Brought to you by Lygos Finance

Happy Friday!

With each Bitcoin bull cycle, a new narrative seeds fear, uncertainty, and doubt (FUD) about the longevity of Satoshi’s creation. Of course, one man’s FUD is another man’s legitimate, existential threat, and whether you see concerns as FUD or legitimate depends on where you’re getting your information and — more importantly — how you process and interpret that information.

Before China’s 2021 Bitcoin Mining Ban, FUD revolved around China’s supposed iron grip on Bitcoin vis-a-vis mining concentration.

The China FUD was easier to dismiss with hypothetical discussions of Bitcoin’s game theory, and finally, CCP’s ban defused it altogether.

But another threat, one that was discussed obliquely alongside the China FUD, looms larger still, and its shadow is growing.

And that’s Bitcoin’s Quantum Computing vulnerabilities and the fears they inspire — the questions swirling around those fears are the subject of today’s take.

Plus, a new documentary from yours truly at Blockspace, the usual recap of headlines and podcasts, and the coolest map we’ve seen to visualize the U.S.’s explosive data center growth.

Strap in. Today’s newsletter is deep as it is wide.

Lygos: Bitcoin Credit, No Custodian Required

Unlock dollar liquidity without giving up your BTC. Lygos is a fully Bitcoin-native, non-custodial lending platform built on Discreet Log Contracts (DLCs).

• Hold your keys: BTC stays on layer 1 in your control. No wrapping, no bridging, no rehypothecation

• Rates as low as 10% APR

Bitcoin’s quantum computing risk has been shoved into the Overton Window

Numerous Bitcoiners chimed in on the quantum computing debate this week, marking a turning point in overall discourse. Michael Saylor referred to network “upgrades” and “freezing old coins,” while Nic Carter recently dropped a 2-part essay on “the quantum problem.”

OUR TAKE: Quantum just got shoved into the middle of the Overton Window.

It had been bubbling for quite some time, recently revived with BIP-360 in December 2024, but as the discussion started ramping up in November, it feels like this week marked the true breakout moment.

Getting out ahead of it: I am undecided on if quantum is a near term risk and I do not have strong opinions at this time about what the response should be.

I do know that it’s an extremely complex topic and there are very few experts and far more charlatans.

That said, let me outline the important sequence of questions as I see them:

Is quantum a near term risk and should we quantum proof bitcoin?

If yes, how do we quantum-proof bitcoin?

How should the network and users migrate to quantum security?

What do we do about old/lost/Satoshi’s coins?

Each of these questions is sure to be a massive debate, and each one has numerous sub-questions.

Even just the question of how we quantum-proof bitcoin could challenge some long time Bitcoin convictions.

For example, most quantum-proof signature schemes are very big and would take up much more space in a Bitcoin block, which is finite. If we have a significant increase in signature size then we may find the bitcoin block size becomes a prohibitive constraint.

Therefore, it may be popular to increase bitcoin’s block size – or more accurately discount certain bytes more.

Now you can see why the quantum debate could get quite hairy – a lot of Bitcoiners are deeply opposed to any blocksize increase whatsoever. We fought a war over this after all!

I, for one, welcome our new quantum discourse overlords. It’s way more fun (and productive) arguing about quantum than filters.

-CBS

Like these stories? Reply BITCOIN to let us know!

Blockspace Original: The Bitcoin Professor w/ StarkWare’s Eli Ben-Sasson

In our latest Blockspace Original production, StarkWare co-founder Eli Ben-Sasson hits the road with Blockspace co-founder Charlie Spears. We follow Eli as he braves the noise of a Bitcoin mine, wraps his head around the idea of a Bitcoin cattle ranch, and talks to real Bitcoiners at a local Bitcoin meetup.

Plus, we learn how StarkWare is supercharging the Bitcoin ecosystem! 👇️

Power Targeting Is Live in LuxOS

LuxOS has launched Power Targeting, designed to deliver a more stable, predictable, and reliable mining experience across supported hardware. LuxOS continuously adjusts frequency and voltage to maintain a defined power target, improving cost predictability and operational planning across mixed fleets.

In the News

Join our Telegram chat to get the latest headline in Bitcoin-related equities.

China BTC miners shut down roughly 1.3 GW in Xinjiang amid CCP scrutiny

Bitcoin miners in China’s Xinjiang province are closing shop amid government scrutiny, taking as much as 100 EH/s of mining equipment offline, according to industry sources. - link

Hut 8 shares soar as data center firm inks $7 billion revenue deal with Fluidstack, Anthropic

Bitcoin miner-turned-AI factory Hut 8 announced Tuesday a new partnership with artificial intelligence company Anthropic and compute provider Fluidstack to develop large-scale AI data center infrastructure in the United States, beginning with a 245 megawatt project in Louisiana. - link

Nakamoto authorizes $10 million share repurchase program

Following a delisting notice from Nasdaq, bitcoin treasury firm Nakamoto authorized a $10 million share repurchase program. - link

Summer weather delayed CoreWeave Denton site as company sheds $33B: WSJ

Summer storms delayed construction at a Denton, Texas site that CoreWeave plans to energize in 2026 to provide AI computing to OpenAI, the Wall Street Journal reported on Monday. - link

Funding stalls for Oracle’s Michigan datacenter as Blue Owl bows out: Financial Times

Blue Owl Capital will not fund Oracle’s 1 GW AI datacenter project in Saline, Michigan, according to the Financial Times who spoke to sources close to the matter. - link

Strategy buys 10,645 bitcoin for $980 million as total holdings top 671,000

Strategy purchased 10,645 bitcoin during the week ending December 14, 2025 for approximately $980.3 million, bringing Strategy’s total treasury holdings to 671,268 bitcoin. - link

Tweet of the Week

If you wanted a single piece of media to visualize the U.S.’s Cambrian explosion of data centers, this mesmerizing map is the only one you need.

Blockspace Podcasts

On the latest Mining Pod news roundup, Colin and Matt dive into reports of a bitcoin mining crackdown in Xinjiang, China, Hut 8's massive $7B hosting deal with Fluidstack, just-reported summer weather delays at Core Scientific’s Denton facility for CoreWeave, and Blue Owl declining to fund a 1 GW AI site for Oracle. And to close the show, veteran crypto reporter Brady Dale, author of the Front Stage Exit newsletter, joins us to talk about a failed vote in Granbury, Texas, to incorporate a new town to expel MARA from its facility in the area.

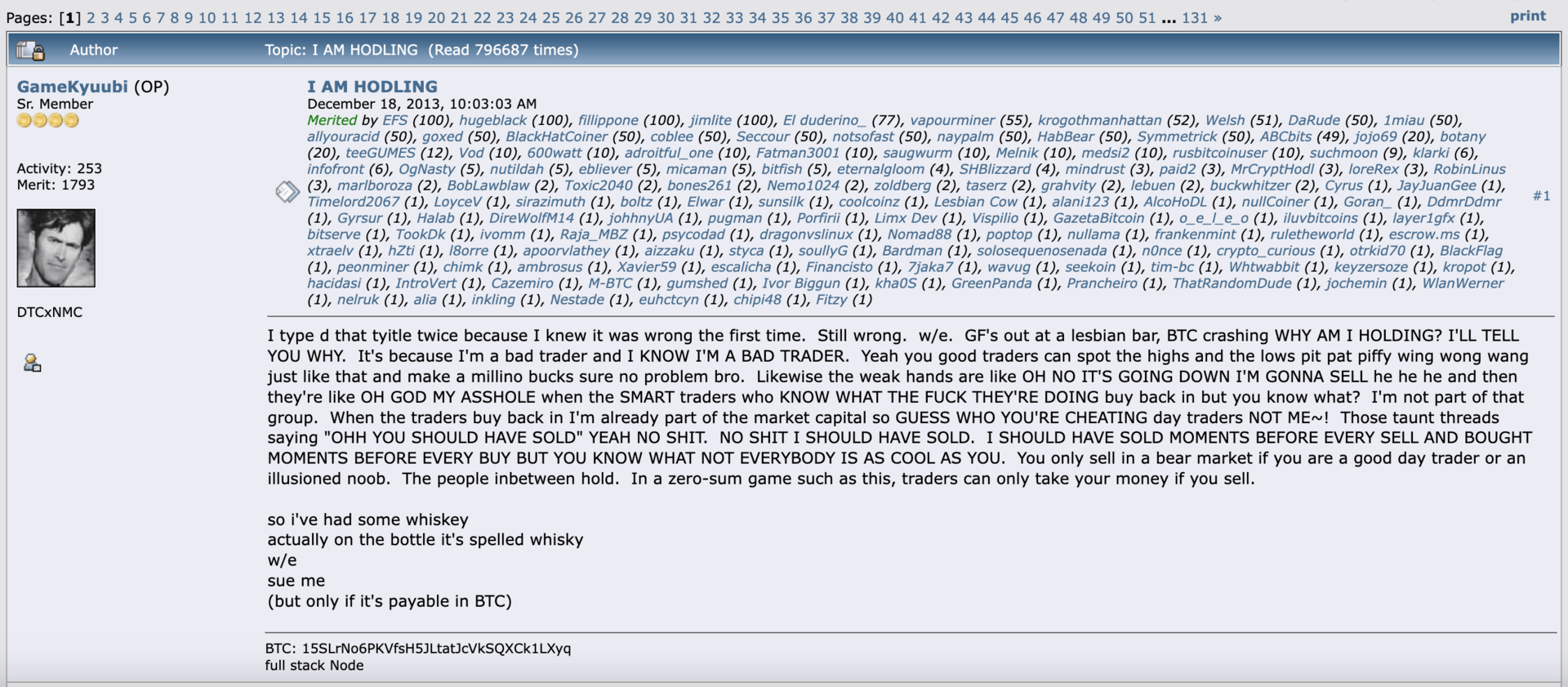

The oft-repeated Bitcoin “HODL” mantra doesn’t mean “Hold on for Dear Life.” It actually comes from a bender-induced typo from a very sauced Bitcointalk user who published a post titled “I AM HODLING” 12 years ago yesterday. The besotted rant has been canonized in Bitcoin lore ever since, and the slang that it birthed has become a rallying cry for Bitcoiners during bearish market conditions.

-CMH & CBS

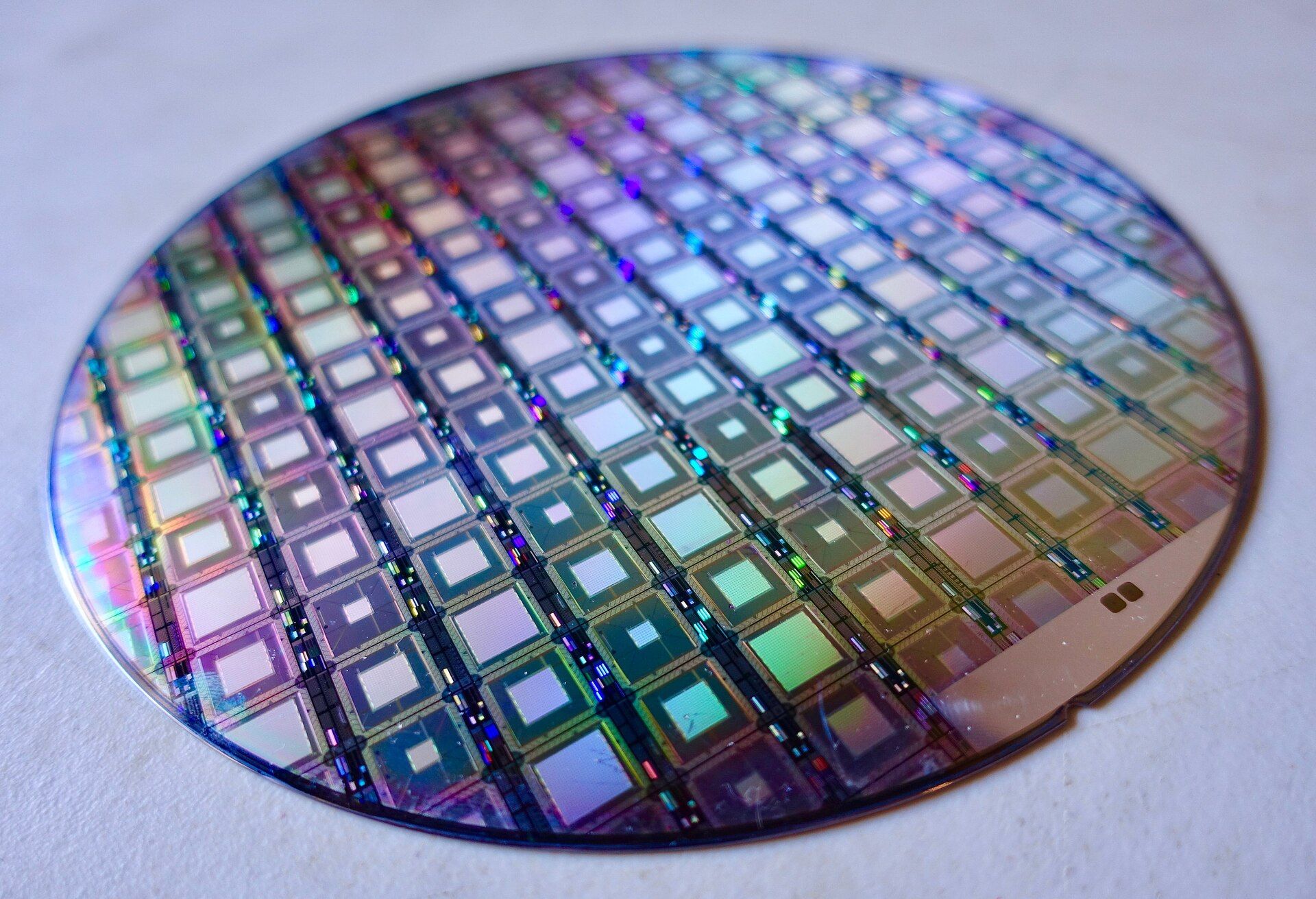

Header image by Steve Jurveston.