25 April 2025 · Block Height 893915 · BTC Price $93K

Presented by Fractal Bitcoin

In today’s newsletter, a trad-fi executive, a tech mogul, a stablecoin founder, and the voice of a bitcoin generation walk into a bar — and come out with a company that wants to compete with Strategy.

It’s about a 4 minute read. But before we dig in…

Fractal: Scale Bitcoin + Boost Miner Revenue.

Earn more with your same resources.

How? Fractal is a Bitcoin-native innovation scaling solution with full Bitcoin compatibility.

• Same hardware, zero extra energy: Reduce up to 50% of your pool fee

• Same address type & wallets, zero transfer: Receive FB rewards directly in your existing BTC wallet and address.

Mine smarter on Fractal: https://fractalbitcoin.io/mining

Strike’s Jack Mallers takes helm of new Softbank/Tether/Cantor Bitcoin venture

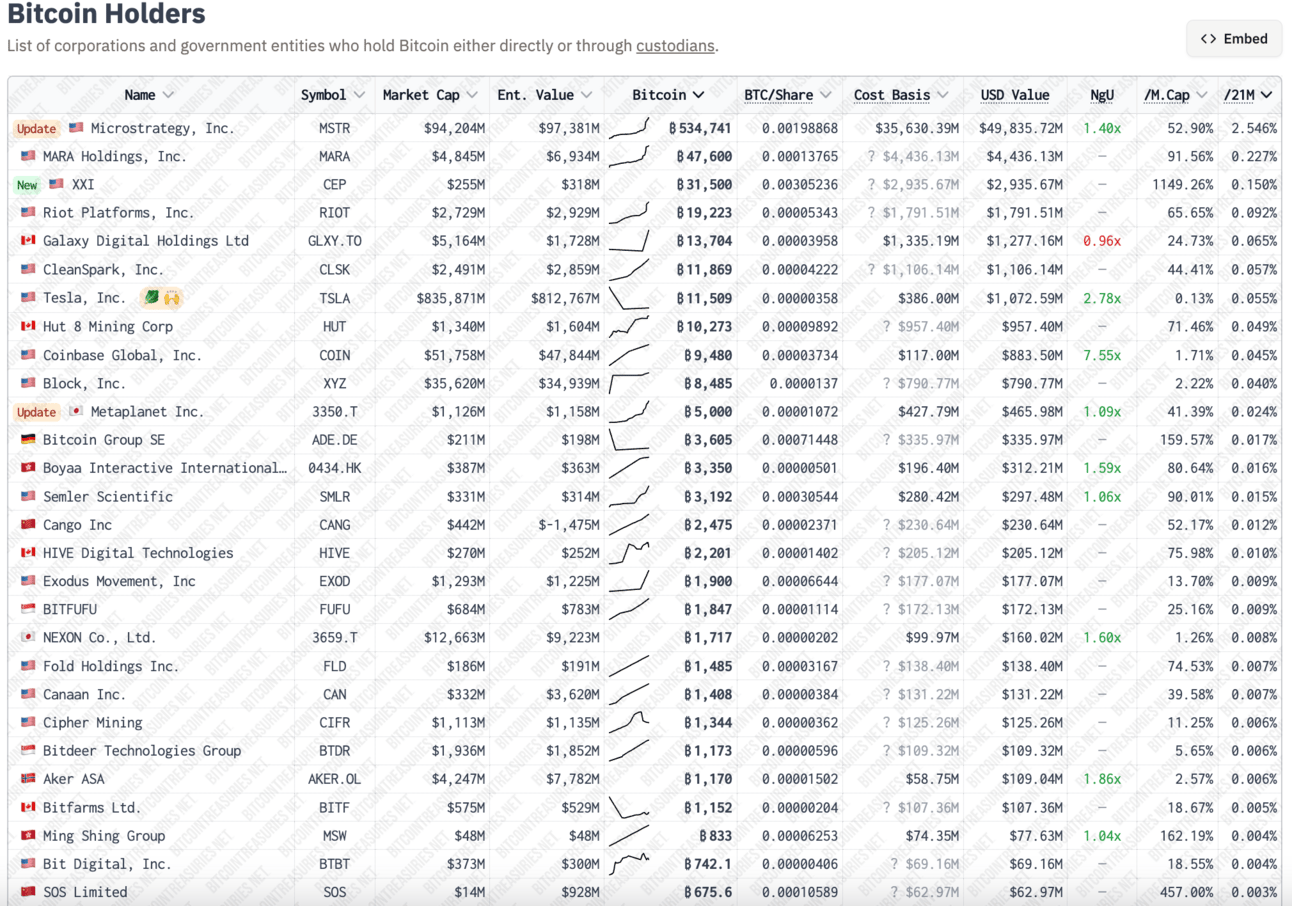

Jack Mallers, CEO of Strike, announced the launch of Twenty One, a Bitcoin-native public company formed through a $3.6 billion SPAC merger with Cantor Equity Partners and backed by Tether, Bitfinex, and SoftBank. The company self reports that it owns 31,500 BTC—making it the third-largest corporate Bitcoin holder—and aims to emulate and surpass Strategy’s (formerly Microstrategy) Bitcoin accumulation model. Twenty One will use metrics like Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR) to measure performance. Beyond holding bitcoin, Twenty One plans to develop Bitcoin-native financial products, media, and advisory services to accelerate global Bitcoin adoption - link

Jack Mallers, CEO of Strike and 21 Capital

OUR TAKE: It’s like the Avengers of big money got together and started a Bitcoin company. Let’s review the fun cast of characters:

First we have Cantor Fitzgerald, whose former Chairman, Howard Lutnik, is now the US Secretary of Commerce and is succeeded by his son Brandon. Then we have SoftBank’s Masayoshi Son who’s known for high conviction bets in emerging tech, with a storied history of both glorious wins and staggering losses. Then we have the interlinked companies, Tether and Bitfinex, who have been shepherded by Paolo Ardoino for close to a decade now. Bitfinex has come a long way from its notable 2016 hack which appears to be close to full resolution. Lastly we have young energetic Jack Mallers, whose galvanizing Bitcoin maxi-isms from his empty closet in Chicago have defined the El Salvador era of Bitcoin adoption. Each of these characters could take up a whole chapter in the annals of what has shaped Bitcoin to-date

This supergroup positions itself to rival Strategy, which has accumulated half a million BTC. The announcement comes with excited celebration (pump our bags Masayoshi!) and criticism (stablecoins, big money, and the suits aren’t aligned with other bitcoiners). So here’s to the new era of Tether, the most profitable company in the world, stacking even more BTC than you imagined they ever could.

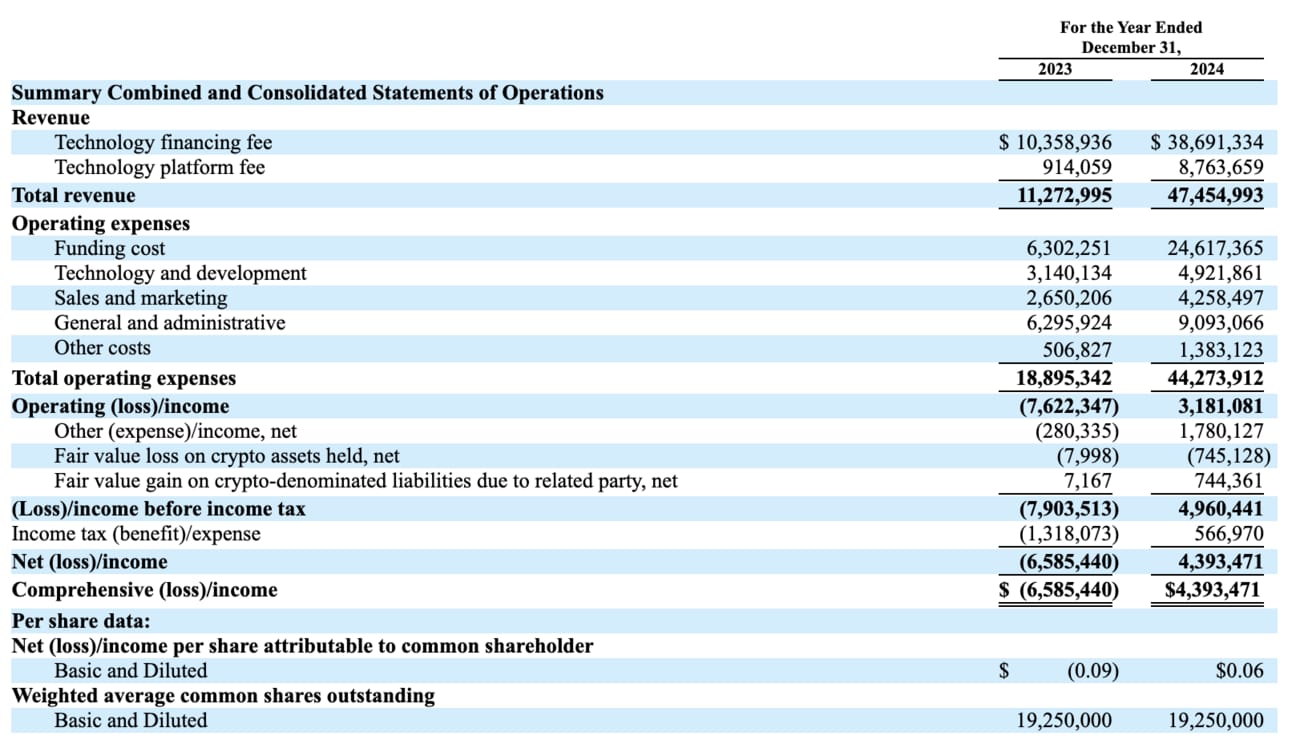

Bitmain-linked Antalpha files for Nasdaq IPO

Bitmain’s strategic financing partner, Antalpha Holding Company, has filed for an initial public offering (IPO) on the Nasdaq under the ticker ANTA, according to a U.S. Securities and Exchange Commission prospectus. The company is seeking to raise $50 million and has tapped Roth Capital and Compass Point to underwrite the offering - link

OUR TAKE: The king wants more. First came BitFuFu, then came Cango, and now Antalpha. Bitmain is slowly inching its way into U.S. public markets with yet another proxy.

Antpool, the second largest mining pool in the world, which spun off from Bitmain in 2021, owns Antalpha. Antalpha provides ASIC financing services for Antpool clients, as well as bitcoin-backed loans. There’s no public evidence that Bitmain and Antalpha hold stakes in each other, but Antalpha extends ASIC loans exclusively for the purchase of Bitmain ASICs, so the manufacturer no doubt has interest in its success.

Outside of turning on the tap for a liquidity event, the question stands, why does Antalpha want to go public now? A look at its customer base may give us some breadcrumbs; Antalpha had $1.63 billion in outstanding loans at the end of 2024, with 77.4% of its business coming from Asia and 6.9% coming from the Americas. This is a big shift dramatically from 2023, where the Americas made up 24.6% and Asia 66.2%. As bitcoin mining capital markets have matured, Antalpha has been losing ground in the U.S. to domestic lenders, so maybe the public listing is an effort to shore up its lending business in the land of the free?

Whatever the case, Bitmain and its partners are leaning into U.S. markets at a time when some miners are looking at international opportunities as Trump’s capricious tariff policy foments uncertainty.

Source: Antalpha F-1

In Mining, You Must Grow

Unlock capital with Luxor Pool’s Forward Market Integration: instantly convert hashrate into financing for fleet expansion and take your operations to the next level.

Federal Reserve Board announces the withdrawal of crypto guidance

The Fed is backing off Biden era regulations around cryptocurrencies and banks, rescinding supervisory letters and Office of the Comptroller of the Currency (OCC) initiatives. Is Choke Point 2.0 dead?

John Carvalho’s proposal to rename “satoshi” unit to “bitcoin” receives BIP number

BIP 177 proposes redefining Bitcoin’s smallest divisible unit from “satoshis” to “bitcoins” (1 BTC = 100,000,000 bitcoins). The proposal intends to make bitcoin nomenclature more accessible as its adoption increases. Yes, it may seem confusing and counterintuitive, but you will have to take up that debate with Carvalho - link

Foundry begins merge mining Fractal Bitcoin, which now has over 93% of BTC hashrate

Foundry, the largest mining pool comprising 30% of Bitcoin hashrate, began merge mining Fractal this week. Fractal now exceeds 719 EH/s in hashrate making it the largest merge-mined sidechain. The sidechain uses a system called “Cadence Mining” which allows miners to either merge mine BTC and Fractal or “permissionless mine” Fractal alone - link

ASIC miners will not benefit from computer tariff exemption

ASIC mining hardware will not enjoy the same tariff exemptions as computers, smart devices, and semiconductors. The exemption only applies to computing devices classified under Harmonized Tariff Schedule of the United States (HTSUS) code 8471, while ASIC miners belong to HTSUS code 8543 (specifically, 8543.70.9960). Code 8543 applies to “electrical machines and apparatus, having individual functions.” - link