance.com

2026 could be an explosive year for bitcoin

Institutions are already impacting global demand for Bitcoin — but this report from Bitwise and UTXO Management shows that there could be (yes, we’re going to say it) a “Wall of Money” coming in 2026.

In “Forecasting Institutional Flows to Bitcoin in 2025/26”, Bitwise and UTXO argue that spot-ETF demand is just the opening salvo. The report is so bullish that it’s got us wanting to tweet some clickbait, but we’ll save the Twitter-bait news flashes for the influenceooors.

Anyways, here’s a few of our favorite takes from the report!

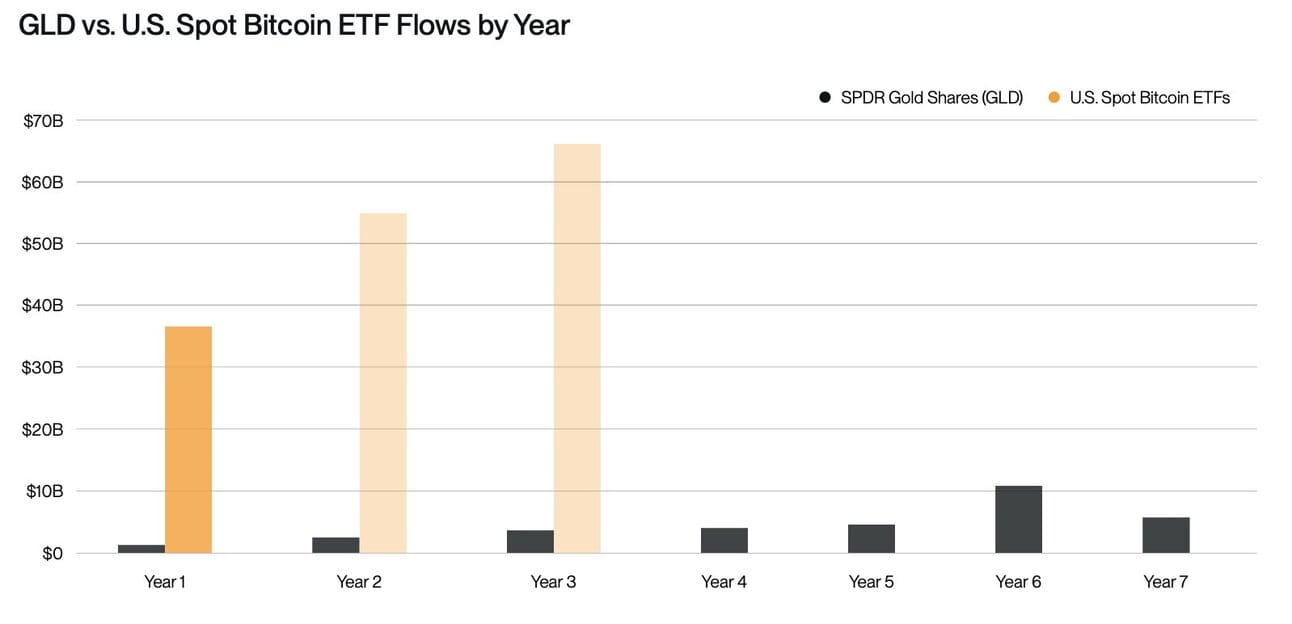

Bitcoin ETFs > Gold ETFs

Year-one bitcoin ETF inflows came in at a record-breaking $36.2 billion, eclipsing every commodity-ETF launch on record. The authors draw a comparison to the SPDR Gold Shares (GLD) precedent: annual net flows could increase to $65 billion by 2026 and over $100 billion in 2027, if the pattern holds.

The chart below tells the story (2027 estimate not included):

The bitcoin ETFs were just the beginning

While bitcoin ETFs are the headline grabber, they’re just one piece of Bitwise’s $427 billion forecasts in new buy-side demand by the end of 2026, equivalent to 4.27 million BTC or nearly 20% of current circulating supply. The base-case modeling is built on five key drivers:

Wealth Platforms: A 0.5% Bitcoin allocation across $60 trillion in managed assets could yield $120B in flows.

Corporate Treasuries: Public companies following the Saylor playbook are projected to absorb 1.18M BTC under FASB’s mark-to-market rules.

Nation-States: The U.S. Strategic Reserve sets the tone for up to 5% gold-reserve rotation into BTC, with four new nations expected to follow.

State Governments: 13 U.S. states have live Bitcoin reserve bills; Bitwise expects five to pass by 2026.

ETFs: With wirehouse access and model portfolio inclusion, bitcoin ETFs are poised to outdo gold’s trajectory

Corporate balance sheets in particular show how fast the landscape is evolving.

By the end of 2024, public companies controlled over 603,000 BTC–803,143 BTC at the time of publication–and the removal of impairment accounting now allows companies to book upside.

Metaplanet (Japan), GameStop (U.S.), and Moon (Hong Kong) are early examples of the same “Bitcoin Standard” strategy—using BTC to offset declining fiat value and improve financial optics.

Sovereign and state adoption is also accelerating. The U.S. government now effectively holds 198K BTC off-market and could consider a 1 million-BTC strategic reserve if Senator Lummis’ BITCOIN Act passes. Globally, Bitwise forecasts a wave of adoption from energy-rich, dollar-wary countries.

Even if only a fraction of their gold holdings are rotated, the impact on bitcoin’s float would be significant.

Mastering Power Costs: Spot vs. Fixed Pricing for Miners

Smart miners treat power like a trading strategy. This article kicks off our new series on energy risk by breaking down the two core pricing models: spot vs. fixed. Get ahead by understanding your energy options.

Click below to read the full article:

Chart of the Week

BTC Inc. — the parent company of Bitcoin Magazine — hosted the first Bitcoin Conference in San Francisco in 2019 in a glorified parking garage. This year’s conference is expected to bring 30,000-50,000 attendees. Are we still “early”?…

Blockspace Podcasts

On last week’s Bitcoin Season 2 Writer’s Room, Charlie and Colin break down the hidden history behind Bitcoin Pizza Day.

How do Bitcoin miners and AI compute actually build out together? TeraWulf’s Naz Khan breaks down infrastructure builds and the recent G42 deal on The Mining Pod.

Enjoyed today's read?

-CBS & CMH